In the practical world of business finance, making wise choices is essential. Consider having two options—purchase order loans and small business loans. Both can benefit your business, but finding the right fit is key.

Purchase order loans and small business loans are like two distinct paths. Our goal is to help you understand them better.

By the end of this exploration, you’ll be well-equipped to decide which option aligns best with your business goals. So, let’s delve in and clarify things, enabling you to choose the right financial tool for your business journey!

What is a Purchase Order Loan?

A Purchase Order Loan is a financial solution that assists businesses in meeting customer orders by providing the necessary funds for production or purchase expenses. This type of financing enables companies to fulfill large orders even when faced with limited capital, as the lender covers the costs associated with order fulfillment. Once the order is complete, the business repays the loan, often with additional fees or interest.

PO financing generally includes 80 to 100 percent of the purchase order cost, and the exact coverage may vary based on factors like the lender, supplier reputation, and the creditworthiness of the customer.

How Does PO Loan Work?

Here’s how it works:

Customer Order: When a business receives a big order but doesn’t have enough money to fulfill it, they can use a PO Loan.

Lender Involvement: The business secures a PO Loan from a lender. This lender may pay the supplier directly or provide a line of credit for the business to make the necessary purchases.

Product Delivery: With the financial support from the PO Loan, the business can produce or purchase the products needed to fulfill the customer order.

Customer Payment: Once the order is complete and delivered to the customer, the business receives payment. The business then repays the PO Loan, often plus fees or interest.

What is a Small Business Loan?

A Small Business Loan is a financial product designed to provide capital to small enterprises. It involves borrowing a specific amount of money, which the business agrees to repay, typically with interest, over a predetermined period. These loans can be used for various purposes, such as expansion, working capital, or equipment purchase, helping small businesses manage and grow their operations.

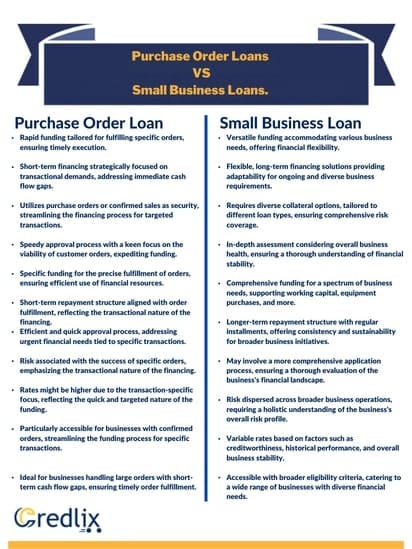

Difference Between Purchase Order Loans vs. Small Business Loans

Here’s an elaborate comparison between purchase order loans and small business loans to help you make a smarter and more informed choice.

Application Process

Purchase Order Loans

Obtaining purchase order financing is generally swift, especially with alternative options like online lenders. In just a few days, you can expect your application to be accepted, processed, and approved. Even with an established online lender relationship, applying for purchase order financing remains a speedy process. It’s important to note that, similar to small business loans, thorough documentation is typically required.

Traditional Small Business Loans

Traditional small business loans, commonly acquired from credit unions or banks, often involve a more extended application timeline, taking a month or more for approval. On the flip side, alternative lenders online can significantly expedite the process, potentially matching the speed of purchase order financing. Despite the differences in approval times, both purchase order financing and small business loans share the commonality of necessitating detailed documentation.

Eligibility Requirements

Small Business Loans

When seeking a small business loan, the primary focus for the lender is your ability to repay the loan. Eligibility criteria revolve around creditworthiness, business track record, revenue, and debt obligations. Depending on the loan type, meeting eligibility requirements often involves maintaining a positive credit history, having a few years of business experience, and sustaining a debt-to-income ratio of 36 percent or lower.

Purchase Order Financing

Contrasting small business loans, eligibility for purchase order financing centers on different factors. PO lenders assess the viability of the sale’s size, the supplier’s capacity to fulfill the order, the customer’s ability to pay, and the non-cancelable nature of the order. According to BizJournals, qualifying for PO financing typically requires a creditworthy supplier and customer, profit margins of 15 percent or higher, business or government customers (B2C not eligible), and the sale of tangible goods.

Use of Funds

Small Business Loans

Entrepreneurs can deploy small business loans across a broad spectrum of expenditures, encompassing inventory, equipment, administrative costs, marketing, expansions, and more. The versatility of small business loans allows entrepreneurs to address various business needs, fostering growth and development.

Purchase Order Financing

In contrast, the utility of funds with purchase order financing is more specific. This type of financing can only be utilized to cover the expenses associated with paying suppliers for the goods you sell. While purchase order financing offers less flexibility compared to small business loans, it proves highly effective when the sole objective is to meet the financial demands of fulfilling a purchase order.

Also Read: A Complete Guide on Purchase Order Financing: What it is and How it works?

Cost

Small Business Loans

When it comes to small business loans, lenders apply fees and interest based on fixed or variable rates. These rates influence the overall cost of the loan and can impact your repayment structure. Small business loans, therefore, involve a combination of fees and interest, contributing to the total cost over the loan term.

Purchase Order Financing

In contrast, the cost structure for purchase order financing is simplified. PO lenders primarily charge fees, and these fees are typically calculated as a percentage of the funds owed to your supplier. Unlike small business loans, the cost of purchase order financing is influenced by the timing of your customer payments. Converting these costs into an annual percentage rate (APR) often reveals a higher rate compared to small business loans.

Final Words: How To Decide

When deciding between purchase order financing and small business loans, the nature of your financial needs plays a crucial role. If your funding requirements extend beyond covering a purchase order, small business loans emerge as the preferred choice. They offer flexibility for various business purposes, from inventory to expansion.

However, if your focus is on working capital for order fulfillment or resolving cash flow challenges, both purchase order and small business loans could be viable. While purchase order financing provides a faster solution, it tends to be pricier. Additionally, if your credit falls short for a small business loan, qualifying for purchase order financing might still be an option.

In summary, if you meet the eligibility criteria for a small business loan and the application process aligns with your timeline, it’s likely the more favorable route. However, if credit challenges or time constraints hinder your small business loan pursuit, exploring purchase order financing becomes a worthy consideration for your financing needs.