Are you familiar with the GST Loan Scheme? Did you know that by filing regular GST returns, you can easily apply for a business loan? This type of loan is specifically designed to help businesses meet their working capital needs. Whether you’re a small, medium, or micro enterprise, showing your GST returns to a lending institution can help you secure funds to grow your business.

In this article, we will explore everything you need to know about the GST loan scheme, including its eligibility criteria, required documents, and more.

What is a GST Loan Scheme?

A GST Loan Scheme is a form of financial assistance that businesses can avail by providing their GST returns to lenders. It’s a simple yet effective way for businesses to secure funds, especially for companies looking to expand or meet short-term working capital needs.

Regardless of the size of your business—whether it’s a micro, small, or medium enterprise—furnishing your annual GST returns can open doors to securing funding for various business operations, from infrastructure development to hiring and scaling.

Benefits of a GST Loan Scheme for MSMEs

For Micro, Small, and Medium Enterprises (MSMEs), business expansion is critical for long-term growth and sustainability. With a GST loan, businesses can fund activities such as increasing brand visibility, upgrading operational processes, and hiring employees.

One of the major benefits of the GST loan scheme is that it gives businesses the boost they need to stay competitive. Whether it’s obtaining better interest rates or improving operational efficiencies, a GST Loan Scheme provides a structured financial solution that can propel businesses forward.

According to a recent McKinsey survey, most medium and small businesses make their annual financial decisions based on favorable borrowing terms. With a GST Loan Scheme, businesses can also attract top talent, improve efficiencies, and enhance their reputation in the eyes of global investors.

Who is Eligible for a GST Loan Scheme?

GST Loan Schemes are available for business purposes, and the eligibility extends to a wide range of business entities, including private limited companies, public limited companies, partnership firms, and sole proprietorships.

It’s important to note that the interest rate on a GST Loan Scheme varies depending on the nature of your business, your credit history, and the amount of your GST return. The better your business profile, the more favorable your loan terms can be.

Credit Collateral: What You Need to Know

One of the major perks of a GST Loan Scheme is the low interest rate, especially for MSMEs. Unlike other loans that require you to pledge valuable assets such as land or property, a GST Loan Scheme does not require collateral, making it easier for businesses to access much-needed capital without risking their assets.

The loan amount can go up to ₹1 crore, depending on the quality of your GST returns. This is a huge advantage for businesses looking to expand post-COVID, where maintaining working capital and securing favorable financial terms are key to staying competitive in a global market.

Advantages of a GST Loan Scheme

There are several advantages to securing a GST Loan Scheme, including:

1. No Need for Collateral

One of the biggest barriers for small businesses in securing loans is the need for collateral. However, with a GST Loan Scheme, you don’t need to pledge assets such as your home or office to get funding. This makes it easier for small businesses to access capital without unnecessary risks.

2. Quick Disbursement

In today’s fast-paced business world, time is money. Many entrepreneurs don’t have the time or resources to spend on lengthy loan approval processes. Fortunately, GST Loan Schemes are processed quickly, ensuring that businesses get the funds they need without unnecessary delays.

Delays in financing can disrupt your supply chain, especially in industries with high seasonal demand. For example, many small businesses in the U.S. are facing labor shortages, making it difficult to meet the demands of holiday shoppers. A GST Loan Scheme can help ensure that you have the funds to recruit workers and meet demand in a timely manner.

3. Retain Full Control of Your Business

A GST Loan Scheme gives you the flexibility to invest in your business as you see fit. Whether you need to purchase new equipment or hire more staff, you maintain complete control over how you use the funds. As long as you continue filing your GST returns on time, you can ensure smooth access to funds when you need them.

4. Boost Your Business Visibility

Expanding into new markets is crucial for business growth. With a GST Loan Scheme, you can invest in marketing and promotional activities to increase brand visibility and expand into new geographic areas. Just be sure to file your GST returns accurately and on time to avoid any issues with loan approvals.

5. Multipurpose Loan

A GST Loan Scheme can be used for a wide variety of business purposes, from increasing your brand visibility to improving your product development cycle. It’s a flexible financing solution that allows you to maintain adequate working capital while meeting your business’s raw material and payroll needs.

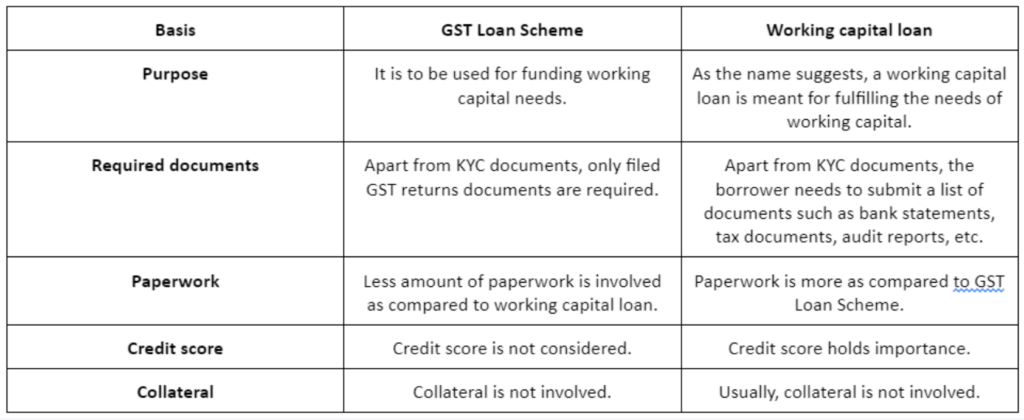

GST Loan Scheme vs. Working Capital Loan

While a GST Loan Scheme is a type of working capital loan, there are key differences between the two. Here’s a breakdown of how they compare:

Eligibility Criteria for a GST Loan Scheme

The eligibility criteria for a GST Loan Scheme may vary from lender to lender, but the general requirements include:

1. GST Registration

To qualify for a GST Loan Scheme, your business must be registered under the GST system and comply with all GST laws.

2. Business Profile

Lenders usually offer GST-based loans to businesses involved in manufacturing, trading, or services sectors.

3. Business Vintage

Your business must have a certain level of operational history, usually at least one year, though this requirement may vary by lender.

4. Minimum Turnover

Many lenders set a minimum turnover requirement to ensure that your business has consistent sales. This can vary depending on the lender’s policies.

5. Age of the Applicant

Lenders typically require borrowers to be at least 21 years old, with a maximum age limit of 65 years at the end of the loan tenure.

How to Apply for a GST Loan Scheme?

Applying for a GST loan is a straightforward process. Here’s a step-by-step guide to help you get started:

Choose a Lender: Research different lenders, including banks and non-banking financial companies (NBFCs), to find one that offers GST-based loans at favorable terms.

Check Eligibility: Make sure your business meets the lender’s eligibility criteria, including the necessary GST registration and business vintage.

Gather Documents: Collect all the required documents, including your GST returns, KYC documents, and bank statements.

Submit the Application: Fill out the application form provided by the lender and submit it along with the required documents.

Wait for Approval: Once the lender reviews your application, they will either approve or deny the loan. If approved, the funds will be disbursed directly to your business account.

Conclusion

In today’s business environment, access to capital is critical for growth and sustainability. While many businesses struggle to secure loans due to insufficient collateral or documentation, a GST Loan Scheme offers a straightforward solution. By filing your GST returns on time and keeping your business in compliance with GST laws, you can secure the funds you need to grow your business and meet its financial demands.

Also Read: Understanding GST-Based Loans for Businesses