When establishing or operating a small business in India, understanding the tax implications, particularly regarding installation charges, is crucial. The Harmonized System of Nomenclature (HSN) codes play an important role here, providing a standardized classification for goods and services.

In this comprehensive guide, we will understand the significance of HSN codes for installation charges. By delving into the intricacies of these codes, business owners and entrepreneurs can navigate the tax landscape more effectively, ensuring compliance and optimizing financial strategies.

Whether you’re launching a startup or managing an established enterprise, grasping the HSN codes for installation charges is indispensable for fostering fiscal responsibility and operational efficiency in the Indian business landscape.

What is an HSN Code?

An HSN (Harmonized System of Nomenclature) code is a standardized numerical system used globally for classifying goods and services in international trade. Developed and maintained by the World Customs Organization (WCO), the HSN code comprises a series of digits that categorize products and services based on their characteristics, composition, and intended use.

Each HSN code consists of a minimum of six digits, although some countries may extend it further for more specific classification. The first two digits generally represent the chapter, which broadly defines the category of the product or service. Subsequent digits provide more detailed classifications, offering a systematic way to organize a wide array of items.

Also Read: HSN Codes: What You Need to Know for Trade and Taxation

What is the HSN Code for Installation Charges?

The HSN Code for installation charges in India is 9987. This code falls under the broader category of services, as indicated by the first two digits, ’99’, which represent the chapter for services in the HSN classification system. The subsequent four digits, ’87’, specifically identify installation charges as the product or service being classified.

Installation charges encompass a wide range of activities involved in setting up or assembling various goods or systems. This can include the installation of machinery, equipment, appliances, fixtures, or even entire systems such as solar panels, HVAC (heating, ventilation, and air conditioning) units, or telecommunications infrastructure.

Businesses across various sectors rely on installation services to ensure the proper functioning and integration of their products. Whether it’s a manufacturing plant installing new machinery, a retail store setting up display fixtures, or a homeowner arranging for the installation of household appliances, understanding the HSN code for installation charges is crucial for accurate tax assessment and compliance.

Moreover, the HSN code facilitates streamlined record-keeping and reporting for businesses and tax authorities alike. By correctly categorizing installation charges under the appropriate HSN code, businesses can ensure transparency in financial transactions and mitigate the risk of errors or discrepancies in tax filings. Overall, familiarity with the HSN code for installation charges is essential for businesses to effectively manage their tax obligations and maintain compliance within the Indian regulatory framework.

