For businesses involved in local and international trade, financial security and trust are essential to completing transactions smoothly. Two key financial tools that ensure secure payments and reduce risks in trade are Letters of Credit (LCs) and Bank Guarantees (BGs). Although both tools offer financial protection and involve banks, they serve different purposes and work differently. In this guide, we’ll delve into what each of these instruments is, how they function, and the scenarios where each is most useful.

What is a Bank Guarantee?

A Bank Guarantee is a promise made by a bank to cover the debts or obligations of a client if they fail to meet their financial commitments. In simple terms, if a borrower cannot repay a loan or fulfill a contract, the bank steps in and pays on their behalf. Bank guarantees are used primarily to protect against financial risks in various contracts, especially in construction, manufacturing, and other sectors where parties may have significant financial obligations.

Bank guarantees are categorized into two types:

- Financial-based Bank Guarantees: Here, the bank guarantees that a borrower will pay a specific debt. If the borrower defaults, the bank pays the creditor.

- Performance-based Bank Guarantees: These guarantees cover obligations related to a contract’s performance. For example, if a seller fails to deliver goods on time, the bank pays compensation to the buyer as stipulated in the agreement.

Example: Consider a construction company working on a large project that requires supplies from multiple vendors. The company might use a bank guarantee to reassure the suppliers that they’ll be paid on time. If the company fails to pay, the bank compensates the suppliers, ensuring they don’t suffer financial losses.

How Bank Guarantees Work?

Here’s a step-by-step outline of how a bank guarantee operates:

- The client (applicant) approaches the bank, providing a contract outlining the transaction terms.

- The bank assesses the applicant’s financial history, project success rate, and funds available.

- If the bank is confident the applicant can meet the contract terms, it issues the guarantee.

- In case of a default, the bank covers the applicant’s financial or performance shortfall within a specified period.

What is a Letter of Credit?

A Letter of Credit (LC) is a document issued by a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer is unable to make the payment, the bank covers it, giving the seller security in transactions. LCs are especially common in international trade, where the buyer and seller may not know each other well and need reassurance of the deal’s integrity.

Letters of Credit play a crucial role in the import-export industry by minimizing payment risks. The bank acts as a trusted intermediary, ensuring the buyer has sufficient funds and meets all agreed conditions.

Example: Suppose an electronics manufacturer in China exports phones to a retailer in the U.S. The Chinese manufacturer might request an LC from the U.S. buyer to guarantee payment. Once the goods are shipped, the Chinese manufacturer submits the necessary documents to their bank, which then pays them. The U.S. buyer’s bank reimburses the Chinese bank, completing the transaction securely.

How Do Letters of Credit Work?

Here’s a step-by-step process for how an LC operates:

- The buyer (importer) requests an LC from their bank (Bank 1), as required by the seller (exporter).

- The bank assesses the buyer’s financial status, and if approved, issues the LC to the exporter.

- Once the goods are shipped, the exporter submits the necessary documents to their own bank (Bank 2).

- Bank 2 verifies the documents, pays the exporter, and then recovers the amount from Bank 1, which collects it from the buyer.

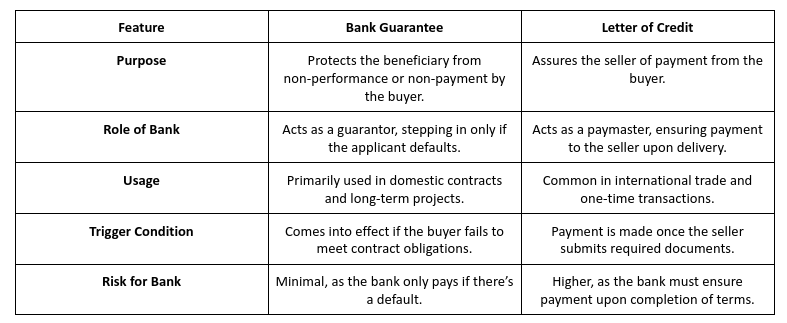

Differences Between Letters of Credit and Bank Guarantees

While both LCs and BGs are financial tools used to minimize risk in trade transactions, their purposes, working mechanisms, and applications differ. Here are the key differences:

Examples to Illustrate Bank Guarantees and Letters of Credit

Bank Guarantee Example

A real estate developer contracts a supplier for building materials, with both parties issuing bank guarantees. The developer’s bank guarantees payment for the materials, while the supplier’s bank guarantees that materials will be delivered as agreed. If one party fails, the respective bank compensates the other.

Letter of Credit Example

A furniture exporter in Italy sells goods to a retailer in Canada, relying on an LC to secure payment. Once the goods are shipped, the exporter submits the LC to their bank, which releases payment. The Canadian retailer’s bank reimburses the Italian bank, ensuring a smooth transaction.

Standby Letters of Credit vs. Bank Guarantees

A Standby Letter of Credit (SBLC) serves as a fallback in case a buyer cannot fulfill payment or performance obligations. Although similar to a bank guarantee, an SBLC is more often used as an additional security layer in contracts. While a BG only activates if there’s a default, an SBLC might be performance-based, protecting against breaches of contract and ensuring prompt action if obligations aren’t met.

How to Choose Between a Letter of Credit and a Bank Guarantee?

- Risk Level of Transaction: If you’re unsure about the other party’s ability to fulfill contract terms (e.g., an international supplier), an LC provides stronger payment security.

- Nature of Agreement: For long-term projects with repeated transactions, a BG is often better as it addresses payment and performance guarantees.

- Trade Sector: In high-value contracts like construction or manufacturing, a BG is often used to protect against losses. In contrast, an LC is ideal for cross-border trade where quick, secure payment is essential.

- Cost Considerations: LCs tend to be more expensive than BGs due to processing and payment requirements. However, the added security for international trade often justifies the cost.

Final Thoughts on Bank Guarantees and Letters of Credit

In today’s global economy, where trade frequently crosses borders, financial instruments like LCs and BGs are invaluable. A bank guarantee is ideal for businesses seeking coverage for long-term, performance-based agreements, while a letter of credit offers critical payment assurance, especially in international transactions. Both instruments are crucial in trade finance and risk management, helping parties build trust and conduct business with confidence.

Also Read: Types of Letters of Credit