In the world of international trade, cash flow is crucial, and waiting for customer payments can be a challenge. Factoring comes to the rescue, offering a range of benefits that make a significant impact on the success of exporters.

Imagine a tool that not only speeds up your access to cash but also provides a safety net against the uncertainties of global markets. That’s what factoring does. It goes beyond just financing – factoring can improve cash flow, mitigate risks, and open doors to new opportunities.

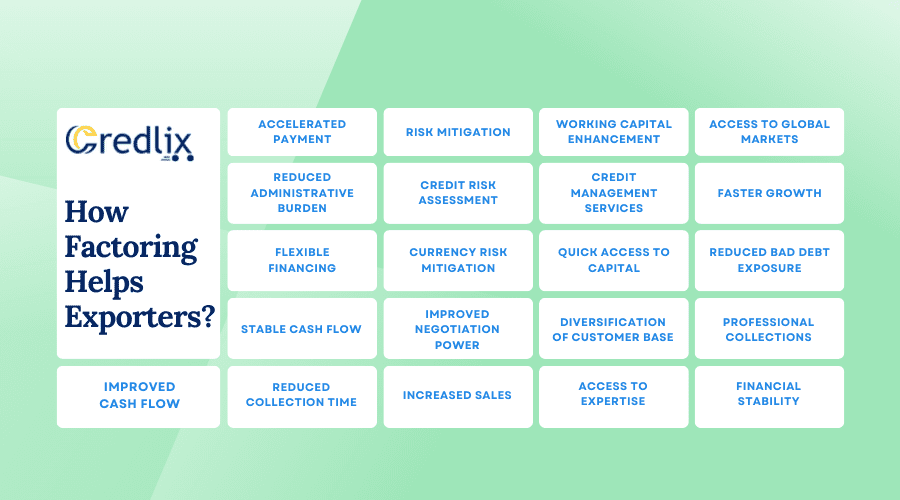

In this blog, we’ll delve into 21 ways factoring can empower exporters. From accelerating payments and reducing administrative hassles to providing credit insurance and facilitating entry into new markets, factoring proves to be a versatile ally for businesses engaged in international trade. Let’s explore how these financial strategies can enhance the growth, stability, and overall success of exporters on the global stage.

Also Read: Types of Export Factoring

What is Factoring?

Factoring is a financial arrangement that involves a business selling its accounts receivable (unpaid invoices) to a third-party financial company, known as a factor. The factor then assumes responsibility for collecting the payment from the customers. This process provides the business with immediate cash, improving its cash flow without having to wait for customers to settle their invoices.

Here’s how factoring typically works:

Invoice Generation: A business generates invoices for goods or services provided to customers on credit.

Selling Invoices: Instead of waiting for these invoices to be paid, the business sells them to a factoring company at a discounted rate.

Immediate Cash: The factoring company advances a significant portion of the invoice amount to the business, usually around 70-90%, providing immediate cash.

Collection: The factoring company takes over the responsibility of collecting payments from the customers mentioned in the invoices.

Final Settlement: Once the customers pay the full invoice amount, the factoring company deducts its fees and transfers the remaining amount to the business.

Also Read: How Does Export Factoring Work

How Factoring Helps Exporters?

Factoring can be a valuable financial tool for exporters, providing numerous benefits that can help improve cash flow and mitigate risks associated with international trade. Here are 21 ways how factoring can assist exporters:

Improved Cash Flow

Factoring enhances cash flow for exporters by providing immediate funds for their invoices, mitigating the need to wait for customer payments.

This quick injection of liquidity empowers businesses to meet operational needs, pursue growth opportunities, and navigate the challenges of international trade more effectively.

Accelerated Payment

Exporters experience accelerated payments through factoring, receiving funds for their invoices within a brief timeframe, typically just a few days. This contrasts with the extended credit terms that would otherwise require prolonged waiting periods for payment.

This expedited payment process enhances cash flow, enabling exporters to swiftly reinvest in their operations, pursue strategic initiatives, and maintain financial agility in the dynamic landscape of international trade.

Risk Mitigation

Factoring companies play a crucial role in risk mitigation for exporters by providing credit insurance. This safeguard shields exporters from potential losses due to non-payment or insolvency of foreign buyers. With this protective measure in place, exporters can confidently engage in international trade, knowing that they are insulated against unforeseen financial risks.

The credit insurance offered by factoring companies contributes to the overall security and stability of export transactions, allowing businesses to focus on growth and expansion with reduced apprehension.

