The HSN code is like a global language for sorting and labeling products during import and export. It’s a code that tells us about different types of furniture, what they’re made of, and how they’re used.

It’s like a special tag for furniture that makes it easier to understand and handle when it travels between countries.

So, in this blog, we’ll chat about furniture HSN codes – these codes are like little labels that help us quickly figure out what a piece of furniture is all about, from its materials to its purpose. Let’s dive into the world of furniture codes and unravel their secrets!

What is an HSN Code?

The HSN (Harmonized System of Nomenclature) Code is a global classification system used to categorize products for international trade. It assigns a unique code to each product, simplifying identification during imports and exports. This standardized coding system streamlines communication and ensures uniformity in trade practices worldwide.

Types:

Basic HSN Code: This identifies products broadly and is usually a 2 to 4-digit code.

Detailed HSN Code: More specific, this extends the basic code to 6 digits, providing a detailed classification of products.

Understanding the HSN Code is essential for businesses engaged in international trade, facilitating smooth transactions and efficient customs procedures.

HSN Code for Furniture

In the Harmonized System, furniture is categorized in chapter 94. Here are the HSN codes for furniture, each reflecting its specific use.

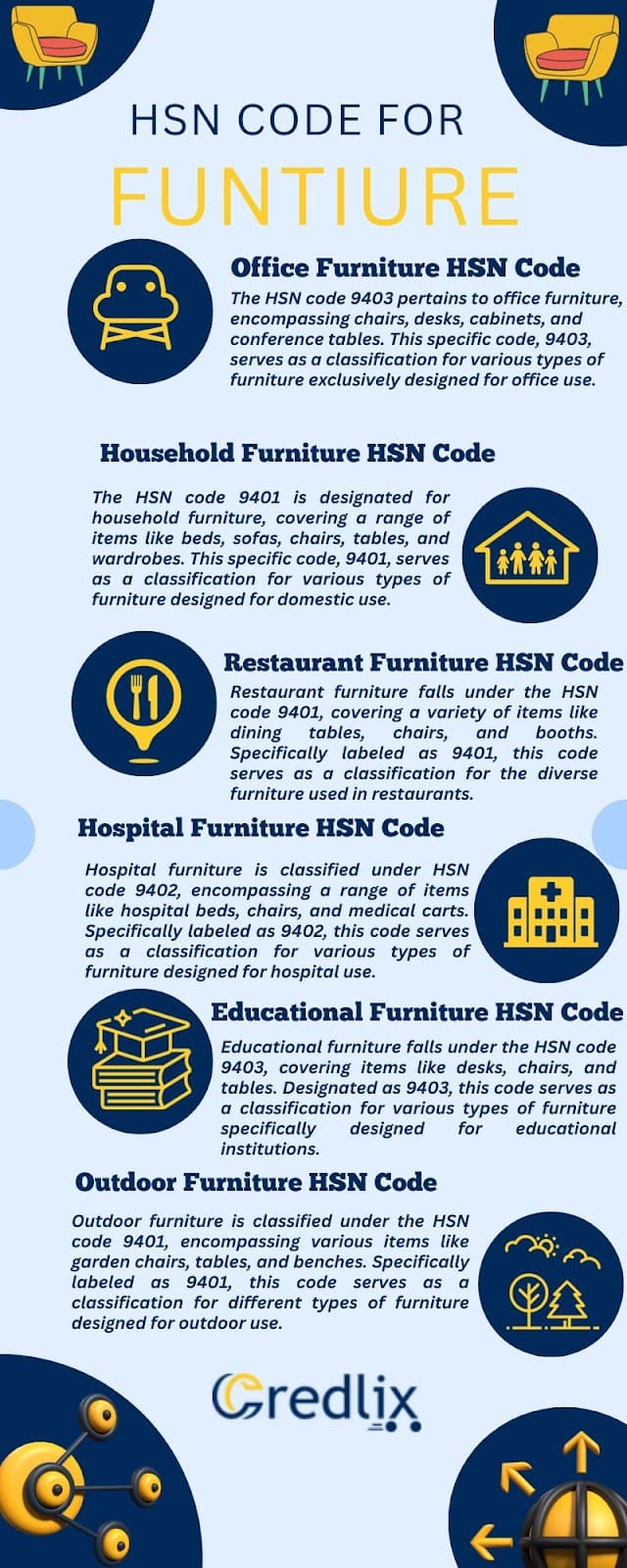

Office Furniture HSN Code

The HSN code 9403 pertains to office furniture, encompassing chairs, desks, cabinets, and conference tables. This specific code, 9403, serves as a classification for various types of furniture exclusively designed for office use.

So, if you’re dealing with office furniture in the realm of import and export, recognizing the HSN code 9403 simplifies the process by neatly categorizing these essential workplace elements.

Household Furniture HSN Code

The HSN code 9401 is designated for household furniture, covering a range of items like beds, sofas, chairs, tables, and wardrobes. This specific code, 9401, serves as a classification for various types of furniture designed for domestic use.

Whether you’re involved in importing or exporting household furniture, understanding the HSN code 9401 streamlines the process by providing a clear identification for these essential elements found in homes.

Restaurant Furniture HSN Code

Restaurant furniture falls under the HSN code 9401, covering a variety of items like dining tables, chairs, and booths. Specifically labeled as 9401, this code serves as a classification for the diverse furniture used in restaurants.

Whether you’re engaged in importing or exporting restaurant furniture, the HSN code 9401 offers a streamlined way to categorize and identify these essential elements within the hospitality industry.

