In the import-export industry, waiting weeks or months for payment is common, leading to cash flow challenges as immediate expenses demand attention. Late payments can force businesses to dip into assets or equity, exacerbating the cycle of negative cash flow and accumulating debt.

To fuel growth, import-export companies require funds for payments, product acquisitions, and payroll obligations. International invoice factoring offers a solution. This financing method involves selling outstanding invoices to a factoring company at a discount, providing immediate cash flow.

In this article, we explore how invoice factoring for import-export firms operates, its advantages, and comparisons with alternative financing options. By leveraging international factoring services, businesses can maintain cash flow, seize growth opportunities, and navigate the intricacies of global trade more effectively.

What is International Factoring?

International factoring is a financial arrangement where a company sells its accounts receivable (invoices) to a specialized financial institution known as a factor. Unlike domestic factoring, international factoring involves transactions between companies located in different countries.

Here’s an example to illustrate international factoring:

Let’s say Company A, based in the United States, exports goods to Company B, located in France. After delivering the goods, Company A issues an invoice to Company B, with payment terms of 60 days. However, Company A needs immediate cash flow to cover its operational expenses and fund future production.

To address this, Company A engages an international factoring company. The factoring company purchases Company A’s invoice at a discounted rate, providing immediate cash to Company A. In exchange, Company B will pay the factoring company directly when the invoice becomes due, effectively transferring the credit risk from Company A to the factoring company.

In this scenario, international factoring allows Company A to access cash quickly, enabling it to fulfill its financial obligations and continue its operations without waiting for payment from Company B. Additionally, it helps mitigate the risk of non-payment or late payment by Company B, providing greater financial stability and flexibility for Company A to pursue growth opportunities in the global market.

Also Read: Factoring and PO Financing: Working Together to Fund Your Business

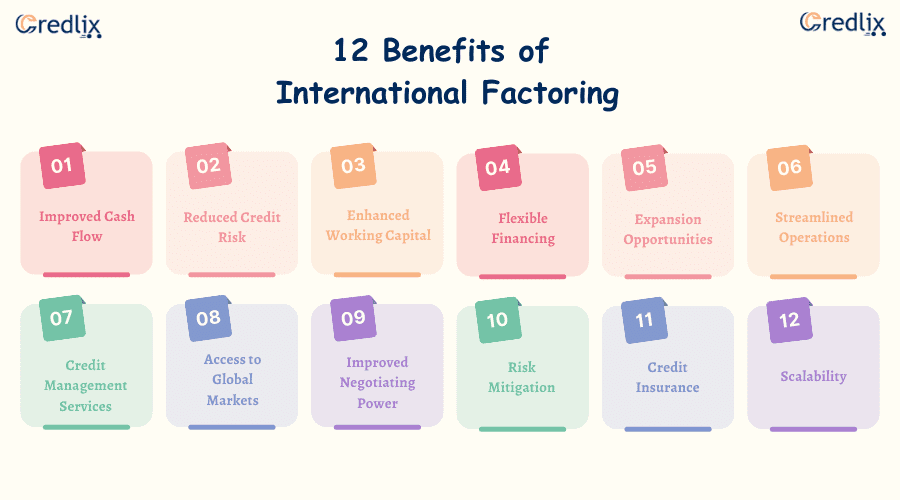

12 Benefits of International Factoring

International factoring offers several benefits to businesses engaged in cross-border trade. Here are 12 key advantages:

Improved Cash Flow: International factoring provides immediate access to cash by selling accounts receivable, helping businesses manage day-to-day expenses and invest in growth initiatives without waiting for customer payments.

Reduced Credit Risk: Factoring companies assume the credit risk associated with international transactions, protecting businesses from losses due to non-payment or delayed payment by foreign buyers.

Enhanced Working Capital: By converting invoices into cash, international factoring improves working capital, allowing businesses to fund operations, purchase inventory, and meet financial obligations promptly.

Flexible Financing: Factoring arrangements can be tailored to meet the unique needs of businesses, providing flexibility in terms of funding amounts, repayment terms, and credit lines.

