In the realm of international trade, a seamless and well-documented logistics process is paramount to the success of exporters, particularly when shipping goods via ocean freight. At the forefront of this process are essential transport documents known as the Seaway Bill and Bill of Lading. Serving as the backbone of secure goods exchange, these documents play a crucial role in facilitating smooth transactions and mitigating legal disputes between exporters and importers.

The Seaway Bill and Bill of Lading serve as irrefutable proof of export, providing comprehensive records of shipment details and contractual agreements. In this context, understanding the significance of the Seaway Bill becomes imperative for exporters, as it not only ensures compliance with international shipping regulations but also safeguards their interests throughout the export journey. Let’s delve deeper into the intricacies of the Seaway Bill and explore why it is indispensable for exporters navigating the complexities of global trade.

What is a Seaway Bill (SWB)?

A Seaway Bill (SWB) serves as a contractual agreement between a shipper and a cargo company, outlining the terms of carriage for goods transported via ocean freight. Unlike a Bill of Lading, which conveys ownership title, the Seaway Bill primarily functions as a receipt for the shipped goods. Typically, the ocean carrier issues the SWB directly to the shipper, indicating receipt of the cargo.

Unlike traditional Bills of Lading, the Seaway Bill can be issued in either soft or hard copy format, providing flexibility in documentation methods. It’s a non-negotiable document that plays a crucial role in the logistics process, ensuring transparency and accountability throughout the shipment journey.

When is a Seaway Bill Needed By Exporters?

A Seaway Bill (SWB) finds application in various scenarios within the realm of international trade, particularly when specific conditions and requirements are met. One such condition is when known recipients are involved in the transaction. In instances where there exists a high level of trust between the consignor and the consignee, the SWB serves as a viable option as it does not entail the transfer of ownership of goods. This trust dynamic obviates the need for a legal transfer of ownership, streamlining the logistics process.

Furthermore, the utilization of a Seaway Bill proves advantageous in preventing unauthorized sale of goods while in transit. By issuing an SWB against a consignment, the carrier effectively prohibits the transfer of the bill to any other party during the shipment’s journey. This measure enhances security for the shipper, offering reassurance that the cargo will reach its intended destination without unauthorized intermediation.

Another scenario wherein the SWB proves invaluable is when immediate clearance of goods from customs is imperative. In such cases, the SWB serves as an expedient alternative to the traditional Bill of Lading (BOL), facilitating swift customs clearance without the need for presenting a BOL. This expedited clearance process is particularly beneficial when dealing with trusted parties and is one reason why the Seaway Bill is often referred to as the ‘Express Release Bill of Lading’.

Moreover, transactions occurring within the same business group also warrant the issuance of a Seaway Bill. When companies operate under the umbrella of the same business entity, the SWB provides a streamlined documentation solution, simplifying the logistics process and ensuring efficient transaction management.

In essence, the Seaway Bill serves as a versatile and indispensable tool in international trade, offering flexibility, security, and efficiency in the exchange of goods across borders.

Seaway Bill Format

The Seaway Bill, a vital document in ocean freight transportation, encompasses several key components that delineate the particulars of the shipment process comprehensively.

Shipper’s Information (Sender’s Information): At the forefront of the Seaway Bill lies comprehensive details about the shipper, who is essentially the sender of the goods. This includes the shipper’s name, address, and contact information, providing crucial identification details necessary for initiating and processing the shipment.

Importer’s Information (Receiver’s Information): Equally significant is the inclusion of importer’s information, representing the receiver or consignee of the goods. This section comprises detailed particulars about the importer’s identity, address, and contact details, ensuring accurate delivery and communication channels between the involved parties.

Destination Port: The Seaway Bill explicitly specifies the destination port where the goods are destined to arrive. This pivotal piece of information guides the cargo along its intended route, ensuring it reaches the designated port for subsequent clearance and delivery.

Boarding Port: Complementing the destination port is the boarding port, denoting the point of origin or embarkation for the shipment. This critical detail marks the commencement of the cargo’s journey and serves as a reference point for tracking its progress across the seas.

Contact Details of the Shipper and Receiver: To facilitate seamless communication throughout the shipping process, the Seaway Bill provides contact details for both the shipper and receiver. This enables swift and efficient correspondence, allowing for timely updates, inquiries, and resolution of any logistical issues that may arise.

