Importing goods or services involves purchasing products from another country to fulfill domestic demand or leverage advantages such as cost-effectiveness or quality that aren’t available locally. This process is integral to international trade, where countries acquire essential resources, raw materials, finished goods, or specialized services that enhance their economy.

For instance, a clothing retailer importing silk from China to sell in the United States benefits from cost savings and access to superior quality materials. Importing offers businesses and consumers a wider range of choices, stimulates competition, and supports economic growth by fostering trade relationships globally.

Understanding importing, including its benefits, challenges, and strategic tips, is crucial for businesses looking to expand their market reach and optimize their supply chain efficiency.

Key Takeaways

- Imports are products or services made abroad and bought in your own country.

- Countries import goods when local industries can’t produce them as cheaply or effectively.

- Free trade agreements and tariffs decide which goods are cheaper to import.

- Experts debate whether imports have positive or negative effects on economies.

What is Import?

An import is a product or service purchased by one country from another country. Imports form the basis of international trade. When a country’s imports exceed its exports in value, it results in a negative balance of trade, commonly known as a trade deficit. For instance, the United States has consistently experienced a trade deficit since 1975, amounting to $576.86 billion in 2019, as reported by the U.S. Census Bureau.

The Basics of Imports

Imports are goods or services that countries buy from other countries. Countries usually import things they can’t make as efficiently or cheaply themselves, or items like raw materials that aren’t found locally. For example, many countries import oil because they can’t produce enough on their own.

Why Imports Happen

Free trade agreements and tariffs (taxes on imports) often decide which goods are cheaper to import. With globalization and more free-trade deals, the United States imported goods and services worth $3.1 trillion in 2019, up from $580.14 billion in 1989.

Impact on Jobs

Importing from countries with lower labor costs has affected manufacturing jobs in the U.S. Between 2000 and 2007, and during the Great Recession and its slow recovery, many manufacturing jobs were lost. Free trade allows cheaper goods from other places, reducing the need for domestic products and jobs.

Debate Over Imports

Economists and experts have different views on how imports affect countries. Critics say relying too much on imports can lower demand for local products, hurting new businesses and entrepreneurship. On the other hand, supporters argue that imports give consumers more choices and lower prices, which also help prevent prices from rising too quickly (inflation). They believe this makes life better for everyone by offering affordable goods.

