India’s export sector has witnessed a remarkable upsurge over the past two years, bolstered by robust manufacturing and favorable government policies. With merchandise exports hitting a record high of US$417.81 billion in FY 2022, India aims to surpass this milestone, targeting US$450 billion in exports for FY 2023 and 2024.

Despite global economic challenges and supply chain disruptions, India’s resilient domestic market and strategic trade agreements with Australia and the UAE are poised to mitigate significant impact.

This article delves into the key trends shaping India’s export landscape and highlights the prominent destinations for FY 2023 & 2024.

India’s Export Boom Continues: Achieving Record Highs in FY 2022 and Beyond

In recent years, India’s export sector has witnessed a remarkable surge, fueled by robust manufacturing across diverse sectors and supportive government policies. In FY 2022, merchandise exports soared to an unprecedented US$417.81 billion, surpassing the initial target of US$400 billion. This growth was driven by heightened demand for key commodities such as petroleum, textiles, chemicals, and engineering goods.

Moving into FY 2023 (April-November 2022), exports reached US$295.26 billion, marking an 11% increase from the same period in the previous year, reflecting sustained momentum.

According to the latest report from the economic think tank Global Trade Research Initiative (GTRI), India is poised to achieve its highest-ever export turnover in calendar year (CY) 2024. Projections suggest total merchandise and services export turnover in the range of US$740-750 billion. Merchandise exports are anticipated to reach US$440–450 billion, while service exports are forecasted to be in the US$295–300 billion range for CY 2024, compared to US$254 billion in CY 2021.

India’s Leading Export Destinations

here’s an elaboration on the top five export destinations of India in 2023:

United States

The United States continues to be one of India’s largest export destinations, with trade relations between the two countries spanning a wide range of industries, including information technology, pharmaceuticals, and automotive. India exports products such as software services, textiles, machinery, and agricultural products to the US. The strong economic ties and strategic partnership between India and the US contribute to the steady flow of exports, making it a key market for Indian businesses.

United Arab Emirates (UAE)

The UAE serves as a significant export destination for India, driven by bilateral trade relations and a large Indian expatriate population in the UAE. India exports various commodities to the UAE, including petroleum products, gems and jewelry, textiles, and machinery. The UAE’s strategic location as a major trading hub in the Middle East makes it an attractive market for Indian exporters seeking to expand their presence in the region.

Netherlands

The Netherlands has emerged as a prominent export destination for India, owing to its strategic location in Europe and strong trading relations with India. India exports a diverse range of products to the Netherlands, including textiles, chemicals, pharmaceuticals, and engineering goods. The Netherlands serves as a gateway to the European market, providing Indian exporters with access to a large consumer base and facilitating trade across the continent.

China

Despite being a major importer from China, India also exports goods to its neighbor, contributing to bilateral trade between the two countries. India exports various products to China, including agricultural commodities, raw materials, chemicals, and pharmaceuticals. The economic relationship between India and China is characterized by both cooperation and competition, with opportunities for Indian exporters to tap into the Chinese market.

United Kingdom (UK)

The United Kingdom remains an important export destination for India, with trade ties dating back centuries. India exports a wide range of goods to the UK, including textiles, automobiles, machinery, and electronics. The UK’s status as a global financial center and its strong consumer market make it an attractive destination for Indian exporters looking to expand their presence in Europe. Despite challenges posed by Brexit and global economic uncertainties, trade between India and the UK continues to thrive, bolstered by strong historical and cultural ties.

Overall, these top five export destinations highlight the diverse range of markets that India caters to, reflecting the country’s growing significance in global trade and its ability to leverage strategic partnerships to boost exports across different regions.

Key Export Markets for India: Netherlands and Brazil

India’s export landscape is undergoing significant shifts, with notable changes observed in the leading export destinations for the fiscal year (FY) 2023. Traditionally prominent markets like the US, UAE, and China remain steadfast, while newer contenders such as the Netherlands and Brazil have surged ahead, signaling a diversification of India’s export portfolio.