Name of the Vessel/Ship: Central to the Seaway Bill is the identification of the vessel or ship tasked with transporting the goods. This includes the vessel’s name, serving as a key identifier in tracking and tracing the shipment’s progress from boarding port to destination port.

Place of Delivery: The Seaway Bill specifies the final destination or place of delivery where the goods are to be offloaded and received by the designated party. This clarity regarding the delivery location facilitates efficient logistics operations and ensures timely receipt of the consignment.

Description of the Cargo: A detailed description of the cargo accompanies the Seaway Bill, providing pertinent information regarding its nature, quantity, and specifications. This descriptive account serves as a reference point for verifying the contents and condition of the shipment upon receipt.

Number of Packages in Transit: Finally, the Seaway Bill enumerates the number of packages comprising the shipment, offering insight into its volume and scope. This quantitative data aids in inventory management, cargo handling, and logistics planning, contributing to the seamless execution of the transportation process.

Also Read: House Bill of Lading

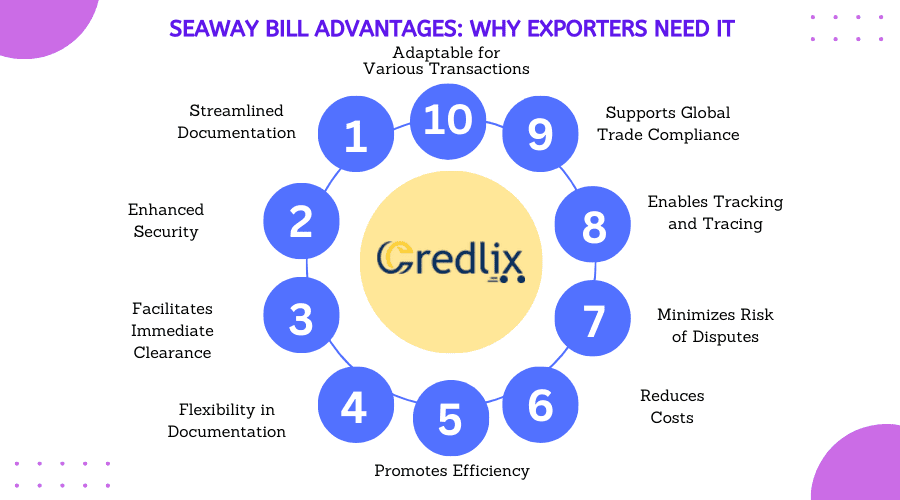

Seaway Bill Advantages: Why Exporters Need It

Here are ten advantages of using a Seaway Bill in international trade, elaborated upon for clarity:

Streamlined Documentation: The Seaway Bill simplifies the documentation process by serving as a single, comprehensive transport document. Unlike traditional Bills of Lading, it eliminates the need for physical paperwork, reducing administrative burden and expediting logistics operations.

Enhanced Security: By eliminating the transfer of ownership, the Seaway Bill minimizes the risk of fraudulent activities such as unauthorized sale or transfer of goods in transit. This enhances security and mitigates the potential for disputes or discrepancies during the shipping process.

Facilitates Immediate Clearance: In situations where immediate customs clearance is required, the Seaway Bill offers expedited processing. Known as an ‘Express Release Bill of Lading’, it enables shippers to swiftly clear goods through customs without presenting a physical Bill of Lading, streamlining trade operations.

Flexibility in Documentation: The Seaway Bill provides flexibility in documentation methods, allowing for issuance in both soft and hard copy formats. This versatility caters to varying logistical needs and preferences, ensuring compatibility with modern digital systems while accommodating traditional paper-based processes.

Promotes Efficiency: By incorporating essential shipment details such as shipper and receiver information, destination port, and cargo description, the Seaway Bill facilitates efficient coordination and communication throughout the shipping process. This promotes smooth operations and timely delivery of goods.

Reduces Costs: The streamlined documentation process enabled by the Seaway Bill helps reduce administrative costs associated with paperwork, processing, and storage of physical documents. This cost-effectiveness translates to overall savings for exporters and importers engaged in international trade.

Minimizes Risk of Disputes: Through its clear and comprehensive documentation of shipment particulars, the Seaway Bill minimizes the risk of disputes or discrepancies between parties involved in the trade transaction. This promotes trust and transparency, fostering positive business relationships.

