Embarking on the journey of international trade? Exciting, but it comes with its own set of challenges, especially in managing cash flow. Enter Export Factoring, your financial ally in this global venture. Picture this: faster cash, reduced risk, and the freedom to focus on what you do best—growing your business.

In this blog, we’ll unravel the magic behind Export Factoring, showcasing how it empowers businesses to thrive in the world of exports. From boosting cash flow to navigating the complexities of cross-border transactions, we’ll delve into the advantages that make Export Factoring a game-changer.

Get ready to discover a financial tool that not only eases the process but also propels your business towards unprecedented growth. Welcome to the realm of Export Factoring – where financial solutions meet global success!

What is Export Factoring?

Export factoring is a financial transaction in which a company (the exporter) sells its accounts receivable, or invoices, to a third-party financial institution (the factor) at a discount. This practice is often used by businesses engaged in international trade to improve cash flow and mitigate the risks associated with selling goods or services on credit terms to overseas buyers.

Export Factoring in the Current Scenario

Exporters in India are embracing export factoring, leading to increased demand within the country. Despite this positive trend, the global growth of export factoring in India remains sluggish. While local exporters are increasingly comfortable with this financing option, the pace of adoption on the international stage suggests that there is potential for further expansion. Addressing the factors contributing to this slower growth could unlock greater opportunities for Indian exporters in the global market.

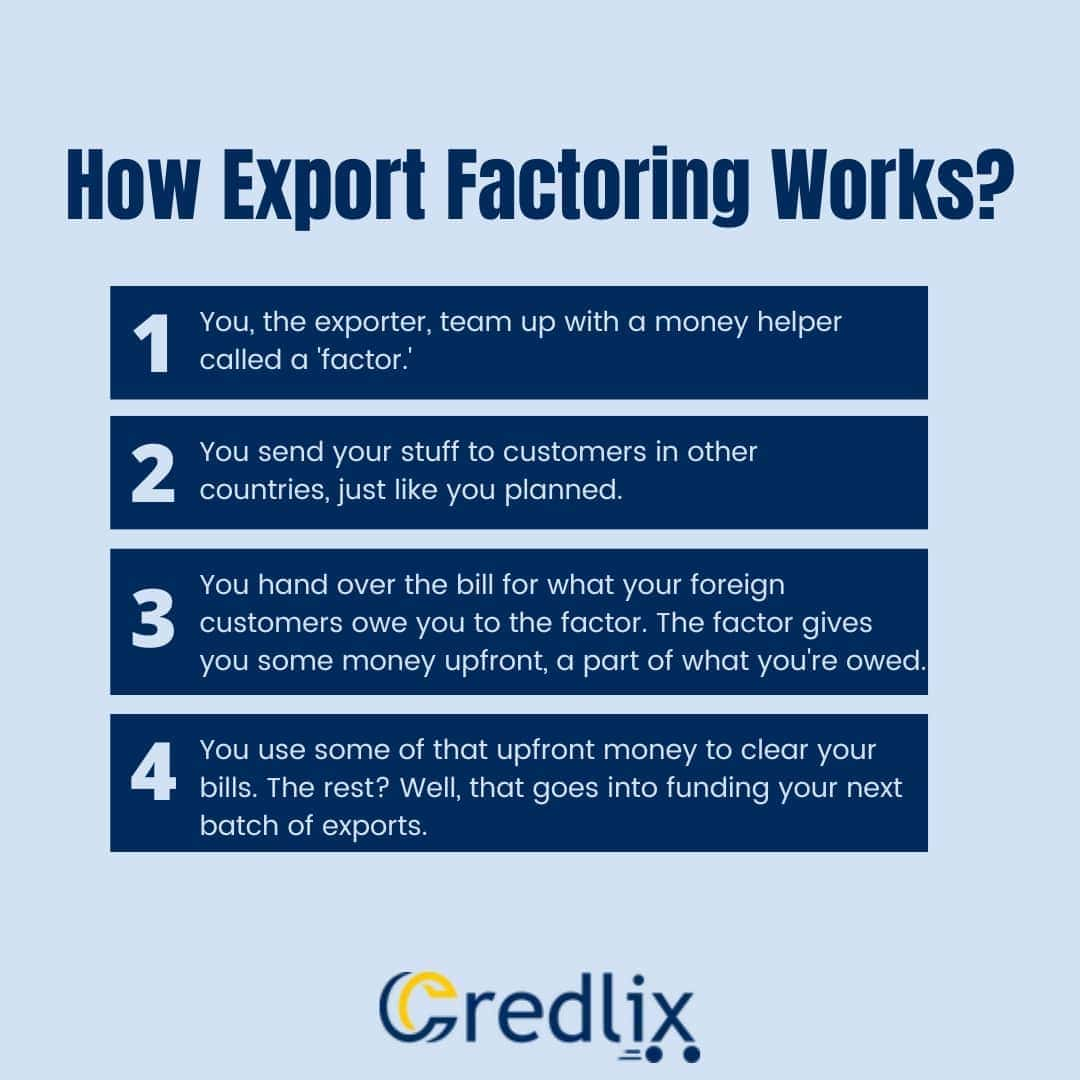

How Export Factoring Works?