Expansion Opportunities: With improved cash flow and reduced credit risk, businesses can pursue new market opportunities, expand their customer base, and increase sales volumes in foreign markets.

Streamlined Operations: International factoring simplifies the accounts receivable process, eliminating the need for businesses to chase payments from customers and allowing them to focus on core operations.

Credit Management Services: Factoring companies often provide credit management services, including credit checks on potential customers and collections on overdue invoices, reducing administrative burdens for businesses.

Access to Global Markets: Factoring facilitates trade with international customers by providing financing solutions tailored to cross-border transactions, enabling businesses to compete more effectively in global markets.

Improved Negotiating Power: With cash on hand, businesses have greater negotiating power with suppliers and vendors, potentially securing discounts for early payment and improving overall profitability.

Risk Mitigation: International factoring helps mitigate risks associated with currency fluctuations, political instability, and trade disputes, safeguarding businesses from financial losses in volatile global markets.

Credit Insurance: Some factoring arrangements include credit insurance, further protecting businesses from the risk of customer default and providing peace of mind when trading internationally.

Scalability: International factoring can accommodate businesses of all sizes, from small enterprises to large corporations, providing scalable financing solutions to support growth and expansion initiatives.

Overall, international factoring offers numerous advantages for businesses engaged in cross-border trade, providing a reliable and efficient means of financing and risk management in the global marketplace.

International Factoring Working Process

Import-export factoring simplifies cash flow for businesses by converting unpaid invoices into immediate cash advances. Here’s how it works:

Submit Invoices: Send your unpaid invoices to the factoring company. They accept invoices from creditworthy customers, typically within a 30-90 day turnover.

Get Cash Advance: Upon receiving your invoices, the factoring company advances you up to 80-90% of the invoice’s value within 24-48 hours. This quick cash infusion helps finance your business initiatives promptly.

Customer Payment Collection: The factoring company handles the collection process professionally. They provide secure methods for customers to pay, like online portals, and communicate with them if any issues arise.

Remainder Paid Out: Once the invoice is paid, the factoring company releases the remaining funds to you, deducting a small factoring fee (usually 1-5%).

Maintain Business Relationships: Throughout the process, the factoring company ensures that customer relationships are preserved by handling any payment issues with care and professionalism.

Flexible Financing: Import-export factoring offers flexibility, allowing you to access cash whenever you need it, rather than waiting for customers to pay their invoices.

Streamlined Process: With import-export factoring, the accounts receivable process is simplified, freeing you from the burden of chasing payments and enabling you to focus on growing your business effectively.

Also Read: How Factoring Benefits Manufacturers and Exporters in Apparel Industry

Practical Uses for International Factoring Cash Advances

Utilizing international invoice factoring can be a game-changer for businesses, offering a way to bypass lengthy payment cycles and access much-needed capital swiftly. With cash advances from factoring, you’re no longer beholden to waiting for customer payments to fund essential aspects of your business. Here’s how you can make the most of international factoring cash advances:

Ensure Timely Payroll: Late customer payments can wreak havoc on your cash flow, leading to delayed payroll and impacting employee morale. By utilizing invoice factoring cash advances, you can ensure that you always have the funds to pay your employees on time, fostering a positive work environment and maintaining productivity.

Seize Growth Opportunities: Don’t let delayed payments hinder your ability to take on new orders and expand your business. With cash advances from invoice factoring, you can confidently accept new customer orders without waiting for previous invoices to clear. This flexibility allows you to capitalize on growth opportunities and propel your business forward.

Cover Operating Expenses: Running an import-export company comes with various expenses, from transportation costs to legal fees. Invoice factoring cash advances provide the necessary funds to cover these operating expenses promptly, ensuring smooth business operations without the need to dip into assets or equity.

By leveraging international factoring cash advances, businesses can navigate the challenges of cash flow management more effectively, unlocking growth capital and accelerating business development. With the ability to pay employees on time, take on new orders, and cover operating expenses without delay, businesses can focus on driving growth and achieving their strategic objectives in the competitive global marketplace.

