Export financing plays a crucial role in facilitating the expansion of companies beyond domestic borders. It involves securing funding against future receipts from sales made overseas. In today’s globalized landscape, venturing into foreign markets is not only advantageous for growth but also essential for resilience during economic downturns.

However, navigating international trade presents significant challenges, particularly regarding financing. Companies often encounter barriers to entry and the risk of default when attempting to sell abroad. This article delves into the critical issue faced by exporting firms in terms of both pre-financing and post-financing their foreign trade operations.

While traditional banking options exist, they may not always suffice to address the diverse financing needs of exporters. Hence, exploring alternative financing avenues, such as export leasing, becomes imperative. By analyzing these challenges and considering innovative financing solutions, companies can better position themselves to capitalize on global opportunities and enhance their competitiveness on the international stage.

Also Read: The Role of Export Credit Agencies in Export Financing

Understanding Export Leasing

Export leasing, also referred to as international leasing, stands out as a noteworthy alternative among non-bank financing options for exports. Unlike traditional leasing arrangements, export leasing involves renting goods located abroad, catering specifically to international trade transactions.

In essence, export leasing operates similarly to regular leasing agreements—a leasing company purchases the goods desired by the importer from the exporter and subsequently leases these goods to the importer. This arrangement proves especially advantageous for goods with a lifespan exceeding two years.

For exporters, export leasing presents a streamlined approach to facilitate international sales by leveraging the expertise and resources of leasing companies. By transferring ownership of the goods to the leasing company, exporters can expand their reach into global markets without the need for significant upfront investment or extensive financial commitments.

Overall, export leasing offers a straightforward and efficient mechanism for exporters to meet the needs of international buyers while mitigating financial risks and enhancing cash flow, thus fostering greater opportunities for global trade expansion.

Role of Export Financing in International Trade

Export financing plays a pivotal role in facilitating international trade transactions by addressing the financial needs that arise at various stages of the export process. These financial requirements typically span from the initial production phase to the final collection of payment upon delivery of goods.

During the pre-export phase, exporters often encounter the need for funding to support manufacturing activities and prepare the goods for shipment. This period, known as export pre-financing, encompasses the duration from the commencement of production to the point of product delivery. Exporters seek pre-financing to ensure they have the necessary liquidity to cover production costs, purchase raw materials, and meet operational expenses. Such financing arrangements are commonly structured through loan facilities or credit lines, enabling exporters to access the capital needed to initiate and sustain the export process.

Conversely, post-export financing, also referred to as post-financing of exports, addresses the financial requirements arising after the goods have been dispatched and delivered to the importer. In this scenario, exporters may opt to receive advances on payments owed to them by importers who have chosen to defer payment. Post-financing allows exporters to mitigate the cash flow challenges associated with delayed payments, providing them with access to funds that would otherwise be tied up until the importer settles their dues. The duration of post-financing typically extends from the moment of product transport to the agreed-upon date of payment collection, offering exporters a financial bridge during the interim period.

In essence, export financing serves as a crucial financial mechanism that enables exporters to navigate the complexities of international trade by providing them with the necessary capital at different stages of the export process. Whether it’s to facilitate production activities or to manage cash flow uncertainties post-shipment, export financing plays a vital role in supporting the growth and sustainability of businesses engaged in global trade.

Also Read: How Does Export Financing Promote Trade?

When to Use International Leasing?

International leasing serves as an advantageous financial tool in various scenarios where traditional purchasing or financing methods may not be feasible or cost-effective. Businesses often opt for international leasing when they seek to acquire equipment, machinery, or other assets for use in international markets without the need for substantial upfront investment or long-term commitment. This approach proves beneficial when navigating uncertainties such as fluctuating exchange rates, regulatory complexities, or limited access to capital.

Additionally, international leasing offers flexibility in terms of asset management, allowing businesses to adapt to evolving market conditions and technology advancements without being tied down by ownership constraints. Furthermore, leasing provides opportunities for businesses to conserve cash flow and preserve credit lines, as lease payments are typically structured over a specified period, offering manageable and predictable financial obligations. Overall, international leasing presents a strategic option for businesses aiming to expand globally while minimizing financial risks and maximizing operational efficiency.

