Distribution finance is a critical lifeline for businesses looking to expand their market reach and streamline supply chains, ensuring a smooth flow of goods from manufacturers to retailers and ultimately to customers. For any manufacturer or distributor aiming to grow their market presence, distribution finance can be a powerful tool. It provides the financial support needed to manage inventory, maintain cash flow, and address fluctuating demand efficiently.

Let’s dive into how distribution finance works, its various forms, and how it benefits companies in different sectors.

What is Distribution Finance?

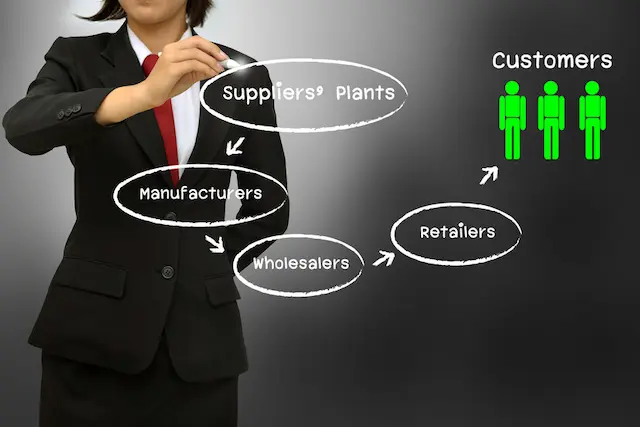

Distribution finance encompasses a set of financing options tailored to help manufacturers and distributors manage their working capital and optimize their supply chain operations. It is a type of financing provided either by the manufacturer to its subsidiaries or by independent financial institutions to local distributors. The goal is to support seamless distribution and overcome common obstacles like cash flow shortages, inventory backlogs, and logistical challenges.

Through distribution finance, businesses can extend credit to distributors, allowing them to purchase and manage stock without exhausting their own resources. This financing method is particularly helpful in situations where a manufacturer from one country partners with a distributor in another. For example, an Italian furniture maker may collaborate with a U.S.-based distributor to reach the American market.

Real-World Example: Distribution Finance in Action

Let’s look at a real-world example to understand how distribution finance operates in a practical setting:

Enzo Furniture Manufacturers in Italy partners with Imperial Furniture in the United States. Enzo grants Imperial exclusive distribution rights to its luxury and designer furniture line within the U.S. market. By providing financing support, Enzo helps Imperial purchase enough inventory to meet demand, keep operations running smoothly, and enhance Enzo’s market penetration in the U.S.

This financing support can include various options, such as vendor financing, cash credit facilities, or bill discounting, helping Imperial manage cash flow, inventory, and demand. Ultimately, distribution finance keeps the supply chain moving and allows both companies to focus on growth.

Key Distribution Finance Solutions

Distribution finance offers several financial tools designed to address different aspects of cash flow and inventory management. Below are some common solutions that companies can use:

Vendor Financing

Vendor financing is a popular distribution finance solution where the vendor, often the manufacturer, provides financing to the buyer, typically a distributor or reseller. This model is especially common in vertically integrated companies, where manufacturers have a vested interest in the success of their distributors.

In this setup, the vendor extends a line of credit to the distributor, allowing them to buy products without immediate payment. This approach has mutual benefits: the vendor gains stronger relationships and loyalty from the distributor, and the distributor can optimize cash flow and avoid upfront costs. One unique feature of vendor financing is dynamic discounting. Distributors who pay earlier than required may qualify for discounts, reducing their costs further and incentivizing timely payments.

Cash Credit Facilities

Cash credit facilities offer another flexible financing option, allowing distributors to maintain steady working capital and keep operations running. Provided by banks or financial institutions, this facility is a revolving line of credit, meaning businesses can withdraw funds as needed up to a specified limit, helping them manage cash flow gaps more efficiently.

The advantage of a revolving credit facility is its flexibility: businesses only borrow what they need, which keeps interest costs low. However, the downside is that securing cash credit usually requires a solid credit history and can involve considerable paperwork.

Bill Discounting (Accounts Receivable Financing)

Bill discounting, also known as accounts receivable financing, allows distributors to use their future receivables as collateral to secure short-term financing. Here, a distributor can receive immediate cash by selling its outstanding invoices to a financial institution at a discounted rate.

This method works particularly well for distributors needing quick cash to fund operations while waiting for customers to pay their bills. For example, if a distributor has outstanding invoices from retailers, they can approach a bank to discount these bills, receiving funds upfront. While this form of financing boosts cash flow, it does appear on the distributor’s balance sheet as debt, which could impact their credit profile.

How Credlix is Enhancing Distribution Finance?

Credlix, a prominent player in the U.S. distribution finance sector, offers cutting-edge solutions designed to simplify and enhance supply chain finance. With advanced technology and a focus on small-to-medium importers, Credlix provides financial support that can make a tangible difference to distributors.

Here’s how Credlix’s channel finance solutions stand out:

Competitive Pricing

Credlix has developed a unique risk assessment model that identifies potential risks and allows for safe lending. This approach helps Credlix provide competitive pricing on its financing products, making it accessible to a wider range of distributors in need of flexible credit.

High Credit Limits

Distributors with a strong credit history can access credit limits of up to $2.5 million, an impressive amount that supports even large-scale distribution needs. This high ceiling ensures that distributors can purchase enough stock to keep up with demand, even during peak seasons.

Quick Disbursements

Credlix recognizes the time-sensitive nature of distribution financing. With a streamlined process and dedicated account managers, the company offers 48-hour disbursements, allowing distributors to meet urgent cash flow needs quickly and efficiently.

Why Distribution Finance is Essential for Modern Businesses?

Distribution finance serves as a critical backbone for companies with complex supply chains, offering numerous benefits that can impact their long-term success.

Improved Cash Flow

Cash flow management can be challenging, especially for distributors facing fluctuating demand or seasonal sales cycles. Distribution finance provides distributors with access to the funds they need, enabling them to purchase inventory without depleting their cash reserves. This helps in maintaining stable operations and meeting customer demands consistently.

Better Inventory Management

With distribution finance, distributors can hold optimal stock levels and avoid issues like overstocking or stockouts. Access to sufficient funds ensures that distributors can keep inventory aligned with demand, reducing the risk of missed sales opportunities or excessive storage costs.

Enhanced Supplier Relationships

Financing solutions like vendor financing strengthen the relationship between manufacturers and distributors. By providing flexible credit options, manufacturers encourage distributors to expand their market reach, ultimately benefiting both parties. These financing arrangements also build trust and foster long-term partnerships.

Market Expansion Opportunities

For manufacturers aiming to enter new markets, distribution finance is an invaluable tool. It allows them to collaborate with local distributors who have market expertise, helping them reach customers more efficiently and scale up quickly.

Conclusion: How Distribution Finance Powers Supply Chains

In today’s fast-paced economy, distribution finance is more than just a financial tool—it’s a strategic resource that empowers companies to streamline their supply chains, improve cash flow, and manage inventory effectively. Solutions like vendor financing, cash credit, and bill discounting provide distributors with the financial flexibility they need to succeed.

Credlix, with its high credit limits, competitive pricing, and fast disbursements, exemplifies how distribution finance can be effectively tailored to the needs of today’s businesses. By partnering with a reliable distributor finance provider, companies can gain the confidence and stability they need to thrive in competitive markets.

Ultimately, whether a manufacturer in Italy or a distributor in the United States, businesses that embrace distribution finance are better positioned to create seamless, resilient, and scalable supply chains.