Did you know that small and medium-sized enterprises (SMEs) account for about 99.9% of all businesses in the United States? That’s right, despite their size, these businesses are the backbone of the economy, contributing significantly to job creation and economic growth. However, one common challenge faced by many SMEs is managing cash flow effectively. This is where accounts receivable financing steps in as a valuable financial tool.

In this complete guide, we’ll break down the complexities of accounts receivable financing and provide you with everything you need to know to leverage it for your business’s success. So, let’s dive in and demystify this essential aspect of financial management!

What is Accounts Receivable?

Accounts receivable is the outstanding balances owed to a company by its customers for goods or services provided on credit. Essentially, it’s the money that’s yet to be collected from sales made on credit terms. This component of a company’s financials is critical as it signifies future incoming cash flow.

In the financial records of a business, accounts receivable are typically categorized as assets, reflecting the anticipated inflow of cash. Monitoring the accounts receivable balance is vital for assessing the efficiency of a company’s cash flow management and its ability to convert sales into cash.

Effectively managing accounts receivable involves several key practices. It starts with issuing timely and accurate invoices to customers, ensuring clear terms of payment are communicated. Following up on overdue payments is essential to prevent cash flow disruptions, which may involve friendly reminders or more assertive collection efforts. In some cases, businesses may need to resort to external collection agencies or legal measures to recover outstanding debts.

Investors and creditors pay close attention to a company’s accounts receivable as it provides insights into its financial health and operational efficiency. It’s not just about the total amount owed but also the speed at which receivables are converted into cash, often measured through metrics like Days Sales Outstanding (DSO).

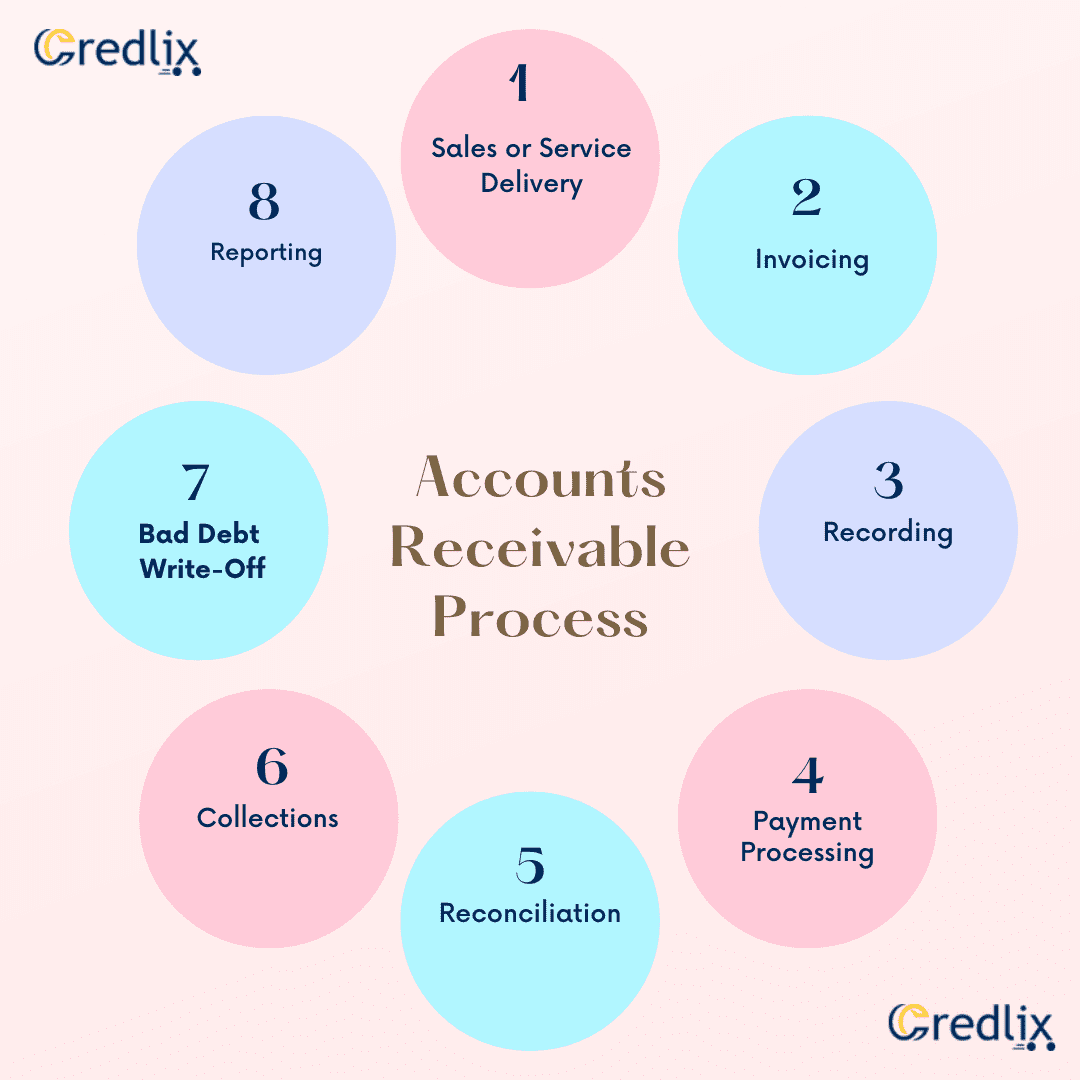

Accounts Receivable Process

The accounts receivable process in the US market operates within a structured cycle, comprising several key steps to effectively manage and track outstanding customer balances:

