Imagine you’re an exporter navigating the waters of international trade. The Letter of Undertaking (LUT) in GST acts like a helpful guide, easing your journey. It’s a simple promise that lets you export goods without paying taxes upfront. It’s like a smooth path through the sometimes choppy seas of taxation, making your life easier as you ship your products worldwide.

What is the Letter of Undertaking in GST?

LUT stands for Letter of Undertaking, which serves as a document for exporters to facilitate the export of goods or services without the requirement of paying taxes upfront. With the implementation of the Goods and Services Tax (GST), all exports are subjected to Integrated Goods and Services Tax (IGST). However, exporters can reclaim the IGST paid through a refund process.

Many exporters encounter challenges in obtaining tax refunds, making alternative options like LUT highly appealing. By furnishing an LUT, exporters can bypass the need for tax payment and the subsequent refund process. This not only saves time and effort but also prevents funds from being tied up in tax payments.

The process of filing an LUT is straightforward and can be done online, offering exporters a hassle-free experience. According to the CGST Rules, 2017, any registered person can submit a bond or LUT in form GST RFD 11 to export goods without paying integrated tax.

Criteria for LUT Eligibility

There’s a criteria for LUT eligibility that you should be aware of:

Intended Supply Destination

Exporters must have intentions to supply goods or services to various destinations, including India, overseas markets, or Special Economic Zones (SEZs).

GST Registration

Eligible exporters must be registered under the Goods and Services Tax (GST) system to avail themselves of the benefits offered by the LUT.

Intention to Supply Goods Tax-Free

Exporters seeking to utilize the LUT option must express their intention to supply goods without paying integrated tax upfront.

Essential Documents Required for LUT Application Under GST

Applying for a Letter of Undertaking (LUT) under the Goods and Services Tax (GST) requires the submission of specific documents to ensure compliance and eligibility. Here’s a list to take care of:

LUT Cover Letter: A formal request for LUT acceptance, signed by an authorized representative of the entity, serves as a prerequisite for the application process.

GST Registration Copy: Proof of GST registration is essential to establish the applicant’s status as a registered entity under the GST framework.

PAN Card: The Permanent Account Number (PAN) card of the entity is required to validate its legal identity and tax obligations.

KYC of Authorized Signatory: Know Your Customer (KYC) documents of the authorized signatory or person signing the LUT cover letter are necessary for verification purposes.

GST RFD 11 Form: Submission of Form GST RFD 11, as prescribed under GST rules, is mandatory for processing the LUT application.

IEC Code Copy: The Import Export Code (IEC) copy is essential for entities engaged in international trade, verifying their authorization for export activities.

Canceled Cheque: Providing a canceled cheque serves as proof of the entity’s bank account details, facilitating seamless fund transactions.

Authorized Letter: An official authorization letter grants the designated person the authority to act on behalf of the entity in LUT-related matters.

