Cash flow keeps your small business alive.

When money flows smoothly in and out, you can pay employees, suppliers, rent, taxes, and other bills on time.

Finding this balance isn’t always simple. A recent survey found that cash flow is a challenge for almost three out of every five small business owners.

Having cash on hand also lets you reinvest in your business. Sometimes you have to spend money to grow—on things like tools, technology, marketing, branding, and hiring staff.

In this article, we’ll show you how to manage your cash flow better.

What is Cash Flow Management?

Cash flow management is monitoring and controlling the money flowing into and out of a business to predict future cash needs accurately. It’s the daily process of tracking, analyzing, and optimizing cash receipts minus expenses.

Responsible financial management ensures there’s sufficient cash to support business growth and cover essential costs like debt payments, payroll, and vendor bills. Effective strategies in cash management help businesses forecast available funds reliably.

Also Read: What is Cash Flow? Understanding the Basics

How Cash Flow Management Benefits Businesses

Cash flow management is essential for a company’s financial stability. Simply put, it ensures that a business has enough money to cover its expenses when needed. Studies show that many small businesses fail because they don’t manage their cash flow well or misunderstand its importance.

Effective cash flow management involves tracking and planning for both past and future expenses. It means paying bills on time, ensuring there’s enough money for employee salaries and future investments. When businesses understand their cash flow, they reduce the risk of running out of money and increase their chances of success and growth. Transparency in finances is key to making all this happen smoothly.

What’s the Key to Managing Cash Flow?

Managing cash flow well means keeping a balance between the money coming in and the money going out of your business. Here are some simple tips to help you manage your cash flow effectively:

Monitor and Track Cash Flow

Always keep an eye on your cash flow by regularly checking bank statements and financial reports. This helps you see patterns and find areas where you can improve.

Cash Flow Forecasting

Forecasting is predicting how much money will come in and go out in the future. Use this information to plan for your business’s needs and make smart financial decisions.

Manage Accounts Payable Efficiently

Organize how you pay your bills to avoid late payments and build good relationships with suppliers. A smooth process can also help you take advantage of early payment discounts and keep your cash flow healthy.

Take Advantage of Early Payment Discounts

Some suppliers offer discounts if you pay invoices before they’re due. Paying early saves money, improves relationships with suppliers, and gives you a clearer picture of your cash flow. This way, you know exactly how much money you have at any time.

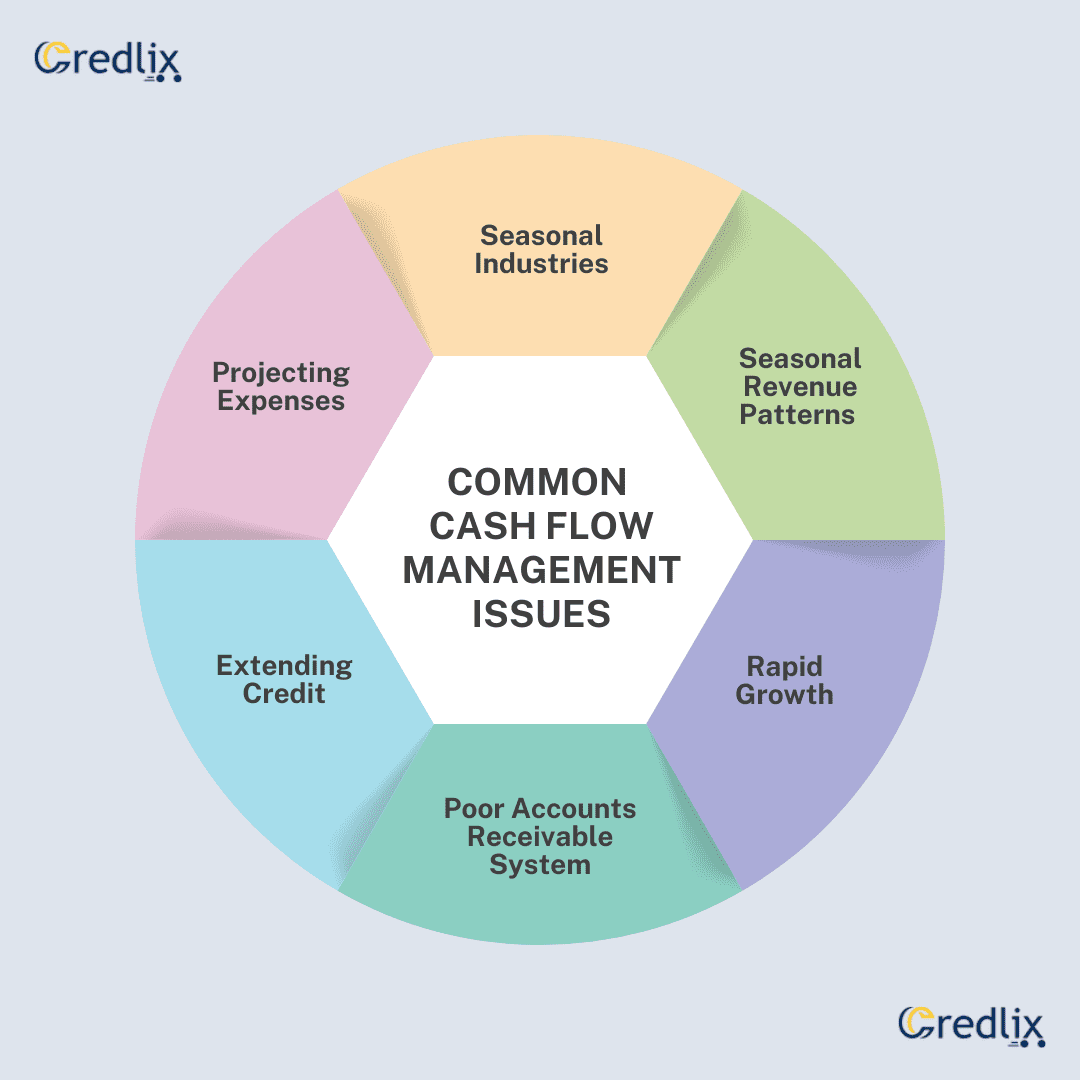

Common Cash Flow Management Issues

Every business faces cash flow challenges. Here are some common issues and how they can affect your business:

Seasonal Industries

Businesses in industries that change with the seasons, like real estate, can have cash flow problems. For example, property development needs a lot of money upfront and continuous cash flow. If properties don’t sell quickly or the market drops, cash flow issues arise.

Seasonal Revenue Patterns

Businesses that are busy during certain seasons and slow during others can struggle with cash flow. To keep money coming in all year, perform a spend analysis and plan for fixed expenses. This involves analyzing your spending and finding ways to save money and improve operations.

Rapid Growth

Companies growing quickly can face cash flow problems. Growth means higher labor costs, more space, and more investment in equipment. Keeping up with inventory can also drain cash. Without proper planning, rapid growth can harm cash flow.

Poor Accounts Receivable System

Many small businesses lack an organized system for collecting payments. Business owners often focus on getting new customers but forget to collect invoices, leading to cash flow problems.

Extending Credit

When a business gives customers time to pay their invoices, usually 30 to 60 days, it can lead to cash flow issues. Customers may delay payments to manage their own cash flow, leaving the business short on funds.

Projecting Expenses

Many small business owners struggle to accurately predict future expenses and debts. It’s essential to look at both short-term and long-term needs for effective cash flow forecasting. Cash flow and sales projection reports help determine if there’s enough money to cover operating costs based on expected revenue.

Best Cash Flow Management Techniques

As a business owner, you should always look for ways to improve your cash flow management. Some tasks are simple, while others need more planning. Here are some easy tips to help you manage your cash flow better:

Cash Flow Analysis

Regularly check your cash flow by looking at your current cash flow statements. Ask yourself “what if” questions, like what happens if a big client leaves or if you have unexpected expenses. This helps you see where the biggest risks are. Use accounting software or apps to make this analysis easier.

Delay Outflows

Find ways to keep money in your business longer. One common strategy is to get paid faster. Shorten the time it takes to get money from your customers.

Cut Expenses

Go through your expenses carefully to find ways to save money. Avoid unnecessary spending and hold off on using business credit cards unless absolutely needed. Also, look at capital expenses—repair equipment instead of buying new to save money.

Finance Large Orders

Instead of paying for big purchases all at once, use a line of credit. Financing large orders with low-interest rates helps keep cash flow steady. This also helps manage inventory without affecting business needs.

Keep Inflows Predictable

Make sure money coming in is timely and predictable. Send invoices and collect payments as soon as possible. Offer discounts to customers who pay early. Even a small discount can encourage quicker payments. Follow up on late payments quickly and reassess any underperforming contracts.

Use Escrow Services

For extra security, use escrow services. This ensures payments aren’t delayed, especially for big projects. It’s useful for businesses that have events or shows that can be canceled at the last minute.

Have a Backup Plan

Always be ready for a cash flow crisis with a backup plan. This should include keeping some reserve cash for emergencies.

Grow Carefully

Growing too quickly can harm your cash flow. As you increase sales, you need to spend more money first. If the time between spending more and earning more is too long, you could face cash flow problems.

Use Technology

Use tools and templates to make managing cash flow easier. This includes software like QuickBooks and cloud-based services.

Conclusion

Managing cash flow effectively is crucial for the success and stability of your small business. By regularly monitoring your cash flow, forecasting future needs, cutting unnecessary expenses, and leveraging tools and technology, you can ensure a healthy cash flow. Implementing these strategies will help you cover essential costs, invest in growth, and avoid financial pitfalls.

FAQs

1. What is cash flow management?

Cash flow management is the process of tracking, analyzing, and optimizing the money coming in and going out of your business to ensure you have enough funds to cover expenses and invest in growth.

2. Why is cash flow management important for small businesses?

Effective cash flow management helps small businesses maintain financial stability, pay bills on time, and invest in future growth, reducing the risk of financial problems.

3. How often should I analyze my cash flow?

Regularly, at least monthly. Frequent analysis helps you spot trends, identify potential issues, and make informed financial decisions.

4. What are common cash flow problems for businesses?

Common issues include seasonal revenue fluctuations, rapid growth, poor accounts receivable management, and extending credit to customers.

5. How can I improve my cash flow?

Monitor your cash flow regularly, cut unnecessary expenses, take advantage of early payment discounts, use financing for large purchases, and ensure timely invoicing and collections.

6. What tools can help with cash flow management?

Accounting software like QuickBooks and cloud-based services can help you track, analyze, and forecast your cash flow more efficiently.

7. How can I prepare for a cash flow crisis?

Have a backup plan that includes maintaining a reserve of cash for emergencies and regularly reviewing and adjusting your cash flow management strategies.

8. What is the benefit of using escrow services?

Escrow services provide additional security by ensuring payments are made on time, especially for large or complex projects, helping you maintain a steady cash flow.

Also Read: Optimizing Cash Flow in International Markets with Export Factoring