Sales or Service Delivery: The process initiates with the completion of a sale or delivery of a service to a customer. At this stage, an account receivable is generated, representing the amount owed by the customer to the business for the provided goods or services.

Invoicing: Following the transaction, the next step involves the creation and transmission of an invoice to the customer detailing the amount owed, payment terms, and relevant dates. This formal documentation serves as a record of the obligation.

Recording: Once the invoice is dispatched, it must be accurately recorded within the company’s accounting system. This step ensures that each customer’s outstanding balance is properly documented, facilitating comprehensive financial tracking and analysis.

Payment Processing: Upon receipt of payment from the customer, the transaction is processed within the accounting system. This entails matching the payment to the corresponding invoice and updating the customer’s account to reflect the reduced outstanding balance.

Reconciliation: Regular reconciliation procedures are imperative to verify the accuracy of the accounts receivable balance. This involves comparing the total outstanding receivables to the recorded balances within the accounting system, identifying any discrepancies that may require further investigation.

Collections: In instances where customers fail to remit payments within the specified timeframe, collection efforts are initiated. These efforts may encompass sending reminders, conducting follow-up calls, or engaging external collection agencies to recover overdue debts.

Bad Debt Write-Off: Should attempts to collect outstanding debts prove unsuccessful, the account may be deemed uncollectible and written off as bad debt. This involves removing the delinquent receivable from the accounting records and recognizing the associated loss as an expense.

Reporting: The culmination of the accounts receivable process involves the generation of various reports to assess its performance and effectiveness. These reports may include aging analyses, collection summaries, and bad debt provisions, offering valuable insights to inform strategic decision-making and process refinement.

Examples of Accounts Receivable

Imagine Sam Inc., a widget manufacturer, receives a $100,000 order from Ted Corp. with a 30-day payment term. But Sam needs cash pronto for materials and payroll. Instead of waiting, Sam taps into accounts receivable financing. They sell the $100,000 invoice to a financing company for immediate cash, say $80,000 upfront. When Ted Corp. pays in 30 days, the financing company collects the full $100,000, and Sam settles the $80,000 advance plus fees. Simple, right? Sam gets cash fast, and Ted Corp. sticks to their payment schedule.

Types of Receivables

There are three major types of Receivables:

Trade Receivables: These are amounts owed by customers to businesses for goods or services provided on credit. For instance, when a retailer sells products to a customer on credit terms, the resulting balance owed is considered a trade receivable. Trade receivables are a fundamental component of many businesses’ revenue streams, reflecting sales made on credit that are yet to be collected.

Notes Receivable: Notes receivable involve formal promises to repay a debt, often documented in the form of promissory notes or similar legal instruments. These notes outline the terms and conditions of repayment, including the principal amount, interest rate, and maturity date. Notes receivable commonly arise in situations where businesses lend money to customers or enter into financing arrangements with other entities. They provide a structured framework for managing and enforcing repayment obligations.

Other Receivables: This category encompasses various types of receivables that do not fall neatly into the trade or notes receivables classifications. It may include items such as interest receivable, representing accrued interest on outstanding loans or investments, or rent receivable from tenants occupying company-owned properties. Other receivables capture diverse financial obligations owed to a business that do not fit the specific criteria of trade or notes receivable.

Forms of Receivables Financing

In the United States, businesses have several options for receivables financing, each tailored to meet different financial needs. Here are the four primary forms:

Factoring: This involves a business selling its outstanding invoices to a third-party financing company, known as a factoring company. The factoring company pays the business a discounted amount upfront, taking over the responsibility of collecting payment from customers. Factoring provides immediate cash flow relief, allowing businesses to focus on operations rather than waiting for invoice payments.

Accounts Receivable (AR) Loans: AR loans enable businesses to borrow against their accounts receivable balances. Lenders provide a cash advance based on the value of outstanding invoices, which the business repays with fees once customers settle their invoices. This form of financing offers flexibility and quick access to capital, leveraging existing assets to support business operations and growth initiatives.

Asset-Based Lending (ABL): ABL utilizes a company’s assets, including accounts receivable, as collateral to secure funding. Lenders assess the value of these assets to determine the credit limit, providing a revolving line of credit for the business. ABL offers flexibility in financing, allowing businesses to access funds based on their asset value rather than traditional credit measures.