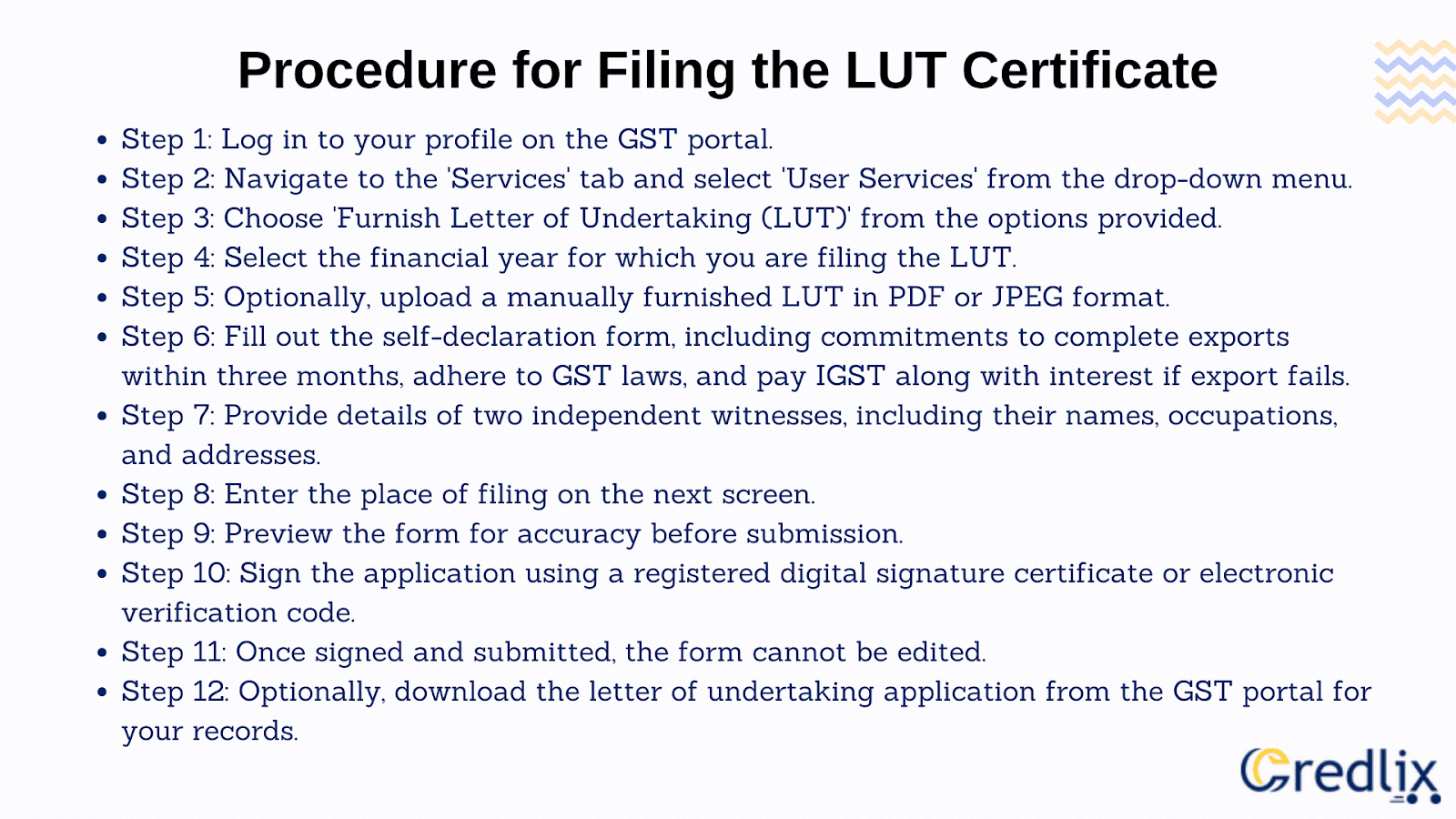

Procedure for Filing the LUT Certificate

Here the step-by-step procedure for filing the LUT certificate:

Advantages of filing LUT for Exporters

Here are some of the advantages of filing LUT for exporters:

Tax Exemption: Exporters opting for the LUT can export goods and services without the burden of immediate tax payments, thus enhancing cash flow and profitability.

Time Savings: By avoiding the need to claim tax refunds, exporters save valuable time that would otherwise be spent on refund procedures and follow-ups with tax authorities.

Unblocked Working Capital: Funds that would otherwise be tied up in tax payments remain accessible for operational needs, particularly beneficial for SME exporters facing financing challenges.

Long-term Validity: Once filed, an LUT remains valid for the entire financial year, providing exporters with consistent tax benefits and reducing administrative burden.

Simplified Process: The online filing process for LUTs and acceptance by tax authorities streamlines administrative procedures, ensuring ease of compliance for exporters.

Enhanced Efficiency: With the LUT in place, exporters can focus on core business activities rather than navigating complex tax refund processes, thereby improving overall operational efficiency.

Financial Stability: Reduced reliance on blocked funds for tax refunds contributes to improved financial stability and resilience against cash flow disruptions for exporters.

Regulatory Compliance: Utilizing the LUT ensures compliance with tax regulations and legal requirements, minimizing the risk of non-compliance penalties or legal issues.

Supporting Documents: Submission of a few supporting documents along with the LUT form facilitates a smooth and efficient process, minimizing paperwork and administrative overhead.

Working Capital Optimization: LUTs enable exporters to optimize working capital by freeing up funds that would otherwise be locked in tax refunds, supporting business growth and expansion initiatives.

Key Information to Remember about LUT for Exporters

Here are some important key information that you have to remember about LUT for exporters in GST:

Validity Period: An LUT remains valid for 12 months from its submission date, providing exporters with a defined timeframe for tax exemption on exports.

Compliance Conditions: Acceptance of the LUT is contingent upon compliance with specified conditions. Non-compliance can result in revocation of privileges, necessitating the submission of a bond.

Bond Requirement: Entities ineligible for LUT submission can furnish a bond on non-judicial stamp paper, accompanied by a bank guarantee covering the estimated tax liability.

Document Format: The LUT must be filed on the letterhead of the registered person intending to supply goods/services without integrated tax payment, ensuring authenticity and compliance.

Application Process: The LUT must be applied for using the prescribed GST RFD-11 form, which can be filed by authorized individuals such as the MD, company secretary, or partner of a partnership firm.

Bank Guarantee Limit: The bank guarantee accompanying the bond should not exceed 15% of the bond amount and may be waived by the jurisdictional GST Commissioner, facilitating ease of compliance for exporters.

Conclusion

The Letter of Undertaking (LUT) in GST is a valuable tool for exporters. It simplifies tax procedures, saves time, and optimizes resources. With its straightforward application process and long-term validity, the LUT empowers exporters to navigate international trade with ease and efficiency. By leveraging the benefits of the LUT, exporters can enhance their competitiveness and drive growth in the global marketplace.

Also Read: Letter of Credit (LC) Unveiled: Meaning, Process, and its Vital Role in Global Trade