Factoring contracts play a pivotal role in the financial landscape, serving as a strategic tool for businesses to manage cash flow and enhance liquidity. In essence, factoring is a financial arrangement where a company sells its accounts receivable, or outstanding invoices, to a third party known as a factor. This transaction allows the business to swiftly convert its receivables into immediate cash, providing a valuable injection of funds.

The fundamental premise of factoring lies in accelerating the cash conversion cycle. Instead of waiting for customers to settle invoices on their standard payment terms, companies can expedite the receipt of funds by selling these invoices to a factor at a discount. The factor assumes the responsibility of collecting payments directly from the customers, mitigating the risk of non-payment for the original business.

Beyond the immediate financial boost, factoring contracts offer businesses increased flexibility and the ability to focus on core operations rather than grappling with cash flow constraints. This financial mechanism is particularly beneficial for companies navigating periods of rapid growth, facing seasonal fluctuations, or requiring swift capital infusions.

Understanding the intricacies of factoring contracts empowers businesses to make informed decisions, leveraging this financial tool to optimize their working capital and sustain healthy financial operations.

What is a Factoring Agreement?

A factoring agreement is a financial arrangement where a business sells its outstanding invoices (accounts receivable) to a third party, known as a factor. In exchange, the business receives immediate cash, enabling it to manage cash flow more efficiently.

The factor assumes the responsibility of collecting payments from customers, reducing the risk of non-payment for the original business. This agreement provides businesses with quick access to funds, especially beneficial during periods of growth, seasonal fluctuations, or when immediate capital injections are needed.

Factoring Agreement Key Parties

A factoring agreement involves three key parties:

- The business selling its outstanding invoices or accounts receivable.

- The factor, which is the company providing factoring services.

- The company’s client, responsible for making payments directly to the factor for the invoiced amount.

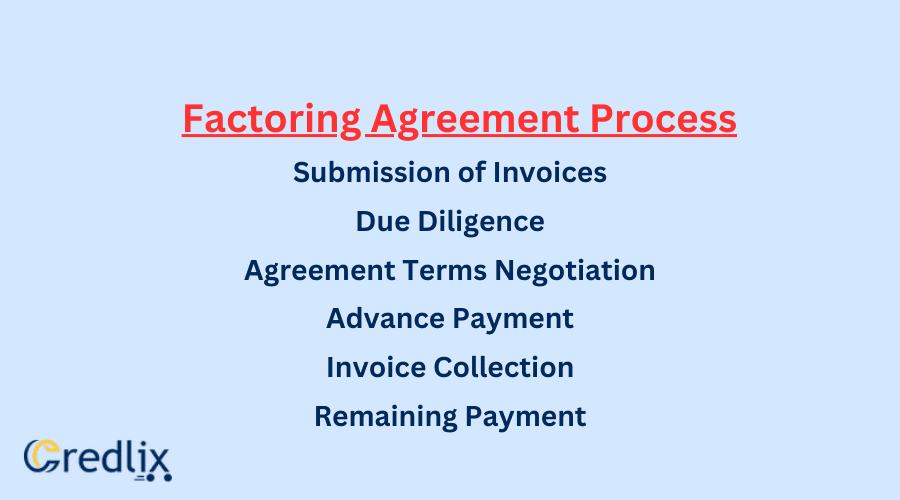

Factoring Agreement Process

The factoring agreement process involves several key steps:

Submission of Invoices

The business submits its outstanding invoices or accounts receivable to the factor, detailing the amounts due from its clients.

Due Diligence

The factor conducts a review of the submitted invoices and assesses the creditworthiness of the business’s clients to determine the risk involved.

Agreement Terms Negotiation

Both parties negotiate the terms of the factoring agreement, including the discount rate applied to the invoices and other relevant terms and conditions.

Advance Payment

Upon agreement, the factor provides an upfront payment to the business, typically a percentage of the total invoice value.

Invoice Collection

The factor takes over the responsibility of collecting payments directly from the business’s clients.

Remaining Payment

Once the clients settle their invoices, the factor deducts its fees and transfers the remaining amount to the business.

This process allows businesses to expedite cash flow, improve liquidity, and transfer the burden of invoice collection to the factor, reducing the risk of non-payment.

Benefits of Factoring Agreement

Here are some of the benefits of a factoring agreement:

Immediate Cash Flow: Factoring agreements provide businesses with quick access to cash by converting accounts receivable into immediate funds, supporting working capital needs.

