In today’s worldwide business world, companies are always looking for simple money plans to handle the tricky parts of global trade. Dealing with changes in money value, delays in payments, and unsure credit situations can be tough. That’s where export factoring becomes important for businesses that send out goods and services.

It’s like a financial safety net – it helps protect against not getting paid and makes sure there’s always enough money coming in. This helps businesses grow and explore new opportunities in other countries.

Export factoring is like a key tool for businesses. It gives them the strength and money smarts to do well in the complicated world of global business. By handling uncertainties and making sure there’s enough money around, export factoring helps businesses keep growing. It’s like a helper that makes it easier for companies to take advantage of the many chances in the always-changing global business world.

What is Export Factoring in International Marketing?

Export factoring in international marketing refers to a financial arrangement that businesses use to manage the challenges associated with selling goods or services across borders. It is a specialized form of financing designed to facilitate and secure transactions in the global marketplace. In export factoring, a business sells its accounts receivable (unpaid invoices) to a third-party financial institution, known as a factoring company or factor.

Here’s how export factoring typically works:

Invoice Issuance: A business sells its products or services to international customers and issues invoices for the transactions.

Engagement with a Factor: The business enters into an agreement with an export factor (factoring company).

Invoice Submission: The business submits its unpaid invoices to the factor.

Advance Payment: The factor advances a significant percentage (typically 70-90%) of the invoice value to the business, providing immediate cash flow.

Collection Process: The factor takes over the responsibility of collecting payment from the international customers on behalf of the business.

Final Payment: Once the customer pays the invoice, the factor deducts its fees and releases the remaining balance to the business.

Export factoring serves several crucial purposes in international marketing:

Risk Mitigation: It helps mitigate the risk of non-payment or delayed payment by providing upfront cash for invoices.

Cash Flow Management: Export factoring ensures a steady cash flow for businesses, allowing them to meet operational needs and invest in growth opportunities.

Credit Management: Factors often assess the creditworthiness of international customers, providing valuable insights for businesses entering new markets.

Efficiency in Collections: The factor’s expertise in international collections streamlines the often complex process of receiving payments from customers in different countries.

Competitive Edge: By offering favorable credit terms, businesses using export factoring can gain a competitive edge in the global marketplace.

Overall, export factoring is a valuable financial tool that enhances the financial stability of businesses engaged in international marketing, enabling them to navigate the complexities of cross-border trade more effectively.

Also Read: How Does Export Factoring Work

Export Factoring: Transforming Global Trade with Financial Resilience and Strategic Growth

Export factoring has profoundly impacted the recent market, bringing transformative effects to businesses engaged in global trade.

Immediate Cash Flow Solutions

Export factoring acts as a financial stability beacon by providing swift access to working capital. By converting unpaid invoices into cash, businesses receive an instant injection of liquidity. This quick access empowers them to promptly meet operational needs, seize growth opportunities, and navigate cash flow constraints without delays.

Mitigating Payment Risks and Ensuring Stability

In the realm of international trade uncertainties, export factoring serves as a robust defense against payment risks. It acts as a shield, offering protection against buyer defaults or delayed payments. This assurance translates to a more secure cash flow for exporters, reducing their exposure to financial risks and enhancing stability in an ever-fluctuating market.

Amplifying Global Competitiveness

Competitive credit terms are pivotal in the global marketplace. Exporters utilizing factoring solutions can extend favorable credit terms to buyers. This not only strengthens business relationships but also provides a competitive edge in markets characterized by aggressive competition.

Streamlining Operations and Efficiency

Outsourcing receivables management to factoring companies streamlines administrative tasks and collections. This optimization allows exporters to focus on core operations, enhancing overall efficiency. The ability to allocate resources more effectively further amplifies their market presence.

Enabling Market Expansion and Growth

Immediate access to funds through export factoring facilitates market exploration and expansion. Businesses can venture into new territories, diversify their clientele, and capitalize on emerging opportunities. This dynamic capability fuels sustained growth and market diversification.

