The shortage or unavailability of timely funds is a common challenge for businesses. Deferred payments or slow growth can limit financial resources, often leaving organizations unable to take up new projects. This financial strain can lead to a downward spiral, risking the company’s future.

However, businesses can overcome this by using various financial instruments, with a bank guarantee being a popular option to secure credit temporarily.

What is a Bank Guarantee?

A bank guarantee is a financial instrument where a bank acts as the guarantor for a borrower. If the borrower is unable to meet their obligations, the bank steps in and pays the agreed amount to the beneficiary, ensuring the fulfillment of contractual terms.

Who Can Issue a Bank Guarantee?

Bank guarantees are issued by leading banks, non-banking financial companies (NBFCs), and lending institutions.

Why is a Bank Guarantee Required?

Following are the two major reasons why is a bank guarantee required:

- Provide Immediate Credit: Entrepreneurs unable to secure immediate funds can start projects using a bank guarantee without upfront investment. Payment is deferred until the necessary funds become available.

- Bridge the Trust Gap: Sellers can trust the guarantee that the bank will ensure payment, even if the buyer is unable to meet their obligations, reducing risk in business transactions.

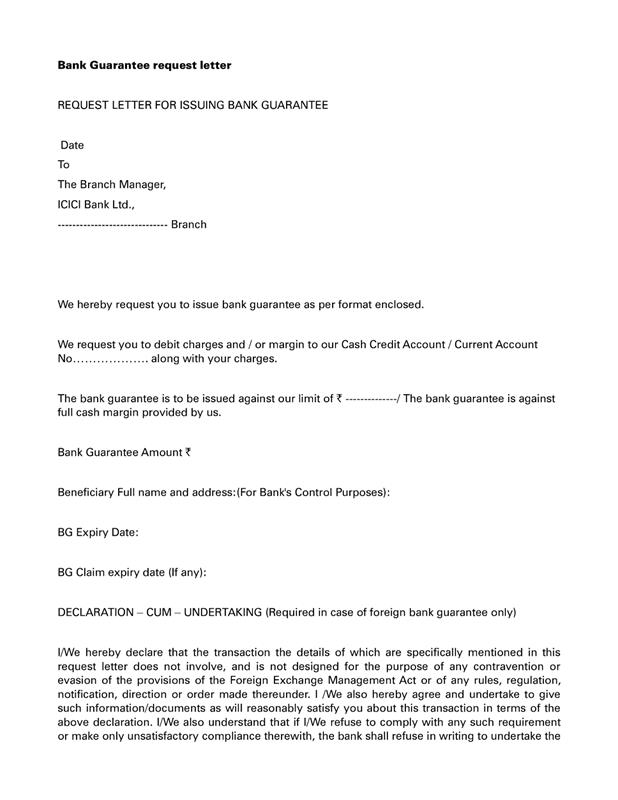

Bank Guarantee Format

Format of request letter for issuance of bank guarantee

Bank Guarantee Procedure

The process for obtaining a bank guarantee is straightforward. Businesses usually approach banks where they have an existing account to simplify the process. Companies or individuals can apply for a guarantee through in-person or online channels.

- Collateral: Banks may require collateral such as fixed deposits, stocks, or mutual funds.

- Time Duration: Guarantees can range from 3 months to 10 years, depending on the agreement.

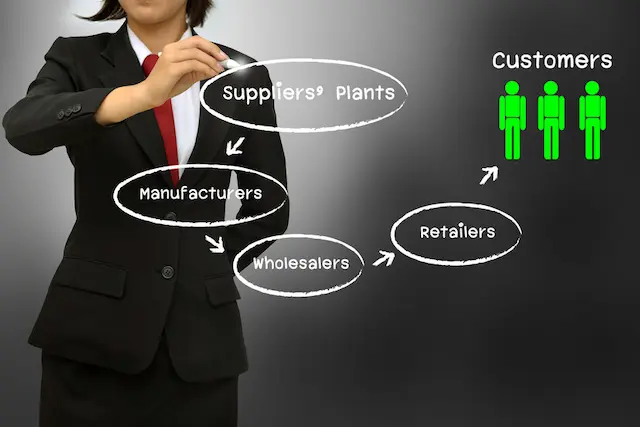

How Does a Bank Guarantee Work?

After the bank issues a guarantee, the buyer can proceed with the transaction. If the buyer defaults on payment, the seller can invoke the guarantee, and the bank will make the payment.

Example:

A company manufacturing goods may need a guarantee to purchase raw materials when funds are tied up in previous projects. The bank issues a guarantee to the supplier, ensuring payment. Once the company pays the supplier within the agreed timeframe, the guarantee becomes void.

Documents Required for a Bank Guarantee

- Application form

- Bank guarantee letter

- Stamp paper (as per the State Stamp Act)

- Board resolution (for companies)

Bank Guarantee Charges

Banks usually charge 0.50% to 0.75% every three months on the total amount. However, these charges can change based on the risk the lender is taking. If a bank guarantee is given without any collateral (security), the charges will be higher compared to when collateral is provided. Other costs include an 18% GST, which applies to all banking services, along with extra fees like processing fees, documentation fees, and handling fees.