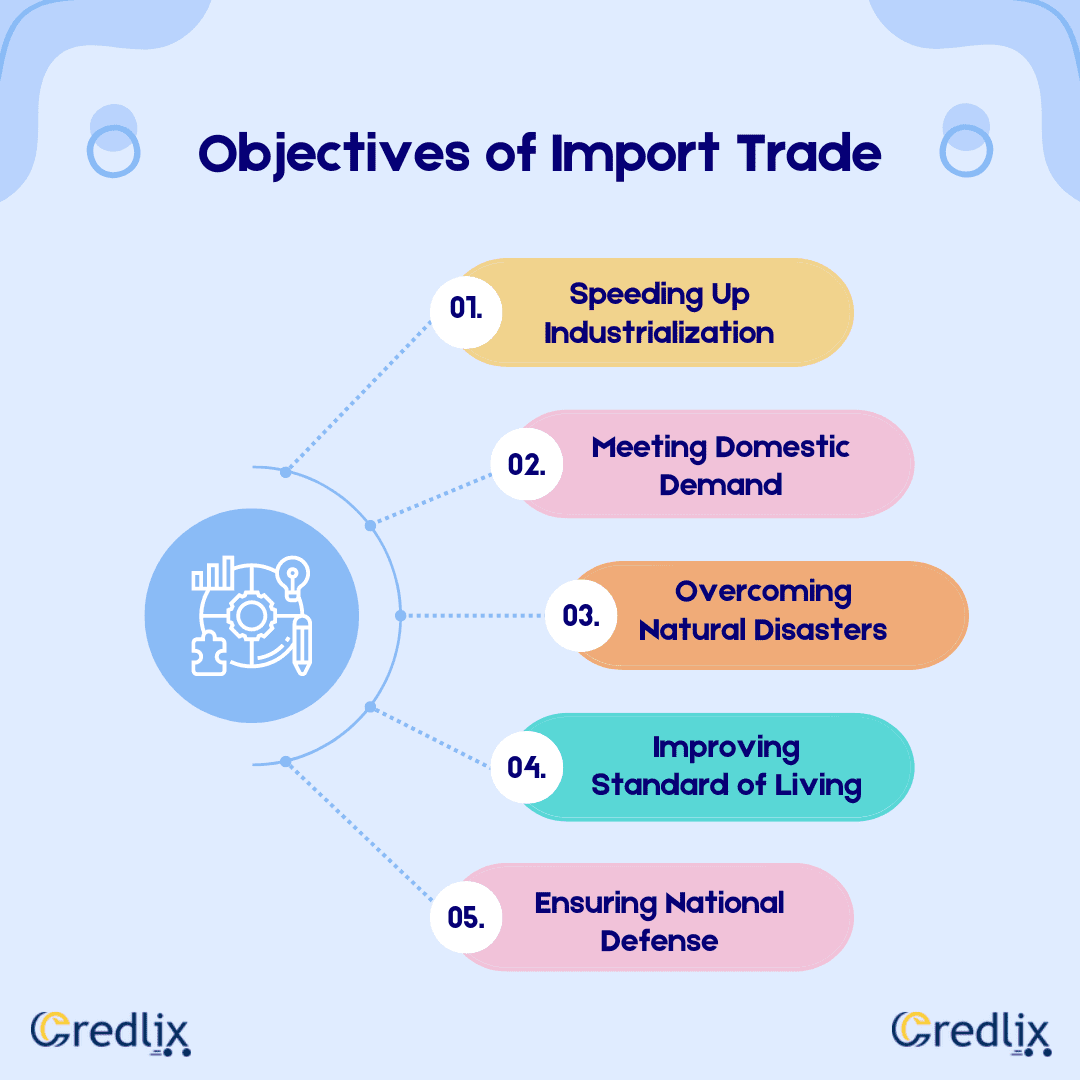

Objectives of Import Trade

Here are some of the objectives of Import Trade:

Speeding Up Industrialization

Developing countries import scarce raw materials, capital goods, and advanced technology needed for fast industrial growth.

Meeting Domestic Demand

Imports fulfill the demand for goods that are needed but not produced locally.

Overcoming Natural Disasters

During droughts, floods, earthquakes, and other disasters, countries import food grains and essential items to prevent starvation.

Improving Standard of Living

Imports provide consumers with a wide range of high-quality products, enhancing the overall standard of living.

Ensuring National Defense

Importing also involves managing financial transactions through banks to ensure the supply of goods essential for national defense.

Step in an Import Transaction

Here’s a detailed explanation of each step in a typical import transaction:

Trade Enquiry and Quotations

When a buyer in one country wants to purchase goods from another country, they begin by sending an inquiry to potential sellers. This inquiry includes details like desired quantity, quality standards, delivery terms, and pricing expectations. In response, the seller provides a ‘Quotation’ or ‘Proforma Invoice’.

This document outlines the terms of the sale, including the price per unit, total cost, shipping details, and any other relevant conditions. It serves as a formal offer from the seller to the buyer, outlining what will be provided and under what terms.

Procuring Import License

Importing goods into a country often requires an import license or permit issued by the government. This license ensures that the imported goods meet regulatory standards, comply with trade policies, and do not pose any risks to public health or safety.

The process for obtaining an import license varies by country and type of goods. It typically involves submitting an application to the relevant government agency, providing necessary documentation, and paying any required fees. Once approved, the importer is legally authorized to bring the specified goods into the country.

Arranging Foreign Exchange

International trade involves transactions in different currencies. When importing goods, the buyer in one country needs to pay the seller in the seller’s currency. This requires converting the buyer’s local currency into the foreign currency needed for payment. In India, for example, the Reserve Bank of India (RBI) oversees foreign exchange transactions through its Exchange Control Department.

Importers must follow RBI guidelines to acquire the necessary foreign currency through authorized banks or financial institutions. This ensures that payments to foreign suppliers are made in compliance with regulatory requirements and exchange rate policies.

Placing Order

Once the buyer reviews and accepts the seller’s quotation, they proceed to place an order or indent for the goods. This formalizes the buyer’s commitment to purchase the specified quantity of goods at the agreed-upon price and terms.

The order details are typically communicated to the seller in writing, outlining specifics such as product specifications, delivery schedule, packaging requirements, and any other contractual obligations. Placing the order initiates the process of fulfilling the import transaction as per the agreed terms between the buyer and seller.