Hospital Furniture HSN Code

Hospital furniture is classified under HSN code 9402, encompassing a range of items like hospital beds, chairs, and medical carts. Specifically labeled as 9402, this code serves as a classification for various types of furniture designed for hospital use.

Whether you’re involved in importing or exporting hospital furniture, understanding the HSN code 9402 facilitates a systematic approach in categorizing and identifying these crucial elements within the healthcare environment.

Educational Furniture HSN Code

Educational furniture falls under the HSN code 9403, covering items like desks, chairs, and tables. Designated as 9403, this code serves as a classification for various types of furniture specifically designed for educational institutions.

Whether you’re involved in importing or exporting educational furniture, the HSN code 9403 provides a systematic way to categorize and identify these essential elements within the realm of learning environments, streamlining processes related to international trade.

Outdoor Furniture HSN Code

Outdoor furniture is classified under the HSN code 9401, encompassing various items like garden chairs, tables, and benches. Specifically labeled as 9401, this code serves as a classification for different types of furniture designed for outdoor use.

Whether you’re engaged in importing or exporting outdoor furniture, understanding the HSN code 9401 streamlines the process by providing a clear identification for these essential elements meant for outdoor spaces, such as gardens or patios.

Wooden Furniture HSN Code

Wooden furniture falls under the HSN code 9403, covering items like chairs, tables, and beds. Specifically designated as 9403, this code serves as a classification for various types of furniture crafted from wood.

Whether you’re involved in importing or exporting wooden furniture, understanding the HSN code 9403 streamlines the process by providing a clear identification for these specific elements made from wood, ensuring a systematic approach in the international trade of wooden furniture.

Why it is Important to Understand HSN Code for Furniture?

Understanding the HSN (Harmonized System of Nomenclature) code for furniture is crucial for several reasons:

International Trade: The HSN code is a globally recognized system, making it essential for anyone involved in the import or export of furniture. It streamlines communication and ensures consistency in product classification, facilitating smoother international trade transactions.

Customs Clearance: HSN codes play a vital role in customs procedures. Knowing the correct code for furniture expedites the clearance process, reducing delays and potential complications at borders.

Accurate Taxation: HSN codes are linked to taxation. Knowledge of the correct code helps businesses apply the accurate tax rates, preventing miscalculations and potential legal issues.

Market Understanding: For businesses in the furniture industry, understanding HSN codes provides insights into market trends, demands, and regulations, contributing to informed business decisions.

Efficient Inventory Management: Using HSN codes for furniture allows businesses to organize and manage inventory more efficiently. It helps track and categorize products systematically.

Legal Compliance: Adhering to international trade standards and regulations is crucial. Knowledge of HSN codes ensures legal compliance, reducing the risk of penalties or disruptions in trade operations.

Factors Considered While Determining HSN Code for Furniture

When assigning HSN codes for furniture in international trade, several key factors come into play, ensuring accurate classification and streamlined business operations. Here are the pivotal considerations:

1. Purpose or Usage

The primary factor influencing the HSN code is the furniture’s purpose. Whether it’s intended for household, office, restaurant, outdoor, hospital, or educational use, each category receives a unique HSN code. This categorization allows for precise identification based on the furniture’s intended function.

2. Material Composition

The materials used in crafting the furniture significantly impact the HSN code. Furniture can be made from various materials, such as wood, metal, plastic, or glass. Distinct HSN codes exist for each material type, ensuring accurate classification and facilitating efficient trade practices.

3. Specific Furniture Type

The type of furniture plays a crucial role in HSN code determination. Different codes are assigned for distinct furniture types, such as beds, sofas, chairs, dining tables, study tables, or coffee tables. This specificity aids in clear product identification and helps businesses adhere to accurate coding in international transactions.

Final Words

Understanding the HSN code for furniture is paramount for businesses engaged in international trade. The HSN system, acting as a global language, not only simplifies the complex landscape of product classification but also facilitates efficient communication in the import and export domain.

As we delved into specific HSN codes for various furniture categories, from office and household to restaurant and hospital furniture, it became evident that these codes serve as crucial guides in navigating the intricacies of the global market. Recognizing the importance of factors like purpose, material composition, and specific furniture types ensures accurate coding, enabling businesses to comply with regulations, expedite customs procedures, and make informed decisions in the dynamic world of international trade.

FAQs

What is the HSN code for furniture?

The HSN code for furniture is a six-digit code that helps classify furniture based on its type, use, and material.

How is the HSN code for furniture determined?

The HSN code for furniture is decided by looking at how the furniture is used, what it’s made of, and its specific type.

What categories of furniture are under the HSN code?

The HSN code covers household, office, restaurant, outdoor, hospital, and educational furniture.

What’s the HSN code for wooden furniture?

Wooden furniture falls under HSN code 9403.

Is the HSN code different for restaurant furniture?

No, restaurant furniture shares the same HSN code (9401) as household furniture.

What’s the HSN code for hospital furniture?

Hospital furniture is categorized under HSN code 9402.

What about outdoor furniture?

Outdoor furniture also falls under HSN code 9401.

Do I need to know HSN codes for importing or exporting furniture?

Yes, it’s essential for customs clearance, taxes, and trade purposes.

Can a wrong HSN code lead to penalties?

Yes, an incorrect HSN code might result in higher taxes or penalties.

Is the HSN code for furniture recognized internationally?

Absolutely, the HSN code for furniture is an internationally accepted system for trade classification.

In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example