In global trade, businesses often deal with uncertainties like payment risks. Export factoring and export credit insurance are two solutions that help manage these challenges. They may seem similar, but they have differences in how they work and the benefits they offer.

In this blog, we’ll break down export factoring and export credit insurance in simple terms to help you decide which one suits your business best. Whether it’s getting guaranteed payments through export factoring or protecting your finances with export credit insurance, we’ll guide you through the basics so you can make an informed choice for your business’s unique needs.

All About Export Factoring

Export factoring is a financial solution that helps businesses engaged in international trade manage their cash flow and reduce payment risks. In simple terms, it involves a company selling its accounts receivable (invoices) to a third party, known as a factor, at a discount. This allows the business to receive immediate funds, typically a percentage of the invoice value, rather than waiting for the customer to make the full payment.

Here’s a closer look at the key aspects of export factoring:

Cash Flow Optimization: Export factoring provides a quick injection of cash, which can be crucial for businesses dealing with long payment cycles in international transactions.

Risk Mitigation: By transferring the credit risk to the factor, businesses protect themselves from non-payment or delayed payment by international buyers. Factors often have expertise in assessing the creditworthiness of foreign customers.

Services Offered: Factoring companies may offer additional services, such as credit protection, collection services, and receivables management, further simplifying the complexities of international trade.

Customer Relations: Despite selling the invoices to a factor, the original business might still maintain a direct relationship with its customers, as factors can operate transparently in the background.

Flexibility: Export factoring is adaptable and can be used on a recurring basis, providing a consistent solution for businesses engaged in frequent international transactions.

In essence, export factoring is a strategic financial tool that allows businesses to navigate the challenges of international trade by ensuring a steady cash flow and minimizing the uncertainties associated with payment collection.

Also Read: How Does Export Factoring Work

All About Export Credit Insurance

Export credit insurance is a protective financial tool designed to safeguard businesses involved in international trade from the risks of non-payment by their overseas customers. In straightforward terms, it acts as a safety net, offering coverage against losses incurred due to a customer’s inability or unwillingness to pay for goods or services.

Here’s an overview of key aspects related to export credit insurance:

Risk Protection: Export credit insurance shields businesses from the potential financial impact of non-payment or delayed payment by their foreign buyers. This ensures a more secure and predictable cash flow.

Coverage for Commercial and Political Risks: Export credit insurance typically covers both commercial risks, such as insolvency of the buyer, and political risks, such as changes in government policies affecting trade.

Global Market Expansion: With the safety net of credit insurance, businesses gain confidence to explore new markets and extend credit terms to international customers, fostering global market expansion.

Credit Risk Assessment: Insurance providers often assess the creditworthiness of foreign buyers, helping businesses make informed decisions about trading terms and customer relationships.

Tailored Policies: Export credit insurance policies can be customized to meet the specific needs of a business, including coverage for particular buyers, countries, or types of products.

Access to Financing: Some financial institutions may require export credit insurance as collateral, enabling businesses to secure financing more easily and at favorable terms.

In essence, export credit insurance acts as a protective shield for businesses venturing into international trade, allowing them to explore new markets, extend credit to customers, and navigate the complexities of global commerce with greater confidence and security.