Setting Up Letter of Credit

To provide assurance to the seller that they will receive payment upon fulfilling the order, the buyer’s bank issues a ‘Letter of Credit’ (LC). This financial instrument serves as a guarantee from the buyer’s bank to the seller that payment will be made once the seller meets all the terms and conditions of the sale.

The LC outlines the exact amount of money available for payment, the expiration date, shipping documents required for payment, and any other specific conditions agreed upon between the buyer and seller. It ensures trust and security in international trade transactions, especially when dealing with unfamiliar or distant business partners.

Arranging Financing

Importing goods often requires financial resources beyond the immediate cash flow of the buyer. Therefore, arrangements for financing must be made to ensure that the seller is paid upon the arrival of the goods. This may involve securing short-term financing from banks or financial institutions to cover the cost of purchasing the goods before they are sold or utilized.

Importers may use various financial instruments such as loans, lines of credit, or trade finance facilities to fund their import transactions and manage cash flow effectively throughout the procurement process.

Receiving Shipment Advice

Once the goods are ready for shipment, the seller notifies the buyer by providing shipment advice or notice. This document includes essential details such as the invoice number, shipping date, vessel name, port of departure, expected arrival date, quantity of goods shipped, and any other relevant information.

It serves as confirmation to the buyer that the goods have been dispatched as per the agreed terms and are en route to the destination port. The shipment advice helps the buyer prepare for the arrival of the goods and facilitates coordination with customs authorities and logistics providers for clearance and delivery.

Goods Arrival and Customs Clearance

Upon arrival at the destination port, the imported goods must go through customs clearance procedures to enter the importing country legally. This process involves verifying the documentation provided by the importer, assessing customs duties and taxes, inspecting the goods for compliance with regulatory standards, and granting permission for release into the local market.

Customs clearance ensures that imported goods meet all legal requirements and do not pose any risks to public health, safety, or the environment. Once clearance is obtained, the goods can be delivered to the buyer’s designated location for distribution or further processing.

10 Strategic Tips for Importing Goods Effectively

By implementing these strategic tips below, businesses can enhance their import operations, mitigate risks, and capitalize on opportunities to expand their product offerings and market presence through international trade.

Research Import Regulations: Understand the specific import regulations, tariffs, and customs procedures of both the exporting and importing countries to avoid delays and compliance issues.

Identify Reliable Suppliers: Establish relationships with reputable suppliers who offer competitive pricing, quality products, and reliable delivery schedules. Use trade directories, industry networks, and referrals for sourcing.

Negotiate Favorable Terms: Negotiate terms of trade, including pricing, payment terms, delivery schedules, and quality standards, to ensure a mutually beneficial arrangement.

Consider Currency Fluctuations: Monitor currency exchange rates and consider hedging strategies to mitigate risks associated with fluctuating exchange rates during international transactions.

Optimize Logistics and Shipping: Choose efficient shipping methods and logistics partners to minimize transit times, reduce costs, and ensure timely delivery of goods. Consider factors like shipping routes, container sizes, and incoterms.

Comprehensive Contractual Agreements: Draft detailed contracts that outline product specifications, delivery terms, inspection procedures, and dispute resolution mechanisms to protect your interests and clarify expectations.

Ensure Product Quality and Compliance: Conduct thorough quality inspections and compliance checks to verify that imported goods meet regulatory standards, safety requirements, and customer expectations.

Manage Inventory and Storage: Plan for efficient inventory management and storage facilities to accommodate imported goods, minimize storage costs, and maintain optimal stock levels to meet demand fluctuations.

Stay Informed About Market Trends: Stay updated on market trends, consumer preferences, and competitive pricing to make informed decisions about product selection, pricing strategies, and market positioning.

Evaluate Import Costs and Profitability: Calculate all import-related costs, including customs duties, taxes, shipping fees, and handling charges, to accurately assess profitability and make cost-effective sourcing decisions.

Conclusion

Importing goods is essential for global trade, providing access to resources, products, and opportunities otherwise unavailable domestically. It fuels economic growth, enhances consumer choice, and supports industry innovation. Understanding the complexities of importing, from regulatory compliance to strategic sourcing, empowers businesses to navigate international markets successfully and sustainably. By embracing efficient logistics, robust supplier relationships, and informed decision-making, businesses can leverage imports to strengthen their market position and meet diverse consumer demands effectively.

Also Read: How To Start Import Export Business In India: The Complete Guide