The Russia-Ukraine war has completed one year with no signs of resolution in the near term. In this newsletter, we take a look at winners and losers from the perspective of India’s merchandise exports at destination as well as commodity level in the last 12-months dominated by disruptions on account of the war. We round it up with an update on export credit performance along with our customary commentary on INR.

1. Winners and losers from Russia-Ukraine war

At headline level, India’s merchandise exports moderated from USD 37.2 bn in Feb-22 to USD 32.9 bn in Jan-23 (while the slowdown cannot be completely attributed to the Russia-Ukraine war, the disruptions from it aggravated the global inflation scenario, which in turn attracted aggressive monetary tightening from most central banks, thereby impacting external demand).

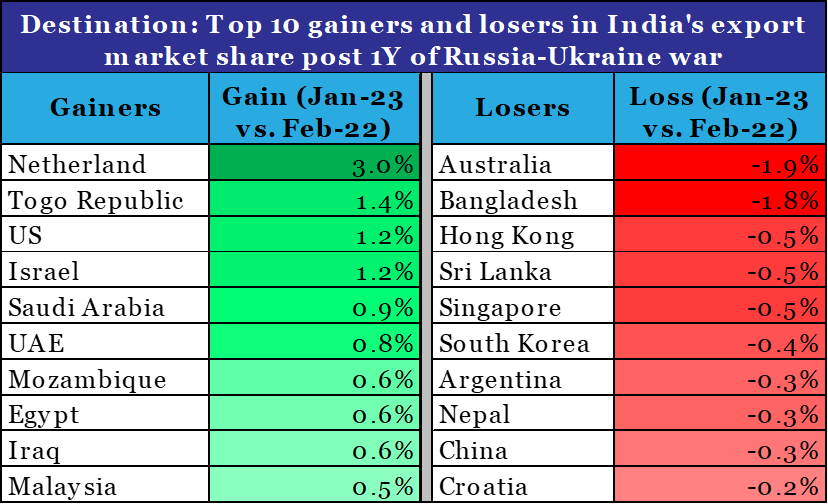

From destination perspective:

- Netherland emerged as the top gainer, with its share in India’s export basket jumping from 3.9% in Feb-22 to 6.9% in Jan-23

- Australia emerged as the top loser, with its share in India’s export basket declining from 3.1% in Feb-22 to 1.2% in Jan-23

From commodity perspective:

- Petroleum Products became the top gainer, with its share in India’s export basket jumping from 18.6% in Feb-22 to 23.3% in Jan-23

- Iron & Steel became the top loser, with its share in India’s export basket declining from 4.7% in Feb-22 to 2.9% in Jan-23

Data: Ministry of Commerce, QuantEco Research

Data: Ministry of Commerce, QuantEco Research

Although global value chain disruptions have eased compared to one year ago levels, the nature of disruption from the war could continue to have a similar impact on destination and commodity wise performance of India’s exports. We can expect the top beneficiaries and losers to by and large remain unchanged at least in the near term.

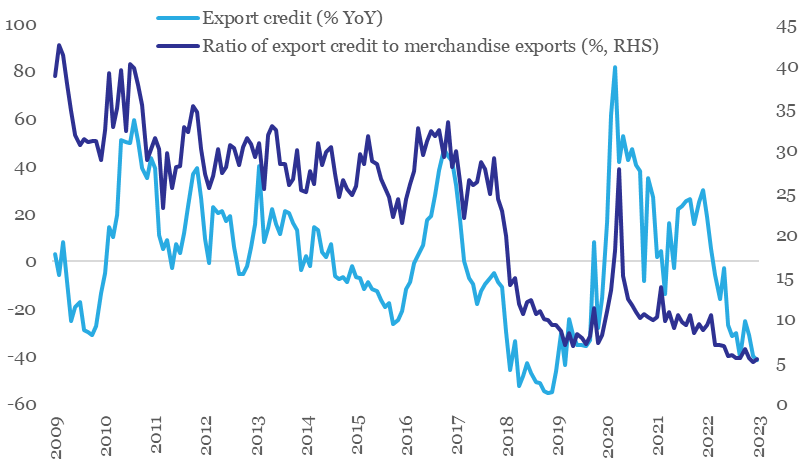

2. Weakness persists in export financing

Amidst slowdown in India’s exports, export financing continues to maintain its declining trend. On annualized basis, export credit has been in contraction since Mar-22, with Jan-23 print of -41.4% being the lowest in nearly 4-years. The overall value of outstanding export credit from banks has fallen to Rs 14,390 cr in Jan-23 from Rs 23,681 cr in Mar-22.

The ratio of export credit to value of merchandise exports (a proxy for extent of export financing coverage) is currently at its lowest levels around 5.0%. As per media reports, with demand uncertainty persisting, exporters are either delaying shipment orders or are not extending the terms of the contract.

Export finance contracting amidst uncertainty

Data: RBI, QuantEco Research

INR: Reassessment of Fed rate trajectory supporting dollar

The Indian Rupee depreciated by 0.9% in Feb-23. This was predominantly a reflection of underlying strong recovery of the US Dollar. The dollar index gained sharply by 2.7% in Feb-23 as market participants priced in additional 75 bps rate hike from the US Fed (vs. 25-50 bps earlier) on account of recent strong economic data in US coupled with firm inflation numbers. Noticeably, market participants have now priced out rate cuts from last quarter of 2023 (vs. expectation of 25-50 bps rate cut earlier).

We had highlighted our USDINR call of 83.5 levels by Mar-23 in previous editions of Credlix Finsights. We continue to maintain the same and expect USDINR to further move higher towards 85.5 levels by Mar-24 on likelihood of persistence of deficit in India’s Balance of Payments.

INR is moving in tandem with USD in 2023 so far

Data: Refinitiv, QuantEco Research

Content powered by: QuantEco Research

Website: https://www.quanteco.in/