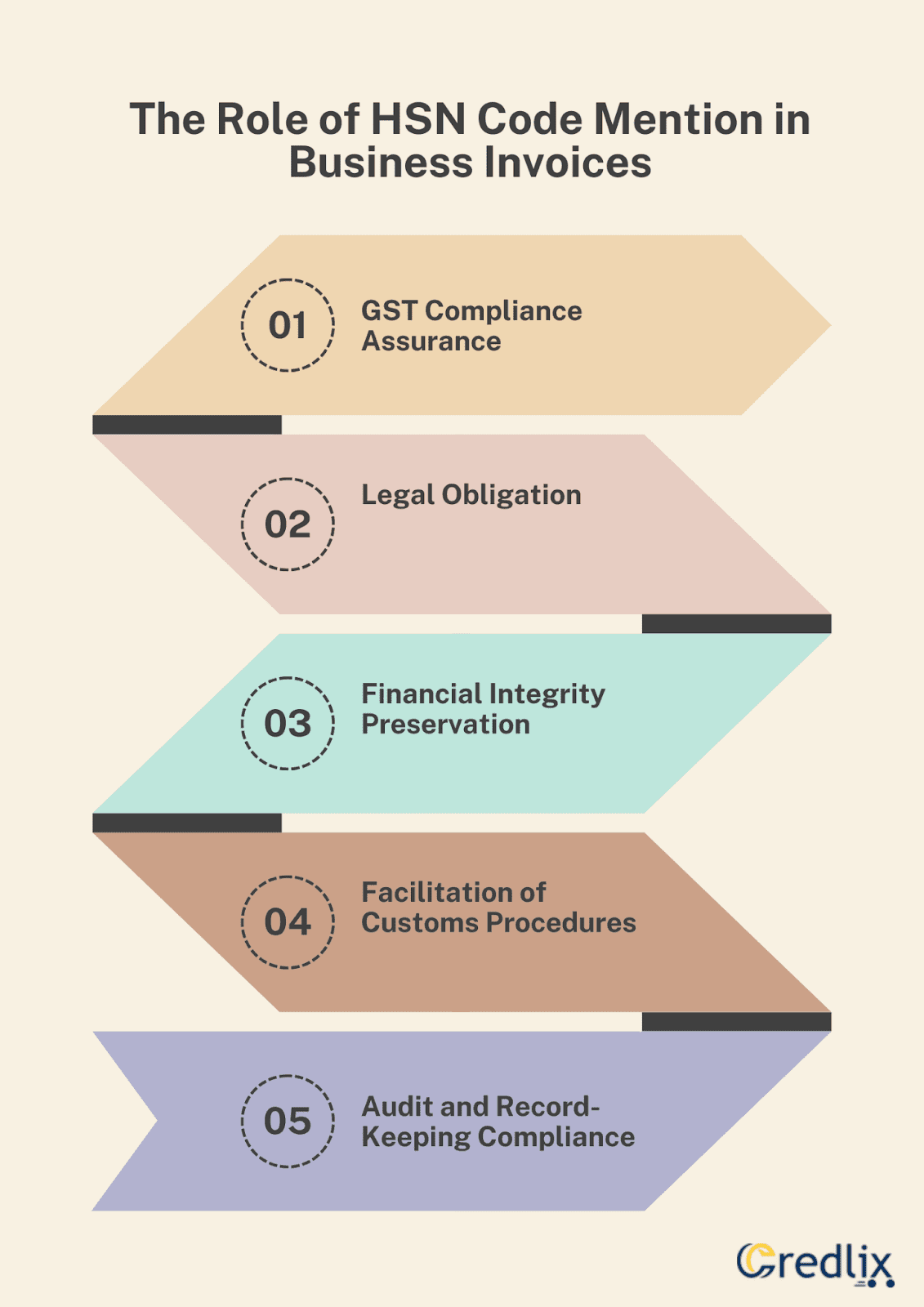

The Role of HSN Code Mention in Business Invoices

Understand the role of HSN code mention in business invoices:

GST Compliance Assurance

Accurate HSN code mentioned on invoices is pivotal for ensuring compliance with India’s Goods and Services Tax (GST) regulations. Each product or service is associated with a specific HSN code, which determines the applicable GST rate.

Failure to correctly classify goods or services under the appropriate HSN code can result in incorrect taxation, inviting potential fines and penalties.

Legal Obligation

Indian tax laws mandate the inclusion of HSN codes on invoices. This legal requirement underscores the importance of meticulous adherence to accurate coding practices.

Any deviation, such as omitting or misrepresenting HSN codes, can not only lead to legal consequences but also financial penalties, highlighting the significance of compliance in this area.

Financial Integrity Preservation

Beyond regulatory compliance, the accuracy of HSN code mentioned directly influences the financial integrity of businesses. Correct classification helps prevent instances of over-taxation or under-taxation, ensuring that the GST rate applied aligns precisely with the nature of the goods or services provided.

This precision fosters financial prudence and upholds the transparency expected in business transactions.

Facilitation of Customs Procedures

In the realm of international trade, HSN codes play a critical role in customs procedures. These codes are utilized by customs authorities for the assessment of import or export duties.

By accurately coding goods, businesses can expedite customs processes, reducing the likelihood of delays or disputes and promoting smoother cross-border transactions.

Audit and Record-Keeping Compliance

Accurate reporting of HSN codes is indispensable for audit and record-keeping purposes. Maintaining verifiable and precise records of transactions is essential for demonstrating compliance and financial transparency during audits or when required for other regulatory purposes.

By adhering to HSN code standards, businesses can ensure robust record-keeping practices and navigate regulatory scrutiny effectively.

Finding HSN Codes Made Easy

Finding the correct HSN code for your product is crucial for GST compliance and accurate tax calculation in India. The official GST website offers a primary resource for this task, featuring a dedicated ‘Search HSN Code’ option under ‘Services > User Services’. Here, users can search by either HSN code or description to locate the appropriate classification. Alternatively, utilizing reliable online HSN code finder tools, such as myBillBook’s HSN code Finder, offers a more straightforward approach.

These tools allow users to input product descriptions or keywords, swiftly generating the relevant HSN code. Whether navigating the GST portal or leveraging online tools, ensuring accurate HSN code identification is essential for seamless tax management and regulatory adherence in Indian business operations.

In conclusion, understanding and correctly applying HSN codes, especially for installation charges, is crucial for businesses operating in India’s tax framework. HSN codes not only ensure compliance with GST regulations but also facilitate accurate tax calculation, streamline customs procedures, and maintain financial integrity. By adhering to HSN code standards, businesses can navigate regulatory requirements effectively, prevent legal repercussions, and foster transparency in financial transactions. Utilizing resources such as the official GST website or online HSN code finder tools simplifies the process of finding the right code, enabling businesses to optimize tax management and regulatory compliance.

Also Read: What are the differences between HSN and SAC code in GST?