In recent years, export factoring, a financial service vital for international trade’s cash flow acceleration, has experienced notable evolution. The shifting dynamics of global markets, as businesses extend their reach, have prompted adaptations in export factoring to meet the evolving demands of international trade.

This blog delves into the dynamic future of export factoring, scrutinizing emerging trends and innovations that are not only reshaping but also revolutionizing the global finance and trade landscape.

Discover how this financial service is staying ahead of the curve, catering to the needs of businesses navigating the complexities of an increasingly interconnected and fast-paced international trade environment.

What is Export Financing?

Export financing refers to the financial support and instruments provided to businesses engaged in international trade to facilitate and optimize their export activities. It plays a crucial role in overcoming the financial challenges associated with cross-border commerce. Export financing encompasses various financial products and services designed to assist exporters in managing cash flow, mitigating risks, and expanding their global operations.

Also Read: A Comprehensive Guide to Export Finance in India

Common Forms of Export Financing

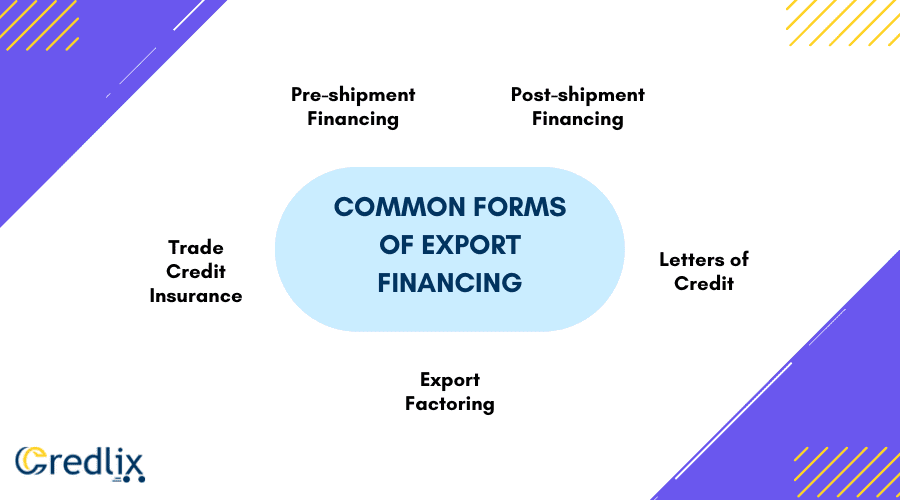

Common forms of export financing include:

-

- Pre-shipment Financing:

Provides funding to exporters before the shipment of goods to cover production and operational costs.

-

- Post-shipment Financing:

Offers financial support after the shipment of goods, ensuring exporters receive payment in a timely manner.

-

- Trade Credit Insurance:

Protects exporters against the risk of non-payment by buyers, safeguarding them from financial losses.

-

- Letters of Credit:

A payment guarantee issued by a bank, assuring the exporter that the buyer’s payment will be received.

-

- Export Factoring:

Involves selling accounts receivable to a third party to accelerate cash flow.

Trends and Innovations in Export Financing

Explore cutting-edge developments in export financing, from blockchain and sustainable finance to P2P lending, reshaping the global trade landscape.

Blockchain Technology in Export Financing: Revolutionizing Trust and Transparency

Blockchain technology is poised to redefine export financing by introducing unprecedented levels of trust and transparency. Its decentralized and immutable ledger system ensures that all parties involved in a transaction have access to the same information, minimizing the risk of fraud and errors. Smart contracts enable automatic execution of agreements, streamlining processes and reducing the need for intermediaries. This not only accelerates the financing process but also significantly cuts costs.

Moreover, blockchain enhances the traceability of goods in the supply chain, providing a secure and unalterable record of transactions. This transparency mitigates risks and increases the confidence of financiers. As the future of export financing unfolds, the integration of blockchain technology promises to foster a more efficient, secure, and trustworthy global trade ecosystem.

Digital Transformation: Streamlining Export Financing Processes

The digital transformation of export financing is ushering in a new era of efficiency and accessibility. Through digitization, manual and time-consuming processes are being replaced by automated systems, accelerating the approval and disbursement of funds. Online platforms and digital tools facilitate smoother communication between exporters, financiers, and other stakeholders, reducing delays and enhancing collaboration.

Additionally, digital transformation enables real-time tracking of transactions, providing stakeholders with instant updates on the status of financing. This not only improves decision-making but also enhances the overall agility of export financing operations. Embracing digital technologies ensures that export financing keeps pace with the fast-evolving global trade landscape, ultimately fostering a more agile and responsive financial ecosystem.

Sustainable Finance: Aligning Export Financing with Environmental Goals

In the future of export financing, sustainability takes center stage. The integration of sustainable finance practices addresses the growing emphasis on environmental, social, and governance (ESG) considerations. Financial institutions are increasingly incorporating sustainability criteria into their lending decisions, encouraging exporters to adopt eco-friendly practices.

Sustainable export financing supports projects that have a positive impact on the environment and society, contributing to global efforts to combat climate change and promote responsible business practices. As the world becomes more conscientious about sustainability, export financing trends indicate a shift towards greener and socially responsible financial solutions that align with the broader goals of a sustainable future.

Supply Chain Finance Integration: Enhancing Liquidity and Efficiency

The future of export financing is closely intertwined with the seamless integration of supply chain finance. This approach optimizes cash flow by leveraging the financial health of the entire supply chain. Exporters can benefit from improved liquidity, as financiers extend credit based on the creditworthiness of the entire supply chain rather than individual businesses.

