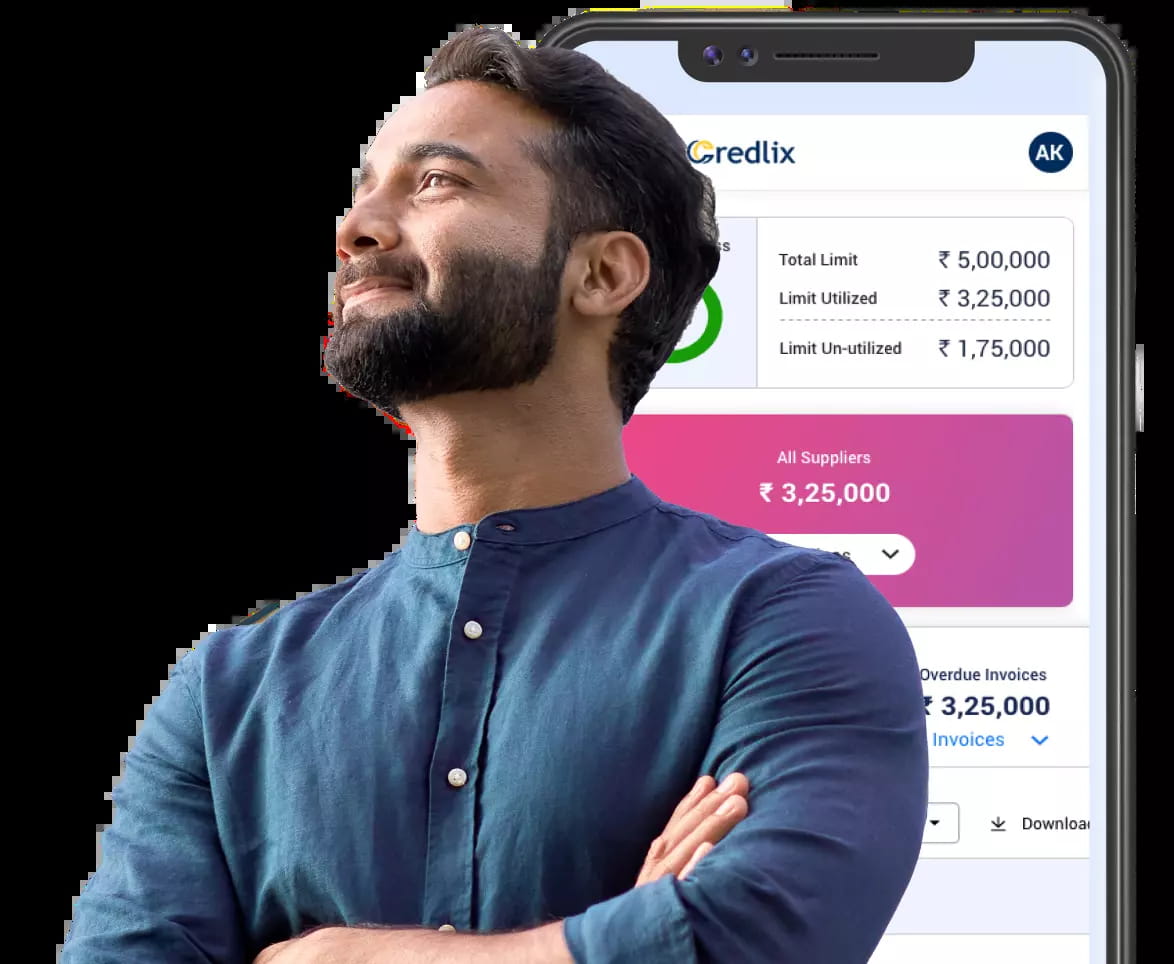

The Credlix Advantage

Collateral Free

No need to pledge assets for funding.

Quick Finance

Up to 90% of your invoice value can be funded within 48 hours.

Digital Process

Minimal one-time documentation required.

Competitive Rates

Secure better interest rates than traditional loans, without any additional collateral.

Simplified Process Flow

Submit

Invoices

Upload your unpaid invoices to our platform.

Get

Funded

Receive up to 90% of the invoice value within 48 hours.

Invoice

Settlement

The remaining 10% is paid on the due date of the invoice.

You sell products and usually wait for 3 months to receive payment.

With Credlix, 90% of the payment is made upfront and the remaining 10% is made on the due date of the invoice. Without Credlix, you would get payment only on the due date.

Tailored Solutions for Various Industries

Apparel

Electronics

Automotive

Pharmaceuticals

Industry-Specific Use Cases:

- Apparel Seamlessly manage cash flow to handle large orders and seasonal spikes.

- Electronics Invest in new technology and innovation without waiting for invoice payments.

- Automotive Maintain a steady supply chain and manage production costs effectively.

- Pharmaceuticals Ensure timely procurement of raw materials and meet regulatory standards with ease.

Explore Credlix Solutions For Your Enterprise

Early Payment Discount

Credlix helps enterprises and their suppliers improve cash flow by enabling early settlement of invoices during supply-chain operations. By offering prompt payment incentives, suppliers receive funds sooner than traditional terms, reducing working capital gaps and strengthening supplier relationships.

- With a fully digital workflow, minimal documentation, and automated processing, Credlix streamlines early payments for better liquidity and returns across your supplier ecosystem, empowering suppliers and optimizing enterprise cash-flow management.

Vendor Finance

Credlix Vendor Financing is a digital supply-chain finance solution that enables enterprises to support their vendors with faster access to working capital. Timely payment recovery early helps vendors invest in business growth and improves the buyer's cash flow.

- With vendor onboarding, flexible financing options, and competitive rates, Credlix strengthens vendor relationships, improves liquidity, and ensures uninterrupted supply chain operations.

Channel Finance

Credlix Channel Financing is a digital invoice and purchase-order solution that enables enterprises to support their distributors and dealers with timely access to funds. Faster access to funds helps channel movement and uninterrupted sales operations.

- With quick onboarding, flexible credit options, and competitive rates, Credlix strengthens channel partnerships, improves liquidity, and accelerates go-to-market efficiency across the supply chain.

Business Loan

Credlix Business Loan is a fast, digital financing solution for MSMEs and growing businesses, offering unsecured loans up to ₹1 Crore with a fully online application and minimal documentation.

- With approvals in as little as 48 hours, flexible repayment options, and competitive interest rates, Credlix helps businesses manage cash flow and scale efficiently without collateral.

Explore Credlix Solutions

Import Financing

Seize Global Opportunities & streamline imports

Why Choose Credlix?

Expertise in Supply Chain Financing

As part of the Moglix Group, we leverage deep industry insights and a robust network.

Global Reach

With offices in India, USA, UAE, and Mexico, and partnerships in 90 countries, we support your global trade needs.

Apply Today to unlock the value of your invoices and propel your business growth with Credlix.

Frequently Asked Questions

What is Invoice Discounting?

How does it work?

What is the eligibility criteria for businesses?

Does Credlix have an upper sanction limit?

Will availing invoice discounting affect the balance sheet?