Purchase Order Financing: This type of financing assists businesses in fulfilling large purchase orders by providing funds to pay suppliers. The lender extends a loan or line of credit secured by the purchase order and related accounts receivable. Once the customer pays for the goods or services, the lender recoups the funds, including fees. Purchase order financing enables businesses to accept and fulfill large orders without straining cash flow or operational resources.

By understanding these forms of receivables financing, businesses can choose the option that best suits their financial needs and objectives, ensuring smooth operations and sustainable growth.

Factors Affecting the Quality of Receivables

In the United States, the quality of receivables, or the likelihood of collecting payments from customers, is influenced by various factors. Here are some key determinants:

Industry Risks: Different industries face varying levels of risk associated with customer defaults. Sectors heavily reliant on consumer spending or subject to regulatory changes may experience higher default rates, impacting the quality of receivables.

Competition: Competition within an industry can affect payment collection. Businesses facing stiff competition may struggle to enforce payment terms, as customers may opt for competitors offering more favorable terms.

Payment Terms: The terms and conditions of payment extended to customers play a crucial role in receivables quality. Lengthy payment periods or lenient payment conditions can increase the risk of late or non-payment.

Creditworthiness of Customers: The financial stability and payment history of customers significantly influence receivables quality. Businesses must assess the creditworthiness of customers before extending credit terms to mitigate the risk of defaults.

Economic Conditions: Macroeconomic factors, such as consumer confidence, unemployment rates, and overall economic stability, impact customers’ ability to fulfill payment obligations. Economic downturns can increase instances of late payments or defaults.

Internal Controls: The effectiveness of a business’s internal controls and financial management systems also affects receivables quality. Strong internal controls ensure accurate tracking, monitoring, and management of accounts receivable, reducing the risk of errors or fraud.

By considering these factors, businesses can proactively manage their receivables and minimize the risk of non-payment, thereby safeguarding their financial health and stability.

What is the Difference Between Accounts Receivable and Accounts Payable?

Here’s a comparison between accounts receivable financing and accounts payable financing presented in a textual format:

Accounts Receivable Financing:

- Purpose: Borrowing against outstanding invoices issued to customers.

- Also Known As: Invoice financing or factoring.

- Loan Type: Short-term.

- Source: Third-party lender.

- Fund Usage: Funds borrowed are against invoices issued to customers.

- Process: Lender provides a percentage of the invoice value upfront; collects the full amount when the customer pays the invoice.

- Repayment: Repaid by the business when the customer pays the invoice.

- Fee Structure: Lender charges a fee, usually a percentage of the invoice value.

- Cash Flow Management: Improves cash flow by providing immediate access to funds against receivables.

- Risk Reduction: Reduces the risk of non-payment by customers.

Accounts Payable Financing:

- Purpose: Obtaining funds to pay off outstanding bills owed to suppliers.

- Also Known As: Not applicable.

- Loan Type: Short-term.

- Source: Third-party lender.

- Fund Usage: Funds used to cover costs of goods and services purchased on credit.

- Process: Lender pays off outstanding bills to suppliers on behalf of the business.

- Repayment: Repaid by the business over time with interest.

- Fee Structure: Lenders may charge interest and/or fees based on the amount and terms of financing.

- Cash Flow Management: Helps manage cash flow by covering payable balances to suppliers.

- Risk Reduction: Enhances supplier relationships and avoids late payment penalties.

This comparison provides insights into the differences between accounts receivable financing and accounts payable financing, including their purposes, processes, and impacts on cash flow management and risk mitigation.

Factoring vs. Accounts Receivable Financing

Accounts receivable financing and factoring both leverage outstanding invoices for short-term lending needs, yet they diverge in key aspects.

Factoring typically incurs higher fees compared to accounts receivable financing. In factoring, a third-party financing company purchases the invoices and manages collections, while in accounts receivable financing, businesses maintain responsibility for collecting payments, thus offering greater confidentiality.

Repayment terms differ between the two. In factoring, repayment is typically due upon the customer’s payment, whereas accounts receivable financing spreads repayment over 6-12 months.

Moreover, factoring provides an advance payment ranging from 80%-90% of the invoice value, whereas accounts receivable financing offers a slightly lower advance payment of 70%-80%.

Conclusion

Understanding accounts receivable financing is essential for SMEs to navigate cash flow challenges effectively. This guide has explored the intricacies of accounts receivable, the receivables financing process, types of receivables, and the factors influencing their quality. Additionally, it has highlighted the differences between accounts receivable and accounts payable financing, as well as the distinctions between accounts receivable financing and factoring. By leveraging this knowledge, businesses can optimize their financial strategies and drive sustainable growth in the competitive market landscape.

Also Read: Financing Receivables and Using Vendor Financing to Improve Your Business Cash Flow