The US and UAE have long been key export destinations for India, maintaining their top positions during the initial months of FY 2023. These countries serve as vital markets for various Indian goods, facilitating continued trade growth. However, what sets FY 2023 apart is the emergence of the Netherlands and Brazil as noteworthy export destinations.

During the April-November 2022 period, the Netherlands catapulted to the third position on India’s list of export destinations. This significant jump underscores the strengthening trade ties between the two nations and highlights the Netherlands’ growing importance as a key trading partner for India. Similarly, Brazil, which previously held the 20th spot on India’s export destination list, has climbed to the eighth position, showcasing its rising demand for Indian goods.

This diversification in export destinations reflects India’s strategic efforts to explore new markets and reduce dependency on traditional trading partners. By expanding into non-traditional markets like Africa, Latin America, and the Oceania region, India is tapping into previously untapped opportunities, further bolstering its export capabilities.

The surge in exports to the African nation of Tanzania exemplifies this trend, with a notable threefold increase observed during the ongoing fiscal year. This surge is primarily attributed to the export of petroleum and diesel, highlighting India’s ability to leverage its strengths and capitalize on emerging opportunities in diverse regions.

Beyond geographical diversification, India’s export basket has also undergone significant expansion, encompassing a wide range of goods catering to diverse market demands. This diversification not only enhances India’s export resilience but also positions the country as a versatile player in the global trade arena.

In conclusion, India’s export landscape in FY 2023 reflects a dynamic shift characterized by the emergence of new export destinations, diversification of export baskets, and strategic exploration of non-traditional markets. With continued efforts to explore new avenues and capitalize on emerging opportunities, India is poised to further strengthen its position as a leading player in the global export market.

India’s Export Basket

India’s export basket comprises a diverse array of commodities, with notable shifts and trends observed in recent years. During the period from April to November 2022, India’s total exports surged by 12.5 percent, reaching over US$263 billion. Of particular significance was the remarkable 70 percent increase in oil product exports, attributed to India’s processing of crude oil imported from Russia and subsequent export to various countries, particularly in Europe. This trend is expected to continue into 2024, as India solidifies its position as a key player in the global energy market.

In FY 2022, several major items dominated India’s export basket, contributing significantly to the country’s total shipments. Gems and jewelry accounted for 16 percent of total exports, followed closely by mineral fuels, oils, waxes, and bituminous substances at 12 percent. Additionally, vehicles, parts, and accessories comprised five percent of India’s exports, while nuclear reactors, boilers, machinery, and mechanical appliances, pharmaceutical products, and organic chemicals each contributed five percent, four percent, and four percent, respectively.

Looking ahead to 2024, these key export items are expected to maintain their prominence in India’s export portfolio, supported by sustained demand and strategic market positioning. The country’s ability to adapt to changing global dynamics, such as shifts in energy consumption patterns and evolving trade relationships, will play a crucial role in shaping the composition of its export basket in the coming years.

Navigating Global Trade: India’s Export Outlook and FTAs

Despite global economic challenges, Indian merchandise exports are projected to maintain or even surpass current levels in FY 2024, as per Santosh Kumar Sarangi, Director General of Foreign Trade (DGFT). The recently inked free-trade agreements (FTAs) with the UAE and Australia are poised to provide a significant boost to exports in the upcoming fiscal year. These agreements, aiming to elevate bilateral trade to US$50 billion and US$100 billion respectively within the next five years, highlight India’s commitment to expanding its global trade footprint.

Furthermore, ongoing negotiations for FTAs with the UK, the European Union (EU), Israel, and other nations underscore India’s proactive approach towards fostering trade partnerships. Despite predictions of a slight downturn in exports due to weakened global demand and economic recession in major economies, India stands to benefit from supply chain restructuring efforts, with increasing numbers of manufacturing firms relocating from China to India. This strategic positioning positions India favorably to navigate future challenges and capitalize on emerging opportunities in the global trade landscape.

