Export factoring is a financial tool that helps businesses manage the challenges of international trade. It involves selling your invoices to a financial company to get quick access to cash. Now, let’s break down why this matters.

Firstly, export factoring reduces the risk of not getting paid. Dealing with customers in different countries can be tricky, but with factoring, the financial company takes on the responsibility of collecting payments. That’s one less worry for you.

Secondly, it improves your cash flow. Instead of waiting for customers to pay, you get a significant portion of the invoice amount upfront. This immediate cash injection is vital for covering expenses and growing your business.

In this guide, we’ll explore five practical ways export factoring makes your life easier and your bottom line healthier. It’s about straightforward financial benefits that can help any business thrive in the global market.

What is Export Factoring?

Export factoring is a financial arrangement designed to help businesses engaged in international trade manage their cash flow and mitigate the risks associated with selling goods or services to customers in foreign countries. It is a form of trade finance that involves the sale of accounts receivable (invoices) to a specialized financial institution known as a factoring company.

How Export Factoring Works?

Here’s how export factoring works:

Sales Agreement: A business sells goods or services to a customer in a foreign country and generates an invoice for the sale. This invoice represents an account receivable, which is the amount the customer owes to the exporting business.

Engaging a Factoring Company: The exporting business enters into an agreement with an export factoring company. This agreement outlines the terms and conditions of the factoring arrangement.

Invoice Submission: The exporting business submits the invoices to the factoring company. The factoring company may advance a significant portion of the invoice value (usually a certain percentage, such as 70-90%) to the exporting business upfront.

Credit Protection (Optional): Many export factoring companies offer credit protection services. This means that the factoring company assumes the credit risk associated with the foreign buyers. In case the buyer fails to pay, the factoring company may cover the losses, providing an added layer of security for the exporting business.

Collections: The factoring company takes over the responsibility of collecting payments from the foreign buyers. This can be particularly advantageous when dealing with customers in different countries with diverse legal and regulatory environments.

Remaining Payment and Fee Deduction: Once the foreign buyer pays the invoice, the factoring company deducts its fees, including the discount or factoring fee, and any other agreed-upon charges. The remaining balance is then remitted to the exporting business.

Key Features of Export Factoring

Export factoring comes with several key features that make it a valuable financial tool for businesses engaged in international trade. Here are some of the key features of export factoring:

Cash Flow Boost: Immediate access to cash by selling accounts receivable.

Risk Protection: Factoring companies assume the risk of non-payment by foreign buyers.

Professional Credit Management: Expert handling of credit checks, invoicing, and collections by the factoring company.

Flexibility in Funding: Financing tied to the volume of accounts receivable, offering scalability.

Access to Foreign Markets: Enables entry into new international markets by providing competitive payment terms.

Debt-Free Financing: No additional debt incurred, leveraging existing assets for working capital.

Efficient Collections: Streamlined collections process with the expertise of factoring companies.

Quick Approval and Funding: Faster processing compared to traditional financing options.

How Export Factoring Reduces Risk?

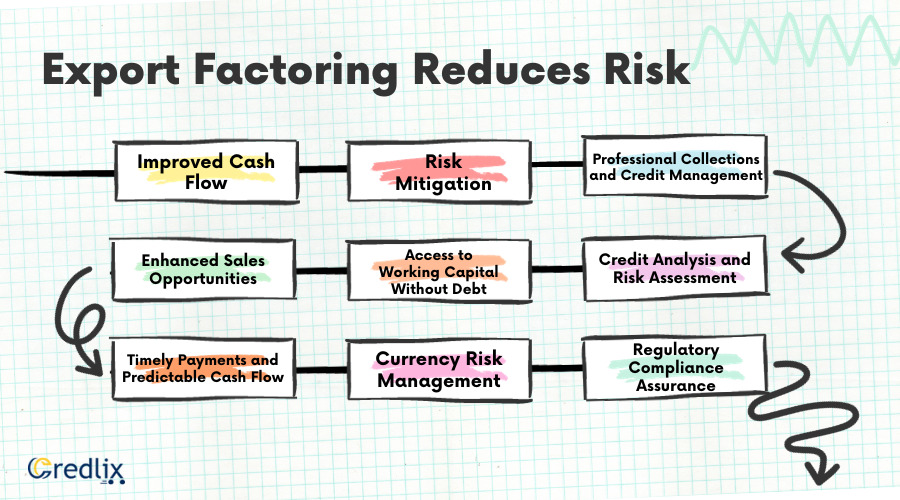

Here are five ways export factoring achieves the aim of reducing risks and boosting your business:

