The HSN, or Harmonized System of Nomenclature, is like a universal language for sorting and taxing goods and services. It helps organize things neatly, and if you’re into the paint business, knowing your product’s HSN code is necessary. Paint falls into Chapter 32 of the HSN, hanging out with dyes, tanning extracts, and, of course, other paints.

In our blog, we’ll be your guide to the paint HSN code. We’ll break it down in simple terms, so you can get what it means and why it’s a big deal. Imagine it as a special code that tells everyone – especially tax folks – exactly what your paint is all about.

So, if you’re in the colorful world of paints, understanding this code is like having a secret handshake for your business. Stick with us, and we’ll make the HSN code journey easy and fun for our readers concerned.

Decoding Paint: HSN 3208

The HSN code for paint is 3208, and it belongs to Chapter 32, which is all about dyes, tanning extracts, and, of course, paints. Now, Chapter 32 has different sections, and for paints, we’re interested in a few specific ones:

- First off, there’s 3208, which covers paints and varnishes made from synthetic polymers or tweaked natural polymers. These are all mixed up in a non-aqueous (non-water) solution, and it includes solutions defined in Note 4 to this Chapter.

- Then, there’s 3209, where you’ll find paints and varnishes similar to the ones in 3208, but the difference is they’re dispersed or dissolved in a watery medium. Yep, water gets involved in this one.

- Finally, there’s 3210, hanging out with other paints and varnishes. This section covers things like enamels, lacquers, and distempers, along with prepared water pigments used for finishing leather.

So, the HSN code 3208 is your go-to if you’re in the paint world, but remember, there are a couple more codes nearby for slightly different paint varieties.

HSN Code for Paint Essential Insights

Discover the significance of HSN code 3208 for paints, ensuring accurate taxation, streamlined customs, and insights into market trends.

Accurate Taxation

- The HSN code for paint serves as a precise identifier for taxation purposes. It ensures that the government imposes taxes on the correct product and at the appropriate rate.

- Each HSN code is linked to a specific tax rate. For businesses in the paint industry, this means the necessity to accurately apply the corresponding tax rate according to their specific HSN code.

Customs Classification

- The HSN code plays a crucial role for customs authorities in classifying and identifying goods during import or export.

- Its use facilitates a streamlined process for determining the accurate customs duty rate. This is essential for regulating international trade and maintaining transparency in cross-border transactions.

International Trade Tracking

- The HSN code acts as a universal language for trade, enabling customs authorities worldwide to understand and categorize goods consistently.

- Through the HSN code for paint, customs officials can efficiently track and manage the flow of goods across borders, promoting smoother international trade operations.

Market Analysis and Trends

- Businesses can leverage the HSN code for paint to gain insights into industry trends and market demands.

- Understanding one’s product’s HSN code allows for effective competitor analysis, aiding businesses in refining marketing strategies to align with prevailing market conditions.

In essence, the HSN code for paint goes beyond a mere classification—it is a critical tool for ensuring accurate taxation, facilitating international trade, and providing valuable market insights for businesses in the paint industry.

Important Details of Paint HSN Code

Here are some important details of the paint HSN code that you should keep in the back of your mind:

- The specific HSN code for paint is 3208, placing it within Chapter 32 of the HSN system. This code is a universal marker used globally.

- HSN code 3208 encompasses paints and varnishes relying on synthetic polymers or modified natural polymers. These substances are either dispersed or dissolved, finding their medium in non-aqueous or aqueous solutions.

- Governments worldwide utilize the HSN system for consistent categorization of goods and services for taxation. Each HSN code, such as 3208 for paint, corresponds to a specific tax rate, ensuring uniformity in tax application across diverse regions.

- India applies the Goods and Services Tax (GST) to goods, including paint, determined by their Harmonized System of Nomenclature (HSN) code. This system dictates tax rates.

- India applies the Goods and Services Tax (GST) to goods, including paint, determined by their Harmonized System of Nomenclature (HSN) code. This system dictates tax rates.

- Utilizing the HSN code for paint enables businesses to track industry trends, gaining valuable insights into market dynamics and preferences.

- Understanding their product’s HSN code empowers businesses to identify competitors and tailor marketing strategies more effectively to meet market demands.

- The paint’s HSN code is crucial for customs authorities, aiding in the identification and classification of imported or exported goods. This simplifies the determination of accurate customs duty rates and enhances the efficiency of tracking international trade transactions.