Working Capital Enhancement

Factoring facilitates a notable enhancement of working capital for exporters, offering swift access to funds. This accelerated financial liquidity empowers businesses to invest strategically in various facets, including day-to-day operations, expansion initiatives, and the pursuit of new opportunities.

By efficiently leveraging working capital, exporters can optimize their financial resources, navigate the dynamic landscape of international trade with flexibility, and position themselves for sustained growth and success in a competitive global market.

Access to Global Markets

Factoring serves as a catalyst for exporters seeking access to new international markets by offering a dependable and adaptable financing solution tailored to the intricacies of cross-border trade. This financial tool provides the necessary resources for exporters to navigate complexities such as diverse currencies, regulatory frameworks, and payment terms.

By facilitating entry into untapped global markets, factoring not only broadens the business’s reach but also empowers exporters to capitalize on emerging opportunities and diversify their revenue streams on a global scale.

Reduced Administrative Burden

Factoring significantly alleviates the administrative load for exporters by entrusting the collection of receivables to specialized companies. This streamlined process frees exporters from the intricacies of managing payments, enabling them to concentrate on core business activities.

With the burden of administrative tasks lifted, exporters can enhance operational efficiency, allocate resources strategically, and dedicate more time and energy to critical aspects of their business. This efficiency gains particular significance in the dynamic realm of international trade, where a focused approach is vital for sustained success and growth.

Credit Risk Assessment

Factoring companies play a pivotal role in risk management by conducting comprehensive credit assessments of buyers. This diligent evaluation empowers exporters with valuable insights, aiding them in making informed decisions about extending credit terms to specific customers.

By leveraging the expertise of factoring firms in assessing creditworthiness, exporters can minimize the risk of non-payment, optimize their credit policies, and forge more secure and profitable relationships in the complex landscape of international trade.

Credit Management Services

Factoring firms go beyond financing, offering invaluable credit management services to exporters. This includes diligent monitoring and collection services that enhance the exporter’s ability to navigate credit risks effectively. By outsourcing these critical functions to specialized professionals, exporters benefit from proactive credit monitoring, timely collections, and a strategic approach to credit risk mitigation.

This comprehensive suite of services ensures a robust and well-managed credit environment, allowing exporters to focus on their core operations while maintaining financial stability and confidence in their international transactions.

Faster Growth

Enhanced cash flow and diminished financial constraints empower exporters to capitalize on growth opportunities, swiftly enter new markets, and accelerate business expansion. The improved financial agility not only allows for the timely pursuit of strategic initiatives but also facilitates a rapid response to dynamic market conditions.

With a solid financial foundation, exporters can confidently invest in innovation, market penetration, and scalability, fostering a trajectory of sustained and expedited growth in the competitive landscape of international trade.

Flexible Financing

Factoring arrangements offer exporters a customized approach to financing, allowing for flexibility in both financing structures and repayment schedules. This tailored financial solution adapts to the unique needs of exporters, providing a versatile framework that aligns with the intricacies of their business operations.

With the ability to adjust financing terms according to specific requirements, exporters can optimize their financial strategies, effectively manage cash flow, and navigate the challenges of international trade with a financing solution that complements the dynamics of their business.

Currency Risk Mitigation

Certain factoring companies provide currency risk mitigation services, safeguarding exporters against the impact of currency fluctuations inherent in dealings across multiple currencies. These services offer a protective shield, allowing exporters to effectively manage the risks associated with volatile currency markets.

By minimizing the exposure to currency-related uncertainties, exporters can enhance financial stability, secure predictable cash flows, and navigate the complexities of international trade with confidence, ensuring that their bottom line remains resilient in the face of fluctuating exchange rates.

Quick Access to Capital

Factoring provides exporters with a prompt and streamlined avenue to access capital. This financial solution proves highly efficient for addressing immediate financial requirements. By sidestepping lengthy bureaucratic procedures, exporters gain swift access to the funds they need.

This agility not only enhances financial liquidity but also empowers businesses to respond promptly to dynamic market conditions, seize time-sensitive opportunities, and maintain a nimble financial posture in the ever-evolving landscape of international trade.

Reduced Bad Debt Exposure

Factoring companies provide credit insurance to help exporters avoid big losses from customers not paying their bills. This insurance lessens the risk of bad debts, keeping exporters safer financially.

