The customs value of imported goods plays a vital role in global trade, serving as the basis for calculating duties and taxes imposed by customs authorities. Essentially, it reflects the total expense of the goods, covering not just the purchase price but also additional costs like shipping, insurance, and handling until they reach the entry port. Accurate assessment of this value is crucial for both importers and customs officers to uphold fairness and legality in trade practices.

There are different methods outlined by the World Trade Organization’s Agreement on Customs Valuation for determining customs value. Understanding these methods and the overall process is essential for businesses involved in international trade to smoothly navigate customs rules and ensure seamless cross-border transactions.

What is Customs Value?

Customs value represents the complete worth of goods imported into a country. It serves as the basis for calculating import duties during customs clearance. For example, if a shipment contains 10 items valued at US$20 each, the total customs value would be US$200. This value is crucial for determining the applicable duties and taxes, ensuring compliance with import regulations.

Also Read: Different Types of Customs Duty in India Complete List

Purpose of Customs Valuation

Establishing a standardized approach to determining the customs value of goods serves several crucial purposes:

Duty Calculation: It ensures fair assessment of import duties, enabling accurate determination of the amount the recipient must pay for the shipment.

VAT Calculation: By basing customs duties and value-added tax (VAT) on the value of goods, it facilitates precise taxation calculations.

Commercial Policy Implementation: It provides a framework for applying commercial policy measures effectively, ensuring consistency and transparency in trade regulations.

Economic Analysis: Standardized customs valuation supports comprehensive analysis of economic and commercial policies, aiding decision-making processes.

Trade Statistics: It enables the generation of reliable import and export statistics, essential for monitoring trade trends and policy evaluation.

Revenue Collection: Proper valuation enhances the collection of import duties and taxes, contributing to government revenue streams.

Trade Facilitation: Consistent valuation methods streamline customs procedures, promoting efficiency and reducing administrative burdens for businesses.

Compliance Assurance: It helps enforce compliance with import regulations, safeguarding against illicit trade practices and ensuring a level playing field for businesses.