1. Improved Cash Flow

Export factoring provides immediate access to cash by allowing businesses to sell their accounts receivable at a discount. This can be crucial for companies involved in international trade, where payment cycles can be extended, leading to cash flow challenges. By converting receivables into cash, businesses can better manage their working capital and fund ongoing operations without waiting for payment from overseas customers.

2. Risk Mitigation

Export factoring companies often offer credit protection services. This means they assume the risk of non-payment by the overseas buyers. In the event of a customer default, the factoring company covers the losses, providing a layer of protection for the exporting business. This can be particularly valuable when dealing with unfamiliar or high-risk markets.

3. Professional Collections and Credit Management

Export factoring firms typically have expertise in international trade regulations, credit analysis, and collections. They can help businesses navigate the complexities of cross-border transactions, ensuring compliance with various legal and regulatory requirements. Additionally, they take on the responsibility of collecting payments from customers, allowing businesses to focus on their core operations.

4. Enhanced Sales Opportunities

With improved cash flow and reduced credit risk, businesses can offer more favorable payment terms to their international customers. This can make their products or services more attractive in the global market, potentially leading to increased sales and market share. Offering flexible payment terms can be a competitive advantage, especially when dealing with customers who prefer longer credit periods.

5. Access to Working Capital Without Debt

Export factoring is a form of financing that doesn’t involve taking on additional debt. Instead of borrowing money, businesses leverage their accounts receivable to access working capital. This can be a cost-effective way to finance operations, as it doesn’t add to the company’s debt load. It also provides a more flexible funding solution compared to traditional loans or lines of credit.

6. Credit Analysis and Risk Assessment

Export factoring companies conduct thorough credit analysis on foreign buyers before approving factoring agreements. This helps businesses avoid dealing with customers with poor creditworthiness, reducing the risk of non-payment. The factoring company’s expertise in risk assessment adds an extra layer of security to the export transactions.

7. Timely Payments and Predictable Cash Flow

Factoring companies often have established relationships with foreign buyers, promoting timely payments. This predictability in cash flow allows businesses to plan their finances more effectively, reducing uncertainty and enhancing financial stability.

8. Currency Risk Management

Dealing with international transactions introduces currency risk due to fluctuating exchange rates. Export factoring companies, experienced in global trade, can provide services to manage this risk. By offering services such as currency conversion and hedging, they help businesses mitigate the impact of currency fluctuations on their receivables.

9. Regulatory Compliance Assurance

Navigating the regulatory landscape of different countries can be challenging. Export factoring firms are well-versed in international trade regulations and ensure that businesses comply with various legal requirements. This reduces the risk of legal issues and penalties associated with cross-border transactions, providing a smoother and more secure trading experience.

Effortless Export Financing for Business Expansion With Credlix

Credlix streamlines the export journey for businesses, providing vital funds to streamline operations. Our support enhances your export capacity, allowing you to meet increased buyer demands. Experience the ease of our solutions, such as invoice discounting and purchase order financing, all without the requirement for collateral. It’s a straightforward and uncomplicated process.

Also Read: Key Factors to Look for When Evaluating Export Factoring Services

Final Words

Export factoring emerges as a straightforward financial ally for businesses navigating the complexities of global trade. By swiftly converting invoices into cash, it not only eases cash flow challenges but significantly reduces the risks associated with international transactions.

The benefits are clear: improved cash flow, professional credit management, and access to working capital without accumulating debt. The added layers of risk mitigation, efficient collections, and expert regulatory compliance make export factoring a practical solution. As businesses look to expand globally, embracing export factoring becomes a strategic move, boosting the bottom line with financial security and simplified trade operations.

Also Read: Demystifying Export Factoring: Benefits, Types, and How It Works