Are you involved in shipping goods internationally? Wondering about the essential documentation required for seamless exports? The Export General Manifest, commonly known as EGM, is a crucial document mandated by the Customs Act (1962) for all carriers involved in export operations.

Serving as a comprehensive record of the consignments loaded onto shipping vessels, aircraft, or other modes of transportation, the EGM plays a pivotal role in customs clearance procedures.

Whether you’re a shipping company, exporter, or logistics provider, understanding the significance of the EGM is paramount for ensuring compliance and facilitating smooth export processes. In this guide, we delve into the intricacies of the EGM, its importance in international trade, and its role in facilitating efficient exports through platforms like ICEGATE.

Also Read: What is ICEGATE and How Does it Work?

What is an Export General Manifest?

The Export General Manifest (EGM) is a crucial document required under the Customs Act (1962) to regulate and monitor exports and imports. It places responsibility on carriers, such as shipping vessels or aircraft, to provide essential details of the consignments loaded onto their vehicles. This information is submitted in a specified format known as the Export General Manifest.

The EGM serves as a vital part of customs clearance procedures, ensuring transparency and accountability in international trade. Filed prior to the departure of the carrier, the EGM acts as conclusive evidence of the shipment and export process.

In addition to shipping vessels and aircraft, vehicular transportation also necessitates a similar report, termed as an Export Report. This report serves the same purpose as the EGM, providing essential details of the consignment being transported.

Overall, the Export General Manifest plays a pivotal role in facilitating smooth and regulated export processes, enabling effective customs clearance and compliance with legal obligations in international trade.

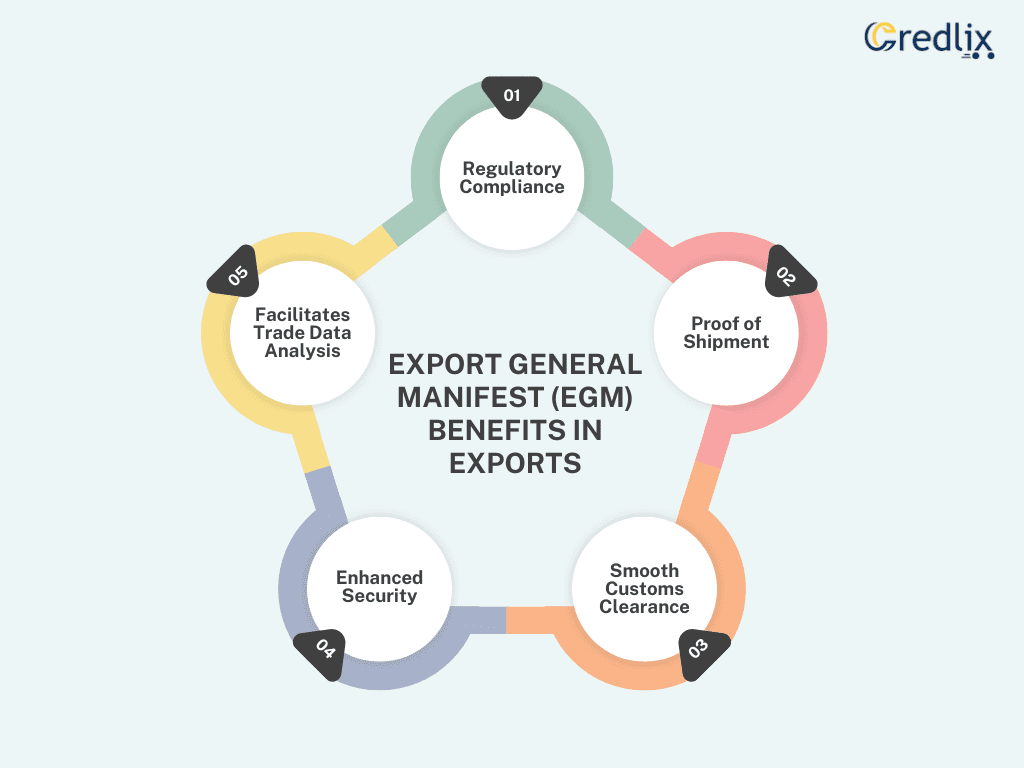

Export General Manifest (EGM) Benefits in Exports

Exporters and shipping companies rely on various documentation to facilitate international trade, and the Export General Manifest (EGM) stands out as a critical component in this process. The EGM offers several benefits that streamline export operations and ensure regulatory compliance:

Regulatory Compliance: The EGM is mandated by the Customs Act (1962), ensuring exporters adhere to legal requirements when shipping goods internationally.