Navigating International Factoring Fees: Understanding Rates and Charges

Invoice factoring fees are determined based on the volume of invoices and the time it takes for customers to make payments. Typically, factoring larger amounts and achieving quicker customer payments result in lower fees. Factors such as your business’s history, the diversity of your customer base, and the creditworthiness of your customers are also taken into account. There are two main types of factoring fees: initial fees and incremental fees.

The initial fee covers the expenses of factoring your invoices for a predetermined initial period, usually around 30 days, and typically ranges from 0.90% to 3.50% of the invoice’s face value. Incremental fees, on the other hand, apply to expenses incurred after the initial fee period and generally range from 0.25% to 1.50% of the invoice’s face value.

Preparing to Apply for International Factoring Services: Essential Requirements

Before applying for international factoring services, it’s crucial to ensure you have the necessary documents and information ready to expedite the process. Here’s what you’ll need:

Customer Information: Make sure you have a comprehensive list of your existing and potential customers, including their names and contact details. This information is essential for factoring companies to assess the creditworthiness of your customers and determine your eligibility for factoring.

Factoring Application: You’ll need to complete a factoring application form when applying for international factoring services. Along with the application form, you’ll need to submit various documents, including:

- Proof of business ownership identification

- Personal identification documents

- Employer Identification Number (EIN)

- Copies of customer contracts

- Articles of incorporation and other relevant corporate documents

Accounts Receivable Aging Report: An accounts receivable aging report is a crucial document that categorizes outstanding invoices based on their due dates. This report helps factoring companies analyze customer payment behaviors and determine their eligibility for factoring services.

By ensuring you have these requirements ready when applying for international factoring services, you can streamline the application process and expedite approval, enabling you to access the financing you need to support your business growth effectively.

How International Financing Differ From Other Import Export Financing Options

International financing differs from other import-export financing options in several key aspects, primarily in terms of scope, risk management, and complexity. Here’s a breakdown of how international financing sets itself apart:

Geographical Scope: International financing involves transactions between entities located in different countries, encompassing a broader geographic scope compared to domestic financing options, which typically involve transactions within a single country or region. This broader scope introduces additional complexities related to currency exchange, cross-border regulations, and cultural differences.

Risk Management: International financing often involves higher levels of risk compared to domestic transactions due to factors such as currency fluctuations, political instability, and trade barriers. As a result, international financing solutions typically incorporate risk mitigation measures such as foreign exchange hedging, political risk insurance, and credit guarantees to protect against potential losses.

Complexity of Transactions: International financing transactions are inherently more complex than domestic transactions due to the involvement of multiple parties, diverse regulatory environments, and varying legal frameworks across different countries. As such, international financing solutions require careful planning, coordination, and expertise to navigate successfully.

Access to Capital Markets: International financing options may provide access to a broader range of capital markets and funding sources, including international banks, multilateral development institutions, and export credit agencies. This expanded access to capital allows import-export businesses to secure financing on favorable terms and scale their operations more effectively.

Documentation and Compliance: International financing transactions typically require extensive documentation and compliance with international trade regulations, including export controls, customs requirements, and trade finance regulations. Import-export businesses must ensure they adhere to these requirements to avoid potential penalties and disruptions to their operations.

Overall, international financing offers import-export businesses the opportunity to access global markets, manage risks, and secure funding for their cross-border trade activities. However, it also presents unique challenges and complexities that require careful consideration and expertise to navigate successfully.

Final Note

International factoring offers import-export businesses a powerful tool to overcome cash flow challenges and fuel growth in the global marketplace. By converting unpaid invoices into immediate cash advances, businesses can maintain financial stability, seize growth opportunities, and streamline operations effectively. With flexible financing options, streamlined processes, and practical uses for cash advances, international factoring enables businesses to thrive in the competitive landscape of cross-border trade.

By understanding the working process, benefits, fees, and requirements associated with international factoring, businesses can make informed decisions and leverage this valuable financial solution to achieve their strategic objectives and drive success in the import-export industry.