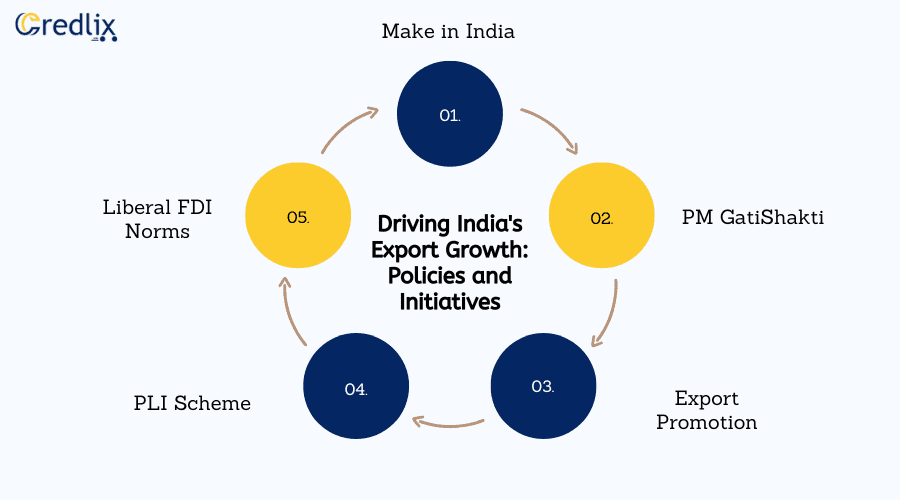

Driving India’s Export Growth: Policies and Initiatives

In recent years, India has implemented a series of policies and initiatives aimed at bolstering its export sector and enhancing its competitiveness on the global stage. Here’s a closer look at some of the key factors driving export growth in India:

Make in India

Launched in 2014, the Make in India initiative aims to promote manufacturing within the country and transform India into a global manufacturing hub. By encouraging domestic production and reducing dependency on imports, Make in India fosters the development of indigenous industries and enhances the country’s export potential. Through initiatives such as production-linked incentives (PLI) schemes, the government incentivizes investment in key sectors to spur manufacturing and boost exports.

PM GatiShakti

PM GatiShakti is a flagship infrastructure development initiative aimed at improving connectivity and reducing logistics costs. By streamlining transportation networks, including roads, railways, ports, and airports, PM GatiShakti enhances the efficiency of the supply chain and facilitates the movement of goods within the country and for export. This initiative plays a crucial role in enhancing India’s export competitiveness by reducing transportation time and costs.

Export Promotion

The government of India actively promotes exports through various measures, including trade fairs, exhibitions, and trade missions, to showcase Indian products and attract foreign buyers. Export promotion councils and agencies provide support to exporters by offering market intelligence, trade facilitation services, and financial assistance. Additionally, export promotion schemes such as the Merchandise Exports from India Scheme (MEIS) and Services Exports from India Scheme (SEIS) incentivize exports and provide financial benefits to exporters.

PLI Scheme

The Production Linked Incentive (PLI) scheme is aimed at boosting domestic manufacturing and enhancing India’s export capabilities in key sectors such as electronics, automobiles, pharmaceuticals, and textiles. Under the PLI scheme, incentives are provided to eligible companies based on their incremental production and exports over a specified period. This incentivizes investment in manufacturing facilities and encourages companies to increase production and exports, thereby driving export growth.

Liberal FDI Norms

India has implemented liberal foreign direct investment (FDI) norms to attract foreign investment and technology into key sectors of the economy. By allowing higher levels of FDI in sectors such as manufacturing, infrastructure, and e-commerce, the government aims to enhance production capacity, upgrade technology, and boost exports. Liberal FDI norms create opportunities for foreign investors to participate in India’s growth story and contribute to the country’s export-led growth strategy.

Final Note

India’s export sector is poised for continued growth and resilience, driven by robust policies, strategic initiatives, and proactive trade engagements. With diversified export destinations, expanding export baskets, and a focus on enhancing manufacturing capabilities, India is well-positioned to navigate global challenges and capitalize on emerging opportunities in the dynamic global trade landscape.

As the country marches ahead with its ambitious export targets, collaboration, innovation, and adaptability will remain key pillars in shaping India’s journey towards becoming a global export powerhouse.

Also Read: Choosing the Right Market for your Export Product