Enables Tracking and Tracing: The Seaway Bill includes vital information such as the name of the vessel and the boarding and destination ports, enabling efficient tracking and tracing of the shipment’s progress. This visibility enhances logistical oversight and enables timely intervention in case of any disruptions.

Supports Global Trade Compliance: Compliance with international trade regulations is facilitated through the use of the Seaway Bill, which ensures adherence to legal requirements governing the transportation of goods across borders. This helps exporters and importers navigate complex regulatory landscapes with ease.

Adaptable for Various Transactions: Whether transactions involve known recipients, immediate clearance needs, or intra-group business dealings, the Seaway Bill offers adaptability to diverse trade scenarios. Its versatility makes it a valuable tool for facilitating a wide range of international trade transactions efficiently.

Seaway Bill Disadvantages

While the Seaway Bill offers numerous advantages in international trade, it also comes with certain limitations and disadvantages. Here are ten points elaborating on the disadvantages of using a Seaway Bill:

Limited Negotiability: Unlike a negotiable Bill of Lading, the Seaway Bill is non-negotiable, meaning it cannot be transferred or endorsed to a third party. This lack of negotiability restricts its use in certain trade transactions where transferability is required for financial or contractual purposes.

Reduced Financing Options: The non-negotiable nature of the Seaway Bill limits financing options for exporters, as it cannot be used as collateral for obtaining trade finance or letters of credit. This may pose challenges for exporters seeking financing arrangements based on traditional Bills of Lading.

Limited Legal Protections: Compared to a negotiable Bill of Lading, which offers legal protections for both the shipper and the consignee, the Seaway Bill provides fewer legal safeguards. In the event of disputes or discrepancies, parties may face challenges in asserting their rights and seeking recourse through legal means.

Risk of Fraudulent Activities: The non-negotiable nature of the Seaway Bill increases the risk of fraudulent activities such as unauthorized sale or diversion of goods in transit. Without the strict control and endorsement mechanisms of a negotiable Bill of Lading, the integrity of the shipment may be compromised.

Lack of Documentation Flexibility: While the Seaway Bill offers flexibility in documentation methods by allowing issuance in both soft and hard copy formats, it may lack the versatility of negotiable Bills of Lading, which can be tailored to specific trade requirements and contractual arrangements.

Limited Tracking and Tracing Features: Unlike negotiable Bills of Lading, which may include advanced tracking and tracing features facilitated by electronic systems, the Seaway Bill may lack robust tracking capabilities. This limited visibility into the shipment’s progress can hinder logistical oversight and management.

Potential for Disputes Over Cargo Ownership: The Seaway Bill does not convey ownership title to the goods, leading to potential disputes over cargo ownership between the shipper and the consignee. This ambiguity may complicate trade transactions and result in conflicts regarding rights and responsibilities.

Challenges in Resolving Disputes: In the absence of clear legal provisions and dispute resolution mechanisms associated with negotiable Bills of Lading, resolving disputes related to the Seaway Bill may prove challenging and time-consuming. This can result in prolonged legal proceedings and business disruptions.

Limited Financing Flexibility: Due to its non-negotiable nature, the Seaway Bill may limit financing flexibility for exporters, as financial institutions may prefer negotiable Bills of Lading as collateral for providing trade finance facilities. This can constrain exporters’ access to credit and working capital.

Complexity in Certain Trade Transactions: In complex trade transactions involving multiple parties or financing arrangements, the limitations of the Seaway Bill may pose challenges in ensuring compliance with legal and regulatory requirements. This complexity can increase transaction costs and administrative burdens for all parties involved.

Final Note

While the Seaway Bill offers significant advantages in terms of streamlined documentation and efficiency, it also comes with limitations and potential drawbacks that exporters, importers, and carriers should consider. Its non-negotiable nature and reduced financing options may pose challenges in certain trade scenarios, and its lack of tracking features and legal protections could lead to disputes or complications. However, when used judiciously and in conjunction with other documentation methods, the Seaway Bill remains a valuable tool for facilitating international trade, offering flexibility, security, and efficiency in the exchange of goods across borders.

Also Read: What Is a Straight Bill of Lading? A Detailed Guide on Straight BOL