Supply chain finance integration fosters collaboration among stakeholders, ensuring timely payments and reducing the risk of disruptions. By aligning financial processes with the dynamics of the supply chain, export financing becomes more resilient and adaptable to the challenges of the global marketplace. This innovative approach enhances efficiency and ensures the financial well-being of all participants in the export ecosystem.

Multi-Currency Capabilities: Navigating the Complexities of Global Trade

In the evolving landscape of export financing, multi-currency capabilities are becoming increasingly essential. With businesses engaging in cross-border trade, the ability to handle multiple currencies efficiently is a strategic advantage. Financiers and exporters need solutions that can seamlessly convert and manage diverse currencies, mitigating the risks associated with exchange rate fluctuations.

Technological advancements, such as real-time currency conversion tools and automated hedging strategies, enable stakeholders to navigate the complexities of multi-currency transactions with ease. As the global market continues to expand, export financing trends suggest a growing reliance on innovative solutions that provide robust multi-currency capabilities, ensuring financial stability and minimizing currency-related risks.

Expansion into Emerging Markets: Seizing Opportunities in a Globalized World

The future of export financing hinges on the exploration and expansion into emerging markets. With globalization accelerating, businesses are increasingly tapping into new and untapped regions for growth opportunities. Export financing plays a pivotal role in supporting these ventures by providing the necessary capital and financial instruments to navigate the challenges of entering diverse and dynamic markets.

Financial institutions are adapting their strategies to meet the unique needs of emerging market players, fostering economic development and global trade partnerships. This expansion not only benefits exporters but also contributes to the overall stability and growth of the global economy. As the world becomes more interconnected, export financing trends emphasize the importance of a flexible and responsive approach to emerging market opportunities.

Customized Solutions: Tailoring Financing to Unique Business Needs

In the future of export financing, one size does not fit all. Customized solutions are gaining prominence as businesses seek financing options tailored to their unique requirements. Financial institutions are increasingly offering personalized packages that address the specific challenges and opportunities of individual exporters. This approach enhances flexibility and ensures that financing solutions align with the diverse nature of global trade.

Customized export financing solutions may include variable interest rates, flexible repayment terms, and specialized risk mitigation strategies. This trend reflects a shift towards a client-centric approach, where financial institutions collaborate closely with exporters to understand their distinct needs and provide bespoke financial solutions. As businesses diversify and innovate, customized financing becomes a cornerstone of a responsive and adaptive export financing landscape.

Data Analytics and Risk Management: Informed Decision-Making for a Secure Future

The integration of data analytics and advanced risk management techniques is shaping the future of export financing. Leveraging big data and analytics tools provides financial institutions with insights into the creditworthiness and risk profiles of exporters. This data-driven approach enhances the accuracy of risk assessments, allowing financiers to make more informed lending decisions.

Furthermore, real-time monitoring of transactions enables quick identification of potential risks, allowing for proactive risk management strategies. As the global business environment becomes more complex, the ability to analyze and mitigate risks is paramount. The synergy of data analytics and risk management in export financing ensures a secure and resilient financial ecosystem that can adapt to the dynamic nature of international trade.

Invoice Financing: Empowering Exporters with Working Capital

Invoice financing is emerging as a key component in the future of export financing, empowering exporters with improved cash flow and working capital. This innovative approach allows exporters to unlock the value of their outstanding invoices by receiving a percentage of the invoice amount upfront. This immediate injection of funds enhances liquidity, enabling businesses to meet operational expenses, invest in growth opportunities, and navigate cash flow fluctuations.

With the use of technology, invoice financing processes are becoming more streamlined and accessible. Online platforms facilitate the quick and efficient processing of invoices, reducing the time it takes to receive funds. Exporters can leverage their accounts receivable to secure financing, creating a flexible and dynamic financial strategy. As the demand for working capital solutions grows, invoice financing is positioned to play a pivotal role in shaping the future landscape of export financing.

Peer-to-Peer (P2P) Financing: Democratizing Export Financing

The future of export financing is witnessing the rise of peer-to-peer (P2P) financing as a disruptive force, democratizing access to capital for exporters. P2P platforms connect businesses directly with a network of individual and institutional investors willing to provide financing. This disintermediated approach streamlines the financing process, reducing bureaucracy and offering competitive interest rates.

P2P financing also opens up new avenues for small and medium-sized enterprises (SMEs) that may face challenges in obtaining traditional bank loans. The transparent nature of P2P platforms, often facilitated by blockchain technology, builds trust among participants. As the export financing landscape evolves, P2P financing stands out as an inclusive and accessible model that has the potential to reshape the traditional dynamics of how businesses secure capital for global trade.

Final Note

In conclusion, the future of export financing is an exciting journey, marked by dynamic trends and innovations that empower businesses on the global stage. From embracing blockchain for trust to tailoring solutions for unique needs, the landscape is evolving. Whether through sustainable practices, digital transformations, or the rise of P2P financing, exporters find new avenues to thrive. As we navigate this financial frontier, the synergy of technology, customized solutions, and inclusive approaches promises a resilient and accessible future for export financing. It’s not just about transactions; it’s about fostering a global community where businesses, big and small, can flourish. The future is bright, promising a world of opportunities for those venturing into the global trade arena.

Also Read: Types of Export Factoring