In today’s fast-changing business world, everyone wants their business to grow quickly. As competition increases and technology changes how companies work, being good with money is the key to lasting success. Financial skills are the foundation for building dreams, expanding ventures, and creating lasting legacies.

Welcome to a journey into financial success, where we explore important financial strategies. This guide is not for those who shy away from challenges, as it dives into the details of financial wisdom and reveals the benefits of smart money management.

In this article, we share eight essential financial tips to help you grow your business quickly. We explore the details of financial planning, budgeting, and making the most of your resources. These tips reveal the secrets behind successful businesses that have grown and expanded at an incredible pace.

Also Read: What is Cash Flow? Understanding the Basics

Unlocking Business Growth: Eight Essential Financial Tips for Fast Success

With these carefully selected tips, we invite you to strengthen your understanding of financial strategies that can help your business grow quickly. From smart investing to managing cash flow, optimizing taxes, and using debt wisely, these financial tips come from experienced experts and real-world business experiences.

1. Better Cash Flow Management

Managing cash flow is crucial for your business, especially if you deal with international trade. You need to keep track of all the money that comes in and goes out. Consider using tools like export financing, Letters of Credit, Bank Guarantees, or trade credit insurance to help with this. Create a detailed cash flow forecast to predict your income and expenses each month or quarter.

This way, you can spot any potential cash shortages early and plan ahead. Also, negotiate good payment terms with suppliers, encourage quick payments from customers, and think about getting a line of credit for short-term needs. A healthy cash flow allows your business to grab growth opportunities and meet financial responsibilities smoothly.

2. Good Investment in Technology and Automation

Investing in technology can make your business more efficient. It helps you complete tasks quickly and with fewer mistakes, especially when it comes to international trade documents. You could use accounting software to simplify financial processes, CRM systems to manage customer relationships, and inventory management software to keep track of stock.

Automation helps reduce manual work and lowers labor costs, giving you and your team more time to focus on activities that grow your business. This makes operations smoother and allows you to serve customers better.

3. Secure Enough Funds

To grow your business quickly, you might need extra money. First, figure out how much funding you need and then look at your options. These could include bank loans, venture capital, angel investors, crowdfunding, or strategic partnerships. When dealing with international trade, consider trade finance solutions like Letters of Credit and Bank Guarantees to help manage trade-related risks.

Choose the financing option that best fits your business needs and goals. Be ready to show a strong business plan and financial forecasts to potential investors or lenders to get the funds you need for expansion.

4. Diversify Sales Channels

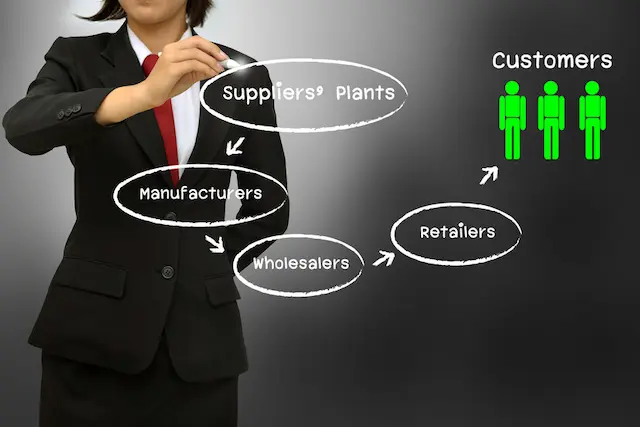

Expanding your sales channels can help your business reach more customers. Consider selling online, partnering with distributors, opening new stores, or entering international markets. When expanding internationally, use trade finance services such as Letters of Credit and Bank Guarantees to manage risks.

Before you expand, evaluate the costs, risks, and potential benefits of each new sales channel. Diversifying your sales channels can reduce your reliance on just one source of income and help your business grow by tapping into new markets. This way, you’ll be able to attract more customers and boost your revenue.

5. Marketing and Getting More Customers

Spend some money to advertise your business and attract more customers. Figure out which advertising methods work best for you, whether it’s social media, blogging, online ads, or working with popular influencers. Monitor how much it costs to get each new customer and how much revenue your ads generate to see if your advertising is effective.

You can adjust your strategy based on this information to ensure you’re reaching your target audience efficiently. By effectively marketing your business, you’ll increase brand awareness and attract more customers, leading to more sales and growth.

6. Employee Training and Retention

Your employees are important for your business’s growth, so focus on keeping them happy and skilled. Offer competitive salaries, a good work environment, and opportunities for career growth to retain your best employees.

High employee turnover can be costly and disruptive, hindering your business’s growth efforts. By keeping your team motivated and well-trained, they can contribute more effectively to the business’s success. A skilled and dedicated team will help you achieve your goals faster and maintain high productivity levels.

7. Continuous Financial Analysis and Adaptation

Regularly checking your business’s financial health is key to staying on track. Look at key performance indicators (KPIs) like revenue growth rate, profit margins, and customer lifetime value. Keep up with market changes, industry trends, and economic conditions. Be ready to adapt your business strategy when new opportunities or challenges arise.

Make data-driven decisions by analyzing your financial situation often, ensuring that your company can grow quickly and sustainably. By continuously evaluating your finances, you can make informed choices that support your business’s long-term success.

8. Optimize Pricing Strategy

Having the right pricing strategy is crucial for maximizing profits. Start by analyzing your costs, competitors’ prices, and market demand. Regularly review and adjust your pricing strategy based on market feedback and changing conditions. Ensure your prices reflect the value your products or services provide to customers while remaining competitive in the market.

By optimizing your pricing strategy, you can attract more customers, increase sales, and boost your bottom line. Understanding your pricing landscape helps your business remain profitable and competitive in the industry.

Also Read: Cash Flow Management For Businesses

Conclusion

Growing your business quickly is possible when you use smart financial strategies. By managing your cash flow well, investing in technology, securing the right funding, and expanding your sales channels, you can reach more customers and increase your profits. Don’t forget the importance of good marketing, keeping your employees happy, and staying on top of your finances. By regularly checking your business’s performance and adjusting your pricing strategy, you’ll be able to make informed decisions that help your business succeed. Remember, the key to growth is staying flexible, learning from others, and always looking for new opportunities.