Export Factoring and Export Credit Insurance

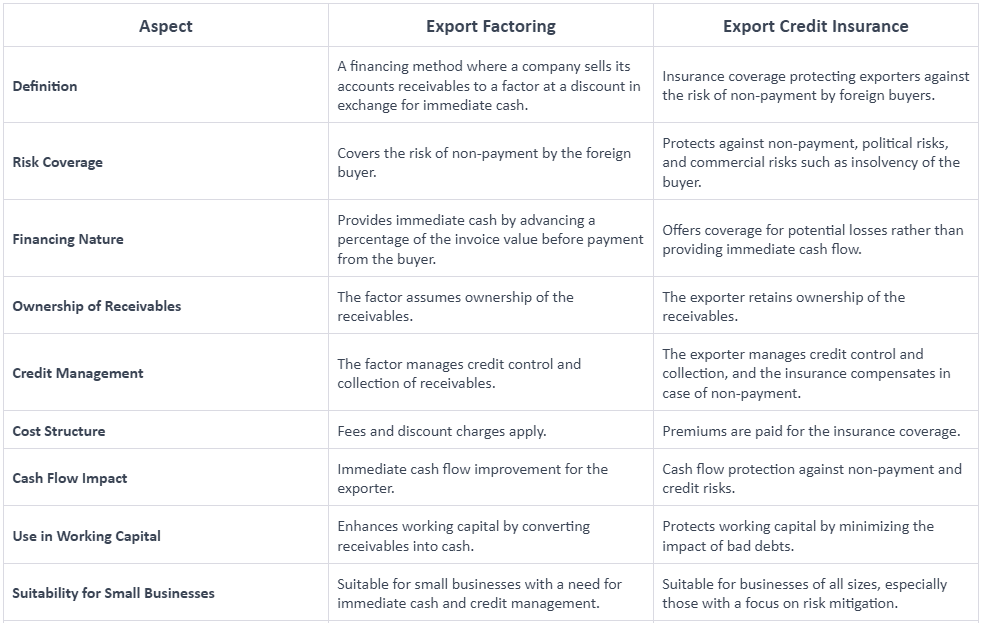

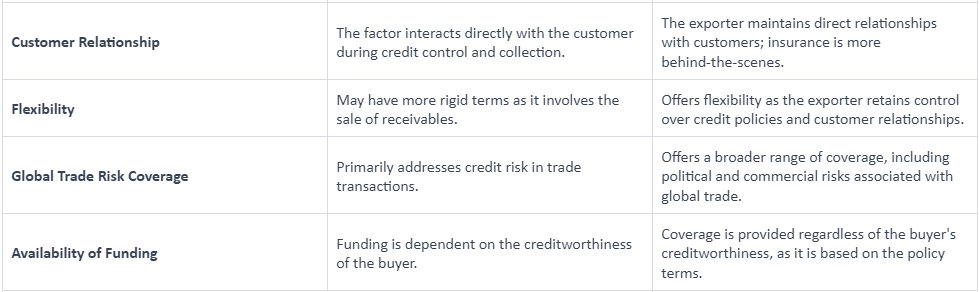

Here’s a table comparing Export Factoring and Export Credit Insurance across various aspects:

It’s important to note that the choice between Export Factoring and Export Credit Insurance depends on the specific needs and preferences of the exporter, the nature of their business, and the level of risk they are willing to manage.

Comparing Export Factoring and Export Credit Insurance: Which One To Choose?

Choosing between Export Factoring and Export Credit Insurance depends on the specific needs, priorities, and circumstances of the exporter. Here are some considerations that may guide the decision-making process:

Immediate Cash Flow vs. Risk Mitigation

- Choose Export Factoring if immediate cash flow is a top priority, and the exporter is willing to accept a discount on the invoice value.

- Choose Export Credit Insurance if the primary concern is mitigating the risk of non-payment, insolvency, and political risks associated with international trade.

Ownership and Control

- Opt for Export Factoring if the exporter is comfortable relinquishing ownership of the receivables and prefers the factor to handle credit management and collections.

- Opt for Export Credit Insurance if maintaining ownership of receivables and having control over credit management and collections is a priority.

Business Size and Structure

- Small businesses with limited resources may find Export Factoring beneficial for immediate liquidity and credit management.

- Larger businesses with established credit management processes may prefer Export Credit Insurance for comprehensive risk coverage.

Cost Considerations

- Evaluate the cost structure of both options. Export Factoring involves fees and discounts, while Export Credit Insurance requires payment of premiums.

- Consider which option aligns better with the budget and financial goals of the exporter.

Risk Tolerance

- If the exporter is risk-averse and seeks comprehensive coverage against various risks, Export Credit Insurance may be more suitable.

- If the exporter is willing to bear some risk in exchange for immediate cash and simpler transaction processes, Export Factoring may be a better fit.

Global Trade Exposure

- Assess the level of exposure to different risks in global trade. Export Credit Insurance provides a broader range of coverage, including political and commercial risks.

- If the focus is primarily on credit risk associated with buyers, Export Factoring may suffice.

Customer Relationships

- Consider the importance of maintaining direct relationships with customers. Export Factoring involves the factor interacting directly with the customer, while Export Credit Insurance operates more in the background.

Flexibility and Customization

- Evaluate the flexibility offered by each option. Export Credit Insurance tends to provide more flexibility in terms of credit policies and customer relationships.

- Export Factoring may have more rigid terms but can still be customized to some extent.

Ultimately, exporters should conduct a thorough analysis of their specific needs, risk tolerance, and financial objectives before deciding between Export Factoring and Export Credit Insurance. It may also be beneficial to consult with financial advisors or trade finance experts to make an informed decision based on the unique circumstances of the business.

Final Note

In conclusion, choosing between Export Factoring and Export Credit Insurance hinges on your business priorities. Opt for Export Factoring for quick cash and streamlined credit management, ideal for small businesses. Conversely, Export Credit Insurance provides comprehensive risk coverage, safeguarding against non-payment, insolvency, and political risks.

It enables global market expansion, offering a safety net for businesses exploring new territories. Assess your cash flow needs, risk tolerance, and the desire for control to make an informed decision. Consult financial experts to tailor a solution aligning with your unique business dynamics, ensuring a secure and prosperous venture into international trade.

Also Read: Advantages of Export Factoring