Improved Liquidity: Businesses can enhance liquidity and financial flexibility, allowing for timely payments of operational expenses or strategic investments.

Risk Mitigation: Factors assume the responsibility of collecting payments, reducing the risk of non-payment, and insulating businesses from the impact of late or delinquent payments.

Flexible Financing: Factoring is a versatile financing option suitable for businesses with varying credit profiles, making it accessible even for those with limited credit history.

Streamlined Operations: Outsourcing invoice collection to factors allows businesses to focus on core operations without the administrative burden of managing receivables.

Accelerated Growth: Factoring is particularly advantageous for businesses experiencing rapid growth, providing the necessary financial support to capitalize on emerging opportunities.

Credit Protection: Factors often offer credit insurance, protecting businesses from losses due to client insolvency or default, further safeguarding their financial stability.

Reduced Administrative Costs: Factoring can lead to cost savings by eliminating the need for in-house collection efforts and reducing administrative overhead associated with managing receivables.

Disadvantages Of Factoring Agreement

Here are some of the drawbacks of a factoring agreement:

Cost Considerations: Factoring services come with fees, which can reduce the overall amount businesses receive from their accounts receivable.

Potential Customer Perception: The involvement of a factor in the collection process may affect how customers perceive the business, potentially impacting customer relationships.

Loss of Control: The factor takes over the responsibility of collecting payments, leading to a loss of control over the direct client relationship and the collections process.

Selective Approval: Factors may choose to approve or reject certain invoices based on their assessment of creditworthiness, limiting the flexibility of businesses in choosing which invoices to factor.

Long-Term Expense: While factoring provides quick cash, the cumulative costs over time may be higher than other financing options, making it less suitable for prolonged use.

Dependency on Client Payments: The factor’s income relies on the timely payments from the business’s clients, introducing an element of risk if clients delay or default on payments.

Creditworthiness Impact: If customers are aware of the factoring arrangement, it could raise questions about the financial stability of the business, potentially affecting its creditworthiness.

Complex Terms and Conditions: Factoring agreements may have complex terms and conditions that businesses need to thoroughly understand, as overlooking details could lead to unforeseen issues.

Factoring Agreement Terms

Entering into a factoring agreement involves understanding several key terms to ensure a smooth and mutually beneficial partnership between a small business and a factoring company.

Notice of Agreement

When a small business signs a factoring agreement, it grants the factor the right to collect the amounts due directly from the clients. This notice of agreement obliges the factor to inform the company’s clients about the payment process being directed to the factoring firm.

Invoice Changes

After selling outstanding invoices to a factoring company, the small business must add a notice to its client’s bills, indicating that the invoices have been sold, and payments should now be made directly to the factor. Any payments made in error to the small company after this transfer must be promptly sent to the factoring firm.

Customer Limit

Factoring agreements typically specify both a total credit line for the small business and a limit per customer. This means the small business cannot utilize its entire credit limit on invoices from a single customer, preventing excessive tying up of funds with one client.

Non-Approved Accounts and Disputes

Before providing factoring services, the factor assesses and approves the creditworthiness of the customer. Disputes between parties may lead to the conversion of an invoice account to a non-approved status. Most agreements allow a certain period for account settlement before declaring it non-approved.

Minimum Annual or Sales Commission

Small businesses should be cautious about the minimum amount they are obligated to pay annually, even if they don’t utilize the services extensively. This part of the agreement needs careful consideration to avoid unexpected financial obligations.

Reserves

Payments made by the company’s clients to the factor are held in escrow in a reserve account. This helps the company track paid, due, or owed invoices, providing transparency in financial transactions.

Warranties and Representations

The factor seeks assurance that the small business operates legally and is financially sound. Warranties or representations are statements made by the company to protect the factor from losses in case of untrue statements or financial instability.

Schedule of Accounts

The factor expects the small business to detail the specific invoices they want to factor, as not all outstanding invoices may be included in the agreement. This schedule helps streamline the factoring process.

Understanding these terms is crucial for small businesses considering factoring agreements, ensuring clarity and effective collaboration with the chosen factoring company.

Factoring Agreement Fees

When engaging with a factoring company, small businesses should anticipate various fees associated with both the commencement and conclusion of the factoring agreement.