Proof of Shipment: By providing a detailed record of the consignments loaded onto shipping vessels or aircraft, the EGM serves as conclusive evidence of the shipment process, enhancing transparency and accountability.

Smooth Customs Clearance: Submitting the EGM before the departure of the carrier facilitates efficient customs clearance procedures, reducing delays and expediting the export process.

Enhanced Security: The comprehensive documentation included in the EGM enables authorities to monitor and track shipments, bolstering security measures in international trade.

Facilitates Trade Data Analysis: The data collected through EGMs enables authorities to analyze trade patterns and trends, informing policy decisions and promoting economic growth.

Overall, the Export General Manifest plays a crucial role in facilitating smooth, secure, and compliant export operations, benefiting exporters, shipping companies, and regulatory authorities alike.

Who Files Export General Manifest?

The responsibility of filing the Export General Manifest (EGM) lies with the person in charge of the vessel or aircraft, as outlined in Section 148 of the Customs Act. Alternatively, this duty can also be fulfilled by an agent representing the person in charge, upon acceptance by a proper officer. In doing so, the agent assumes the obligations and liabilities of the person in charge, including potential penalties or confiscations.

The EGM must be filed before the carrier’s departure, although exceptions may be granted by the proper officer under specific circumstances, contingent upon the provision of adequate security and surety by the carrier’s agent. The filing process can be completed electronically through the Customs EDI system or manually, with the carrier submitting a physical EGM alongside the exporter’s copies of the shipping bills.

Regardless of the filer, whether the person in charge or their agent, the signatory is legally bound to verify the accuracy of the EGM’s contents, rendering it a legally binding declaration. Any amendments or supplements to the EGM must be approved by the proper officer, provided they are satisfied that no fraudulent intent is involved. Failure to file the EGM or any falsification therein may result in penalties under the Customs Act.

The Format of Export General Manifest (EGM)

The Export General Manifest (EGM) is prepared according to the Export Manifest (Vessels) Regulations, 1976, and Export Manifest (Aircraft) Regulations, 1976. It is submitted in duplicate and encompasses all goods transported by the aircraft or vessel.

The EGM comprises four forms:

- Form I: This form entails a general declaration.

- Form II: It contains the passenger manifest.

- Form III: For vessels, it lists private property held by the master, officers, and crew, while for aircraft, it includes the cargo manifest. Additionally, private property of the captain and crew members for aircraft is detailed in a separate Form IV.

- Cargo Manifest: For aircraft, separate sheets detail shipped cargo, transhipped cargo, and cargo remaining onboard. If carrying specific items like arms or explosives, separate sheets are required, or a NIL declaration if not applicable. Similarly, vessels detail shipped goods, transhipped goods, goods remaining onboard, and dutiable goods, including arms and ammunition, with separate sheets for arms and ammunition details.

Moreover, vessels must disclose port names for transported goods and whether the vessel will deliver them. For transhipped goods, the names of ports and vessels used must be disclosed.

Shipping Bill vs. Export General Manifest

In businesses, a common query arises regarding the disparity between a shipping bill and an export general manifest (EGM). The Export General Manifest, as per its definition, necessitates filing by the shipping carrier after the export occurs—either before the goods’ departure or within seven days post-departure. The individual in charge of the vessel assumes responsibility for filing the EGM.

On the other hand, a Shipping Bill is a mandatory document to be generated before exporting goods to another country. This bill is filled out at the time of export and can be generated via the Indian Customs EDI System (ICES) or the non-EDI mode for non-EDI ports. Thus, while the EGM is filed post-export, the Shipping Bill is a prerequisite for the export process itself.

In conclusion, the Export General Manifest (EGM) serves as a cornerstone of international trade, ensuring transparency, compliance, and efficiency in export operations. By providing a detailed record of shipped consignments, the EGM facilitates smooth customs clearance procedures and enhances security measures.

It plays a pivotal role in regulatory compliance, trade data analysis, and the overall facilitation of export processes. Understanding the significance of the EGM, along with its format, filing procedures, and distinctions from other export documentation like the shipping bill, is essential for all stakeholders involved in international trade.

Also Read: How to Download Shipping Bills from ICEGATE?

![Export General Manifest [EGM] – For Shipping, Exports & Icegate](/_next/image?url=https%3A%2F%2Fblog.credlix.com%2Fwp-content%2Fuploads%2F2019%2F09%2F8-3.png&w=3840&q=75)