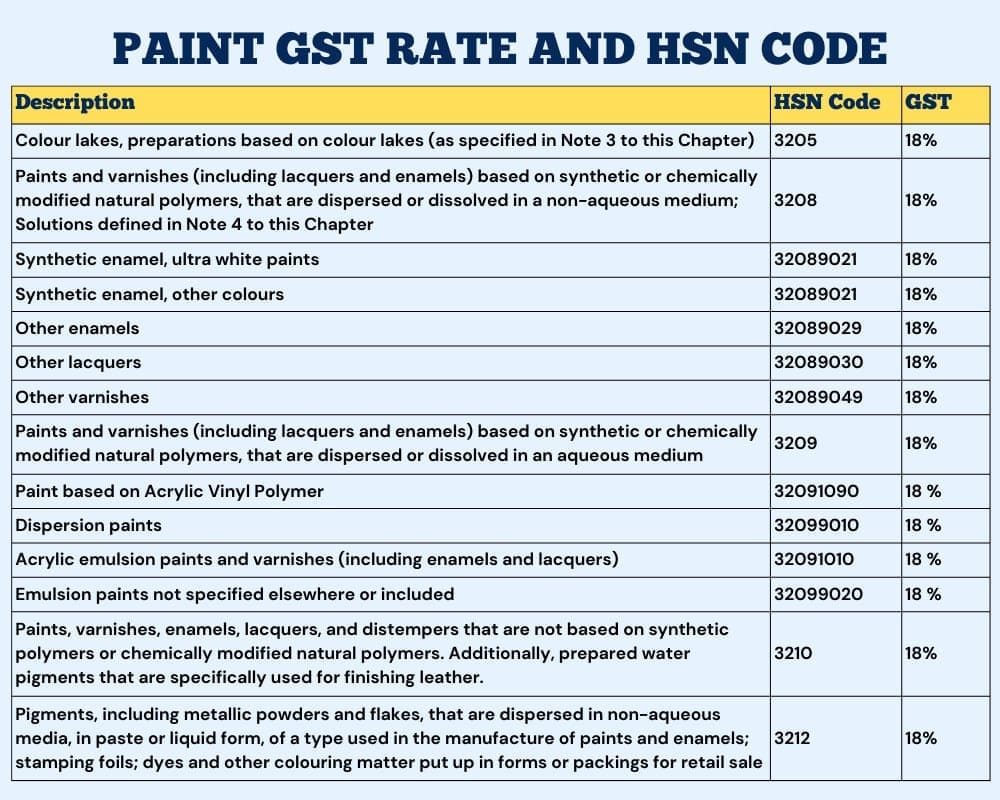

Paint GST Rate & HSN CODE

In the 28th GST council meeting, a decision was made to reduce the paint GST rate from 28% to a lower rate of 18%.

Here is a detailed tabular representation the GST rates and HSN codes for paint and other related products:

Also Read: HSN Codes: What You Need to Know for Trade and Taxation

Final Words

Understanding the HSN code for paint, like 3208, is like having a secret guide in the colorful world of paints. It ensures you apply the right tax rate, avoiding penalties. The code helps customs authorities easily manage imports and exports, making international trade smoother.

Plus, it’s your ticket to tracking industry trends, outsmarting competitors, and targeting markets effectively. So, whether you’re decoding the HSN system or exploring paint varieties under different codes, remember, it’s not just a number – it’s your business’s secret handshake for success in the vibrant paint industry. Stick with these insights, and your paint journey will be easy and fun!

FAQs

1. What is the HSN code for paint?

Answer: The HSN code for paint is 3208. It’s like a special code that puts paint in its own category under Chapter 32 of the HSN system.

2. Why is the HSN code for paint important?

Answer: It helps paint businesses charge the right tax, trade internationally, and spot trends in the colorful world of paints.

3. What tax rate is associated with the HSN code for paint?

Answer: Tax rates for paint vary from 5% to 28%, depending on the specific HSN code.

4. What is the Goods and Services Tax (GST)?

Answer: GST is a tax in India on goods and services. It makes taxes simpler by replacing many others.

5. What’s the penalty for charging the wrong tax rate?

Answer: Charging the wrong tax can lead to fines and a not-so-good reputation for a business.

6. How is the HSN code used in international trade?

Answer: Customs use the HSN code to figure out the right customs duty and keep track of goods going in and out of a country.

7. Can the HSN code identify competitors?

Answer: Yes, understanding the HSN code helps businesses find competitors and figure out what customers want.

8. What’s the difference between non-aqueous and aqueous paints?

Answer: Non-aqueous paints don’t use water, while aqueous ones do. It’s all about the type of liquid they’re mixed in.

9. Is the HSN code for paint the same in all countries?

Answer: No, the HSN code can be a bit different in each country, even though they all follow the same system.

10. How can businesses find the correct HSN code for their product?

Answer: Businesses can use their country’s HSN code lookup tool or ask a tax expert to find the right code for their product.

Also Read: Demystifying HSN Codes: Impact on Your Business and Its Significance