Enhancing Supplier Relationships

Export factoring not only benefits the selling side but also positively impacts relationships with suppliers. The improved cash flow enables timely payments to suppliers, fostering trust and reliability. Strong supplier relationships contribute to a more robust and resilient supply chain.

Adaptability to Market Trends

Export factoring provides businesses with financial flexibility to adapt to evolving market trends. Whether it’s responding to changes in demand, adjusting pricing strategies, or adopting new technologies, the financial stability offered by factoring empowers businesses to stay agile and responsive.

Risk Management and Regulatory Compliance

Factoring companies often assist in navigating complex regulatory landscapes, ensuring that transactions comply with international trade regulations. This support in risk management and regulatory compliance adds an extra layer of security, especially in markets with diverse legal frameworks.

Challenges and Considerations Of Export Factoring in International Marketing

Export factoring in international marketing presents various challenges and considerations that businesses must carefully navigate to maximize its benefits. Understanding and addressing these factors is crucial for a successful implementation of export factoring. Here are some key challenges and considerations:

Currency Fluctuations

Dealing with multiple currencies can expose businesses to exchange rate fluctuations. Fluctuations in currency values can impact the final amount received after factoring, affecting the overall financial outcome.

International Legal and Regulatory Complexity

Each country has its own set of legal and regulatory frameworks. Navigating these complexities requires a deep understanding of international trade laws and regulations to ensure compliance and avoid legal issues.

Customer Relationships and Communication

The involvement of a third-party factor in the collection process may impact the relationship between the business and its international customers. Clear communication and transparency are essential to maintain positive customer relationships.

Creditworthiness Assessment

Assessing the creditworthiness of international customers can be challenging. Factors need to have robust mechanisms in place to evaluate the credit risk associated with customers in diverse markets.

Factor Fees and Costs

Businesses need to carefully evaluate the fees and costs associated with export factoring. Factors typically charge fees for their services, and understanding the fee structure is vital to assess the financial implications.

Selective Factoring vs. Whole Ledger Factoring

Businesses must decide whether to engage in selective factoring (choosing specific invoices) or whole ledger factoring (factoring all invoices). This decision depends on the business’s cash flow needs and the specific circumstances of each transaction.

Impact on Profit Margins

While export factoring provides immediate cash flow, the fees involved can impact profit margins. Businesses need to weigh the benefits against the costs to ensure a positive financial outcome.

Market and Industry Considerations

Different markets and industries may have unique characteristics that impact the feasibility and effectiveness of export factoring. Understanding these nuances is crucial for successful implementation.

Due Diligence on Factoring Companies

Choosing a reliable and reputable factoring company is paramount. Conducting thorough due diligence on potential factors is essential to ensure they have the expertise and resources to handle international transactions.

Confidentiality Concerns

Export factoring involves sharing financial information with the factor. Businesses must consider confidentiality concerns and ensure that sensitive information is handled securely.

Navigating these challenges and considerations requires a strategic approach and a thorough understanding of the intricacies of international trade. Despite the complexities, export factoring can still be a valuable tool for businesses to enhance cash flow and manage the financial aspects of cross-border transactions effectively.