By having this protection in place, exporters can focus on their work without worrying too much about not getting paid, making their business more secure and reliable. It’s like having a safety net that catches any problems with customers not paying, ensuring that the impact on the exporter’s money is as small as possible.

Stable Cash Flow

With factoring, exporters can count on a steady and reliable flow of cash. This means they can plan and manage their money more easily because they know when they’ll get paid. It’s like having a regular income, helping exporters feel more secure about their finances.

This stability allows them to focus on their business without worrying too much about unexpected changes in their cash flow, making it simpler to budget and make smart financial decisions.

Improved Negotiation Power

Exporters gain stronger negotiation power by offering extended credit terms to buyers. This flexibility in payment terms allows exporters to engage in more favorable discussions and secure better conditions in international transactions.

With the ability to tailor credit terms, exporters can build stronger relationships with buyers, potentially accessing improved pricing, favorable contract terms, and enhanced overall trade agreements. This strategic advantage not only facilitates smoother negotiations but also positions exporters more competitively in the global marketplace, fostering mutually beneficial outcomes in international business dealings.

Diversification of Customer Base

Factoring empowers exporters to broaden their customer base, engaging in transactions with a more extensive range of buyers. This strategic approach lessens reliance on a handful of key clients, reducing business vulnerability. By diversifying their customer portfolio, exporters not only spread risk but also open doors to new opportunities.

This increased market reach enhances the resilience and sustainability of the business, ensuring that it remains adaptable to market changes and less susceptible to the potential impact of shifts in the preferences or financial health of individual clients.

Professional Collections

Factoring companies bring professional expertise to international collections, guaranteeing a skilled and efficient approach to recovering outstanding payments. With specialized knowledge in navigating the complexities of global transactions, these firms ensure a thorough and effective process. Exporters benefit from the proficiency of professionals who understand the nuances of international debt recovery, enhancing the likelihood of successful collection efforts.

This specialized support not only streamlines the process but also provides exporters with the assurance that their receivables are being managed with the utmost professionalism and expertise.

Reduced Collection Time

Factoring companies streamline collection processes for exporters, minimizing the time and effort expended on pursuing payments. This efficiency accelerates the overall payment cycle, ensuring exporters receive funds promptly. By entrusting collection responsibilities to the factoring company, exporters can focus on core activities without the burden of prolonged and resource-intensive payment follow-ups.

This reduction in collection time not only enhances cash flow but also optimizes operational efficiency, contributing to a more agile and responsive financial management approach for exporters.

Increased Sales

Exporters can sell more by giving good credit terms. This means they let buyers pay later, making it easier for more people to buy from them. When buyers like the terms, they choose to buy more, helping the exporter sell more products. This boosts the business and makes it perform better overall. It’s like a win-win – buyers get flexibility, and the exporter gets more sales, creating a positive cycle for everyone involved.

Access to Expertise

Factoring companies know a lot about selling things across the world. They help exporters by giving useful advice and support. This is especially handy when dealing with the tricky parts of global markets. Exporters can rely on these experts to guide them through the complexities of international trade. It’s like having a knowledgeable friend to help make smart decisions and navigate the challenges of selling products to people from different countries.

Financial Stability

Factoring helps keep exporters financially stable by providing a steady source of money to run their business. It’s like having a reliable support system that helps them during uncertain times. With this help, exporters can manage their money better and not worry too much about financial ups and downs. It’s like having a safety net that keeps their business strong, even when things in the economy are not very clear.

It’s important for exporters to carefully evaluate the terms and conditions offered by factoring companies to ensure that the arrangement aligns with their business goals and requirements.

Credlix embodies this dedication by integrating cutting-edge technology with industry expertise. Recommendations, legal compliance, and opting for a scalable platform are pivotal in fostering the continuous growth of your business through factoring. This strategic approach not only enhances efficiency in financial transactions but also ensures a reliable and adaptable framework for sustained success in the dynamic landscape of international trade.

Also Read: How Factoring Benefits Manufacturers and Exporters in Apparel Industry

Conclusion

Factoring proves to be a valuable ally for exporters, offering a multitude of benefits that enhance financial stability and foster growth. From speeding up cash access to minimizing risks and expanding market reach, factoring provides a robust solution. Remember, choosing a reliable partner and understanding the terms are key. With tools like Credlix, combining technology and expertise, exporters can confidently navigate the complexities of global markets, ensuring sustained success and a resilient financial foundation for their businesses.