Types of Bank Guarantees

Here are the different types of bank guarantees:

Deferred Payment Guarantee: This guarantee is typically used in situations where a buyer is unable to pay the seller on time. In such cases, the bank promises to make the payments on behalf of the buyer, but in installments over a set period. This ensures the seller gets paid even if the buyer is facing financial difficulties, and the bank will recover the money from the buyer later.

Financial Guarantee: This type of guarantee is often used in large-scale projects or contracts. It ensures that a project will be completed within the agreed timeframe and according to the terms laid out in the contract. If the party responsible for the project fails to deliver on time or according to specifications, the bank will step in to provide the financial compensation required to ensure the project is completed.

Advance Payment Guarantee: This guarantee is designed to protect the buyer’s advance payment. When a buyer pays the seller in advance for goods or services, the bank provides a guarantee that, if the seller fails to deliver the promised goods or services, the bank will refund the advance payment to the buyer. This provides a level of security to the buyer, ensuring that their money is not lost if the seller defaults.

Foreign Bank Guarantee: This type of guarantee is mainly used in international trade. It involves two banks from different countries—one in the buyer’s country and one in the seller’s country. The bank in the buyer’s country provides a guarantee to the seller’s bank, ensuring that payment will be made even if there are issues with the buyer. This helps to reduce the risks involved in cross-border transactions.

Performance Guarantee: A performance guarantee ensures that the seller or service provider delivers the goods or services as agreed upon in the contract. If the goods or services are substandard, defective, or not delivered as promised, the buyer can claim compensation from the bank. The bank will then cover the losses incurred by the buyer due to the seller’s failure to meet contractual obligations.

Bid Bond Guarantee: This guarantee is used in tender processes, particularly in the construction industry or government contracts. When contractors place bids for a project, a bid bond guarantee ensures that the winning contractor will accept the project and fulfill their commitments. If the contractor backs out after winning the bid, the bank will compensate the project owner for any losses or additional costs incurred.

Advantages and Disadvantages of a Bank Guarantee

Understand the advantages and disadvantages of a bank guarantee:

Advantages:

- Low charges due to collateral security.

- Quick approval process.

- Reduced trade risk for sellers.

- Demonstrates a strong financial history.

Disadvantages:

- Requires substantial collateral.

- Startups or companies with poor financial history may struggle to obtain guarantees.

Difference Between Bank Guarantee and Other Instruments

- Letter of Credit: Focuses on international trade, where the buyer’s bank ensures payment.

- Performance Bond: Guarantees compensation for non-performance, whereas bank guarantees ensure payment.

- Corporate Guarantee: The issuing company assumes responsibility for debt, unlike a bank guarantee.

- Standby Letter of Credit (SBLC): Similar to a bank guarantee but covers a wider range of risks.

Rules and Regulations for a Bank Guarantee

- Validity: Typically up to 10 years, though banks may extend this in special cases.

- Approval: Financial guarantees are preferred, while performance guarantees are selective.

- Authenticity Verification: Beneficiaries should confirm the validity of guarantees with the issuing bank.

Also Read: Choosing the Right Trade Finance Instrument for Your Business

FAQs on Bank Guarantee

1. What is a bank guarantee?

A bank guarantee is a legal contract in which a bank promises to pay a certain amount of money to a third party (the beneficiary) if the borrower (the bank’s client) fails to meet their financial obligations. It provides assurance to the beneficiary that they will receive payment, even if the borrower is unable to fulfill their commitments, thereby reducing the risk involved in the transaction.

2. When is a bank guarantee required?

A bank guarantee is typically required in situations where one party is concerned about the financial strength or reliability of the other. It is often used when one party (usually the buyer or contractor) does not have sufficient funds, or when there is a lack of trust between the parties involved. It helps to build confidence in transactions by providing a safety net, especially in large business deals, construction projects, or international trade.

3. Is a bank guarantee refundable?

Yes, a bank guarantee can be voided or canceled once the borrower fulfills their obligations, such as making the required payment or delivering goods/services as agreed. Once the terms of the contract are met, the bank’s responsibility under the guarantee ends, and any fees or charges paid for the guarantee are typically non-refundable. However, the guarantee itself no longer holds any financial liability for the borrower or the bank once the conditions are satisfied.

4. Who is the beneficiary of a bank guarantee?

The beneficiary is usually the party to whom the payment or obligation is owed—most commonly the seller or contractor. In a commercial transaction, the beneficiary receives the assurance that they will be compensated if the buyer (or the party requesting the guarantee) fails to meet their obligations, whether it’s payment, delivery of goods, or completion of services.

5. What is the claim period in a bank guarantee?

The claim period is the specific time frame during which the beneficiary can make a claim against the bank guarantee. This period is typically set out in the terms of the contract and starts from the date the guarantee is issued. If the beneficiary believes that the borrower has defaulted on their obligations within this period, they must raise a claim with the bank before the claim period expires. After this time, the bank is no longer liable to honor the guarantee.