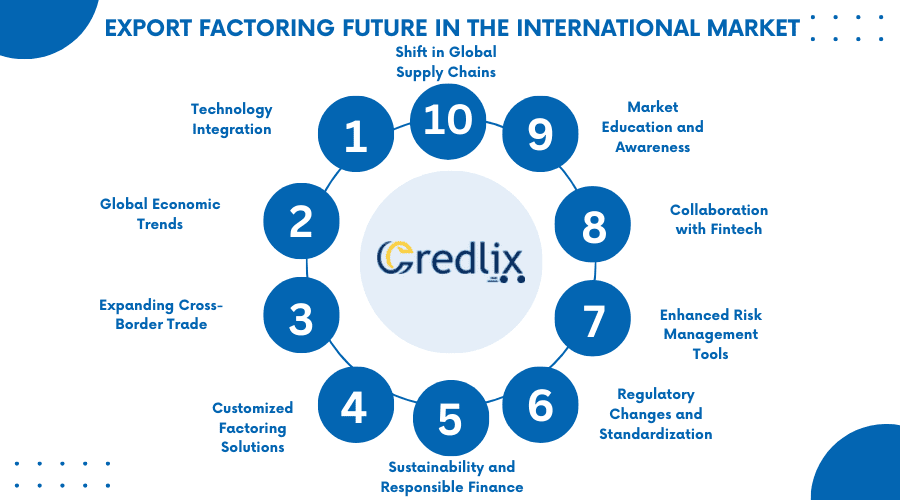

Export Factoring Future in the International Market

The future of export factoring in the international market appears promising, with several trends and developments pointing towards its continued relevance and growth. Here are key aspects shaping the future of export factoring:

Technology Integration

The integration of advanced technologies, such as blockchain and artificial intelligence, is likely to streamline and enhance the efficiency of export factoring processes. Automated systems can facilitate quicker transactions, reduce errors, and improve overall transparency.

Global Economic Trends

Economic trends, including trade tensions, geopolitical shifts, and economic recoveries, will influence the demand for export factoring. Businesses may increasingly turn to factoring as a financial tool to navigate uncertainties and ensure a stable cash flow.

Expanding Cross-Border Trade

As globalization continues, businesses are expected to engage in expanding cross-border trade. Export factoring will play a pivotal role in supporting companies entering new markets by providing financial stability and mitigating risks associated with international transactions.

Customized Factoring Solutions

Factoring companies are likely to offer more customized solutions to cater to the diverse needs of businesses operating in different industries and regions. Tailored factoring arrangements can address specific challenges and provide targeted financial support.

Sustainability and Responsible Finance

With a growing emphasis on sustainable business practices, factors may incorporate environmentally and socially responsible finance principles into their operations. This shift aligns with broader corporate responsibility trends seen across various industries.

Regulatory Changes and Standardization

Regulatory frameworks surrounding international trade and finance are subject to changes. Standardization and clearer regulations in the export factoring space can provide businesses with a more predictable and secure environment for cross-border transactions.

Enhanced Risk Management Tools

Export factoring may see advancements in risk management tools, helping factors and businesses better assess and manage risks associated with international transactions. Improved risk assessment can contribute to more informed decision-making.

Collaboration with Fintech

Collaboration between traditional financial institutions and fintech companies like Credlix may lead to innovative solutions in export factoring. Fintech innovations can introduce new features, improve accessibility, and enhance the overall user experience in the export factoring process.

Market Education and Awareness

Increased education and awareness about the benefits of export factoring, especially among small and medium-sized enterprises (SMEs), can drive higher adoption rates. Efforts to demystify the process and showcase success stories can contribute to a wider understanding of export factoring’s advantages.

Shift in Global Supply Chains

Changes in global supply chain dynamics, including diversification and resilience considerations, may lead businesses to reassess their financing strategies. Export factoring can become increasingly valuable as companies seek financial flexibility in adapting to evolving supply chain structures.

While export factoring faces challenges, its adaptability and potential to address the financial needs of businesses engaged in international trade position it as a relevant and evolving financial instrument in the future global marketplace.

Final Note

Export factoring emerges as a pivotal force in navigating the intricacies of global trade. It acts as a financial safety net, providing immediate cash flow solutions and mitigating risks associated with international transactions. As we look to the future, the integration of advanced technologies, customization of solutions, and collaboration with fintech signal a continued evolution in export factoring, making it an indispensable tool for businesses venturing into international markets.

With its transformative impact on cash flow management, risk mitigation, and market expansion, export factoring remains a key enabler for enterprises seeking financial resilience and strategic growth in the ever-evolving landscape of international commerce.

Also Read: Advantages of Export Factoring