Here’s how the export factoring works in simple steps.

Step 1:

You, the exporter, team up with a money helper called a ‘factor.’

Step 2:

You send your stuff to customers in other countries, just like you planned.

Step 3:

You hand over the bill for what your foreign customers owe you to the factor. The factor gives you some money upfront, a part of what you’re owed.

Step 4:

You use some of that upfront money to clear your bills. The rest? Well, that goes into funding your next batch of exports.

Also Read: Why is Export Factoring Important to Your Business?

Types of Export Factoring

There are generally two main types of export factoring: recourse factoring and non-recourse factoring. Let’s break down each type:

Recourse Factoring

What Is It: In recourse factoring, the exporter remains responsible for the payment if the foreign buyer fails to pay the invoice. If the buyer defaults, the exporter has to buy back the receivable from the factor.

Key Feature: It’s a bit riskier for the exporter, but the factoring fees are usually lower.

Non-Recourse Factoring

What Is It: With non-recourse factoring, the factor assumes the credit risk. If the foreign buyer doesn’t pay due to insolvency or other specified reasons, the exporter is not obligated to buy back the receivable. The factor absorbs the loss.

Key Feature: Offers more security for the exporter, but the factoring fees tend to be higher due to the assumed risk.

Major Benefits of of Export Factoring

Below are some of the major advantages of export factoring.

Improved Cash Flow

Export factoring provides immediate cash by advancing a percentage of the invoice value. This helps exporters maintain a healthy cash flow, allowing them to cover operational expenses, invest in growth, and seize new opportunities.

Reduced Credit Risk

With non-recourse export factoring, the factor assumes the risk of non-payment by the foreign buyer. This protects the exporter from losses due to buyer insolvency or default, enhancing financial stability.

Efficient Working Capital Management

Export factoring facilitates efficient working capital management by converting accounts receivable into immediate cash. This liquidity enables businesses to meet short-term obligations and pursue additional export orders.

Access to Professional Credit Management

Export factors often provide credit management services, including credit assessments of foreign buyers. This expertise helps exporters make informed decisions and minimize the risk of dealing with unreliable or financially unstable customers.

Focus on Core Business Activities

By outsourcing receivables management and collection to the factor, exporters can concentrate on their core business activities, such as production, marketing, and product development, rather than spending resources on debt recovery.

Flexible Financing

Export factoring offers flexibility in financing, allowing exporters to choose between recourse and non-recourse options based on their risk tolerance. This adaptability makes it a versatile financial tool for various business scenarios.

Enhanced Sales Opportunities

Offering favorable credit terms to international buyers can make a business more competitive. Export factoring enables exporters to extend credit without compromising their cash flow, potentially attracting more customers and expanding market share.

Streamlined Collections

Factors specialize in collections, ensuring timely and effective recovery of receivables. This minimizes the exporter’s involvement in the often complex and time-consuming process of chasing payments across international borders.

Mitigation of Currency Risk

Export factors may offer currency conversion services, helping exporters manage the risk associated with fluctuating exchange rates. This feature is particularly valuable when dealing with international transactions involving different currencies.

Credit Insurance

Some export factoring arrangements include credit insurance, further protecting exporters against the risk of non-payment. This insurance coverage adds an extra layer of security and peace of mind for businesses engaged in cross-border trade.

Also Read: How Export Factoring Empowers a Small Business to Conquer International Markets

Unlock Your Export Potential with Credlix

Credlix makes exporting easy for businesses by providing the money you need. We help you handle more orders from buyers effortlessly. Our simple solutions, like getting money for your invoices and financing your purchase orders, don’t require you to give any collateral. It’s really simple with us.

Conclusion

Export Factoring is a practical tool for businesses in global trade. It brings quick cash, reduces risks, and allows a focus on growth. While Indian exporters are catching on, there’s room for more global adoption. Export Factoring simplifies financial processes and accelerates business growth. Whether you’re experienced or starting, it’s a reliable way to navigate international trade challenges. Credlix offers straightforward solutions, making the process even simpler for businesses aiming to thrive in the global market.