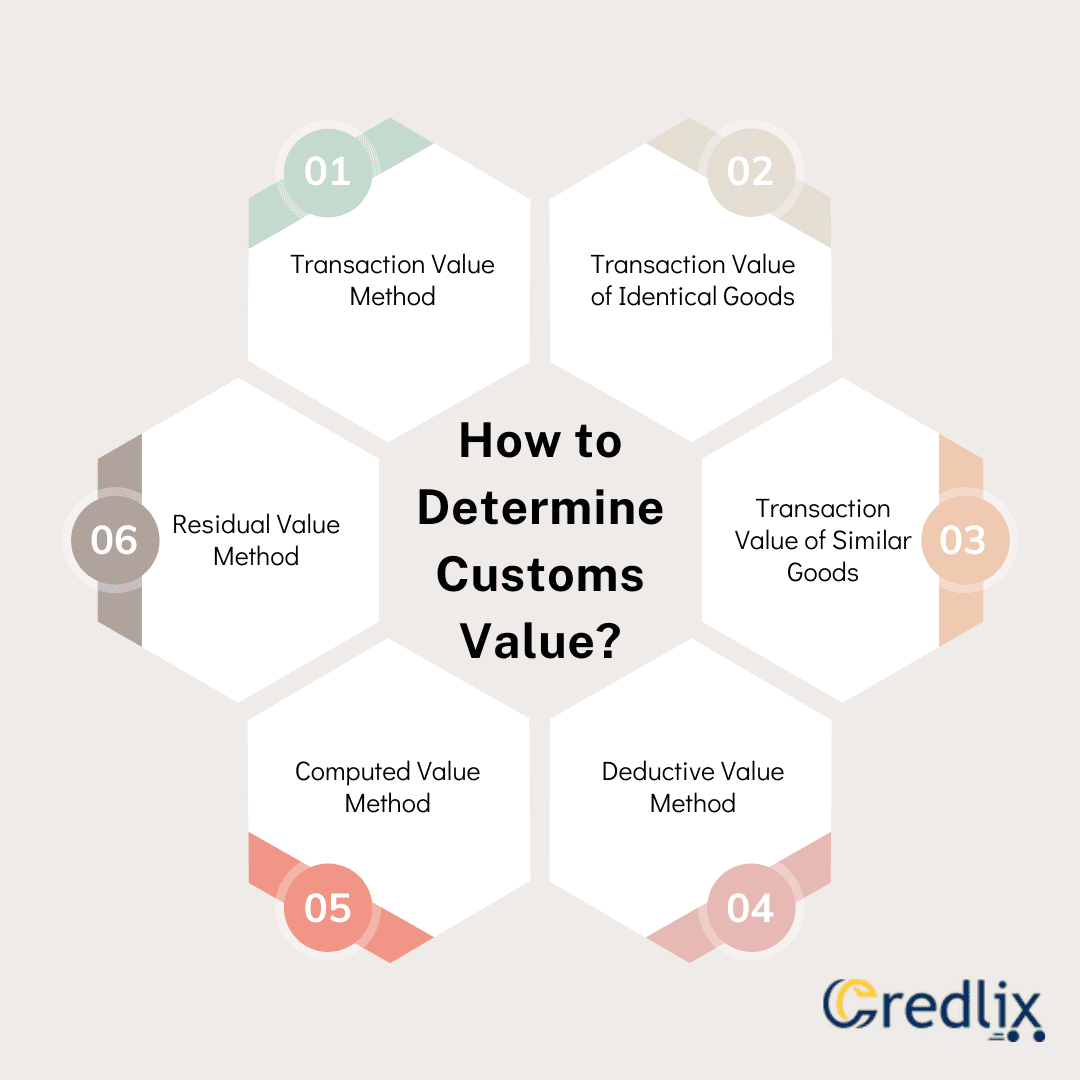

How to Determine Customs Value?

Determining the customs value of imported goods is a crucial aspect of international trade, impacting various aspects such as duty calculation, taxation, and trade statistics. Customs authorities primarily employ the transaction value method, where the actual price paid or payable for the goods serves as the basis for valuation. However, when this method isn’t applicable, alternative methods are utilized.

Transaction Value Method

This method relies on the actual price paid or payable for the goods when sold for export. It’s the preferred approach as it reflects the market value accurately. To apply this method, customs authorities require evidence such as commercial invoices or purchase orders.

Additionally, certain conditions must be met, including restrictions on the use of goods and absence of any conditions affecting their value substantially. If these conditions are fulfilled, the transaction value equals the customs value.

Transaction Value of Identical Goods

When identical goods are available, their transaction value serves as a reference point. This method is applicable if the goods being valued share the same physical characteristics, quality, and production origin as the identical goods.

It ensures consistency in valuation by using prices from comparable transactions.

Transaction Value of Similar Goods

In cases where identical goods are not available, customs may use the transaction value of similar goods. Similarity is assessed based on materials, functions, and the producer of the goods. This method allows for flexibility in valuation while maintaining relevance to the specific goods being valued.

Deductive Value Method

If transaction value or similar goods aren’t feasible, the deductive method determines the unit price at which the goods are sold in the importing country. Deductions may include expenses incurred in sales, transportation, and customs duties. This method ensures that the customs value reflects prevailing market conditions in the importing country.

Computed Value Method

This method calculates customs value based on the production cost of the goods, including materials, fabrication, and general expenses. It’s a complex approach that requires detailed information about production processes and costs. While rarely used, it provides an alternative when other methods are not applicable.

Residual Value Method

As a last resort, the residual method bases the customs value on one of the preceding methods with minimal adjustments. This method ensures fairness and reflects commercial reality while accounting for any unique circumstances that may affect valuation. It offers flexibility in determining customs value in situations where other methods are not suitable.

Also Read: Documents Required for Import-Export Customs Clearance

Comparing Customs Value and Declared Value

Here’s the difference between customs value and declared value:

Definition

- Customs Value: The actual financial worth of the shipment, crucial for customs clearance and determining applicable duties and taxes.

- Declared Value: The selling price or replacement cost of the shipment’s contents as stated by the shipper, used for limiting the carrier’s liability for delay, loss, or damages.

Purpose

- Customs Value: Used by customs departments to assess duties and taxes and facilitate clearance procedures.

- Declared Value: Specifies the maximum liability in connection with the shipment, aiding in determining the carrier’s responsibility for any loss, delay, or damages.

Relation to Duties and Taxes

- Customs Value: Directly influences the amount of duties and taxes imposed by customs authorities.

- Declared Value: May align with the customs value, but there can be discrepancies, especially concerning insurance purposes and replacement costs for damaged items during shipping.

Impact on Transit Time

- Customs Value: Can affect the transit time of the shipment as it is essential for customs clearance procedures.

- Declared Value: Generally does not impact transit time directly but influences the carrier’s liability and handling procedures in case of loss or damages.

In conclusion, understanding customs value is essential for anyone involved in international trade. It determines the financial worth of imported goods, impacting duties, taxes, and clearance procedures. Different methods, such as the transaction value and deductive value methods, are used to calculate customs value accurately. It’s also crucial to differentiate between customs value and declared value, which serves as the maximum liability in case of loss or damage during shipping. By grasping these concepts, businesses can navigate customs regulations more effectively and ensure seamless cross-border transactions.