Origination/Draw Fees

When initiating a factoring agreement, businesses incur an origination or draw fee. This upfront, flat-rate fee, calculated based on the total facility amount (e.g., ₹2,00,000 with a 1% origination fee equals ₹2000), is paid to the factor at the onset of the agreement.

Factoring Fees

The factor disburses funds for purchased invoices at a discounted fee, encompassing the factoring cost. In addition to this, the factor deducts service charges before advancing the remaining amount to the business.

Monthly/Weekly Fees

Depending on the terms of the factoring agreement, businesses may be required to pay periodic maintenance fees, either on a monthly or weekly basis. The fee structure can vary, with different contracts specifying percentages for different time intervals.

Termination Fees

If a business opts to terminate or discontinue the factoring agreement at any point, it may be subject to termination fees as outlined in the agreement’s terms and conditions.

Understanding these fees is essential for small businesses considering factoring, allowing for informed financial planning and minimizing surprises throughout the course of the agreement.

Important Things to Consider with Factoring Agreements

When delving into factoring agreements, businesses should carefully consider several crucial factors to ensure a beneficial and transparent financial arrangement:

Cost Structure

Understand the fee structure associated with factoring, including discount rates and any additional charges. Clear insight into costs helps in assessing the overall impact on cash flow.

Terms and Conditions

Thoroughly review and comprehend the terms and conditions of the factoring agreement. Pay close attention to factors like contract duration, termination clauses, and any penalties for early termination.

Customer Relationships

Recognize the potential impact on customer relationships. The involvement of a factor in the collection process may influence how clients perceive the business. Evaluate whether this aligns with the company’s customer service objectives.

Creditworthiness of Clients

Factors typically assess the creditworthiness of a business’s clients. Be aware of the criteria used and how this evaluation might affect the approval or rejection of certain invoices.

Notification Processes

Understand the notification processes involved, especially regarding the transfer of invoice payments to the factor. Clear communication with clients about the change in payment details is crucial to avoid confusion.

Flexibility in Funding

Assess the flexibility of the factoring arrangement in accommodating the evolving financial needs of the business. Consider whether the agreement allows for adjustments in the volume of invoices or credit limits.

Minimum Volume Requirements

Some factoring agreements may stipulate minimum volume requirements. Evaluate whether these requirements align with the business’s invoicing patterns and financial capacity.

Recourse vs. Non-Recourse Factoring

Differentiate between recourse and non-recourse factoring. Recourse factoring holds the business responsible for any unpaid invoices, while non-recourse factoring provides protection against client insolvency or non-payment.

Confidentiality of Arrangement

Determine the level of confidentiality maintained in the factoring arrangement. Understand how much information about the financial agreement will be disclosed to clients and other stakeholders.

Exit Strategy

Plan for an exit strategy. Be aware of the steps and potential costs associated with terminating the factoring agreement. Ensure that the agreement allows for a smooth transition if needed.

Careful consideration of these factors empowers businesses to make informed decisions when entering into factoring agreements, fostering a mutually beneficial relationship with the chosen factor while mitigating potential risks.

Final Note

Factoring agreements provide businesses with a valuable tool to boost cash flow, manage liquidity, and navigate financial challenges. By selling outstanding invoices to factors, businesses gain immediate access to funds, streamlining operations and fostering growth. Understanding the terms, fees, and considerations involved is crucial for a successful partnership.

From origination fees to customer relationships, businesses must navigate these aspects strategically. With clear communication, flexibility, and an awareness of potential challenges, businesses can harness the benefits of factoring agreements to optimize their financial health and drive sustained success in a dynamic business landscape.

FAQs

1. How do factoring fees impact the financial reporting when utilizing an invoice factoring facility?

When utilizing an invoice factoring facility, your trade debtors remain as assets on the balance sheet, while funds withdrawn from the facility become a liability. Costs related to the factoring facility are deducted from pre-tax earnings on the Profit and Loss statement, impacting the overall financial picture.

2. Does factoring reduce a company’s profit through percentage charges on invoice amounts?

Factoring can diminish a company’s overall profits as factors typically charge a percentage of the total invoice amount, ranging from 1% to 3%. This deduction, especially significant on larger contracts, contributes to a reduction in the company’s net profit.

Also Read: How Factoring Benefits Manufacturers and Exporters in Apparel Industry