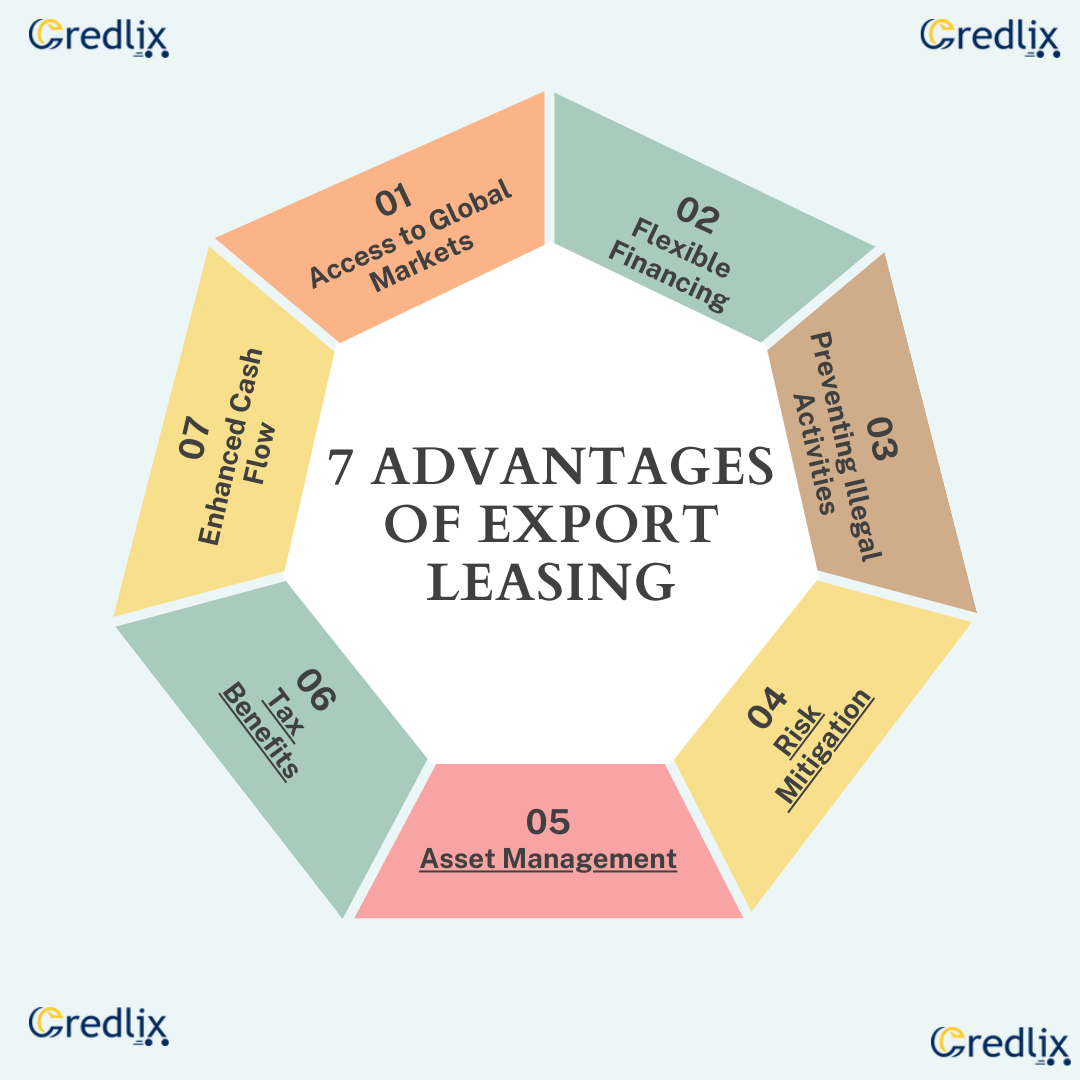

7 Advantages of Export Leasing

Export leasing offers several advantages for businesses engaged in international trade. Here are seven key benefits explained in detail:

Access to Global Markets: Export leasing enables businesses to access international markets without the need for substantial upfront investment. By leasing goods to foreign buyers, exporters can expand their reach and tap into new customer bases around the world.

Flexible Financing: Unlike traditional financing options, export leasing provides flexible payment terms tailored to the needs of both exporters and importers. This flexibility allows businesses to structure lease agreements according to their cash flow requirements and budget constraints.

Preservation of Capital: Export leasing helps preserve capital by avoiding large upfront expenditures associated with outright purchases. Instead of tying up capital in equipment or machinery, businesses can allocate resources to other critical areas such as marketing, research and development, or expansion initiatives.

Risk Mitigation: Export leasing helps mitigate risks associated with international trade transactions. Leasing companies often assume responsibility for managing risks such as currency fluctuations, regulatory compliance, and asset maintenance, providing peace of mind to both exporters and importers.

Asset Management: Leasing companies typically handle asset management throughout the lease term, including maintenance, repairs, and upgrades. This relieves exporters of the burden of managing assets across different geographical locations, allowing them to focus on core business activities.

Tax Benefits: Export leasing may offer tax advantages for businesses operating in multiple jurisdictions. Depending on local tax regulations, lease payments may be deductible as operating expenses, resulting in potential tax savings for both exporters and importers.

Enhanced Cash Flow: By generating steady lease income over the duration of the lease term, export leasing helps improve cash flow for exporters. Predictable revenue streams from lease payments enable businesses to better manage expenses, debt obligations, and investment opportunities.

In conclusion, export leasing emerges as a valuable financial strategy for businesses navigating the complexities of international trade. By leveraging export leasing, companies can efficiently access global markets, preserve capital, and mitigate risks associated with cross-border transactions. The flexibility of lease agreements enables businesses to tailor financing arrangements to their specific needs, while also benefiting from expert asset management and potential tax advantages.

Moreover, export leasing enhances cash flow by providing a steady stream of revenue over the lease term, empowering businesses to allocate resources effectively and seize growth opportunities. Overall, export leasing serves as a catalyst for expanding global reach, fostering competitiveness, and driving sustainable growth in today’s interconnected economy.

Also Read: Also Read: How Does Export Financing Promote Trade?