When selling goods internationally, sorting out payment terms can feel like a tough task. Terms like CAD, DP, DA, LC, OA, and Advance Payments might sound like alphabet soup at first, but they hold the key to ensuring your exports reach their destination smoothly and securely.

In this guide, we’re going to break down these terms in plain language, so you can understand not just what they mean, but how they affect your business. Whether you’re a seasoned exporter or new into the global market, having a solid grasp of these terms will empower you to negotiate deals with confidence and avoid any surprises along the way.

So, let’s unravel the mysteries of export payment terms together. By the end, you’ll be armed with the knowledge you need to navigate the world of international trade like a pro. Let’s dive in!

What are Export Payment Terms?

Export payment terms are like the rules of the game in international trade. They decide how the money for goods or services will be paid between the exporter (the seller) and the importer (the buyer). It’s something they agree on together.

When you’re selling stuff overseas, there’s always a risk that you might not get paid. This risk is higher because of the distance and differences in laws between countries. To make things smoother, there are different ways to pay for exports. Some ways are better for the buyer, and some are better for the seller. Which one they choose depends on how they’ve worked together before and how much they trust each other.

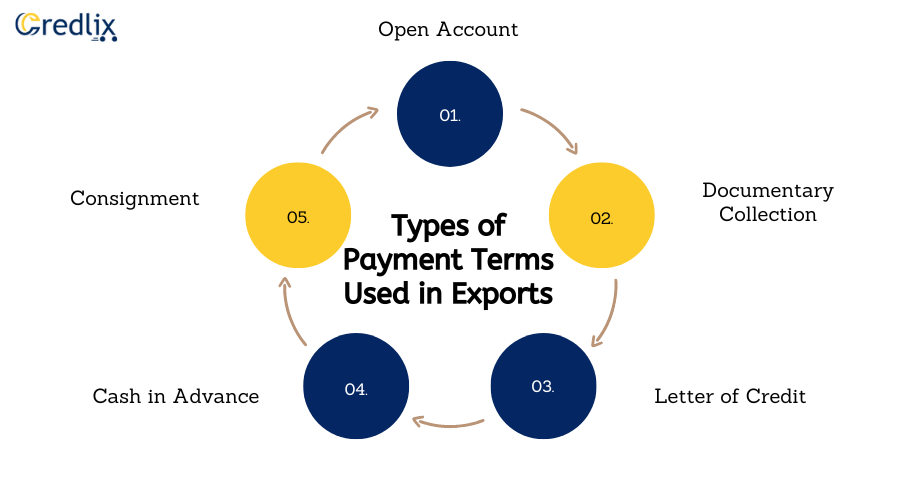

Types of Payment Terms Used in Exports

There are five main types of payment terms used in exports. They are:

- Open Account

- Documentary Collection

- Letter of Credit

- Cash in Advance

- Consignment

Open Account

In open account payment terms within international trade, the buyer accepts delivery of goods from the exporter and then settles the payment after an agreed-upon credit period. This credit period typically spans a fixed duration, such as 30 days, 60 days, or 90 days. During this period, there exists a gap between the receipt of the purchase order and the receipt of payment, with various activities like production and shipping occurring in between.

While this method offers flexibility to the buyer and may foster long-term relationships, it can strain the exporter’s working capital due to the delayed receipt of funds. Despite this, exporters might opt for open account payment terms if the importer is a reliable partner with potential for significant future transactions. Additionally, this method might be chosen based on a trusted relationship between the parties or if the financial risk involved is minimal.

Documentary Collection

In the documentary collection payment method, both the exporter and the importer engage their respective banks to facilitate the transaction. The exporter’s bank, known as the remitting bank, acts on behalf of the exporter, while the importer’s bank, known as the collecting bank, represents the buyer.

After the exporter ships the goods, they provide the shipping documents and a collection order to their remitting bank. The remitting bank then forwards these documents and instructions to the collecting bank. The collecting bank notifies the buyer of the documents and collects payment from them.

Once the payment is received, the collecting bank transfers the funds to the remitting bank, which then releases the documents to the buyer. Documentary collections can be processed either “at sight,” meaning immediate payment, or after a specified period.

There are two types of documentary collections:

a) Cash Against Documents (CAD) or Documents Against Payment (D/P):

In CAD payment terms, the buyer is required to make immediate payment upon presentation of the shipping documents. This payment is made before the buyer’s bank releases the documents, ensuring that the exporter receives payment before the buyer takes possession of the goods.

b) Document Against Acceptance (DA):

In DA payment terms, the buyer agrees to make payment after a specified period upon acceptance of a time draft. Once the buyer accepts the draft, the bank releases the documents, allowing the buyer to take possession of the goods.

Letter of Credit (LC)

A Letter of Credit (LC) is a widely used and secure payment method in international trade. It involves the buyer’s bank issuing a written guarantee, known as the Letter of Credit, to the seller. This letter serves as a promise that the buyer’s payment will be made according to the agreed-upon terms and conditions, providing assurance to the exporter of timely and secure payment.

Cash in Advance

Cash in Advance is widely regarded as the most secure payment method for exporters in international trade. In this arrangement, the exporter ships the goods to the buyer only after receiving payment in full or in part, depending on the agreed terms. Because the buyer bears the majority of the risk in this scenario, many importers are hesitant to agree to cash-in-advance terms.

Consignment

Consignment is a payment method in international trade that operates similarly to an open account. In this arrangement, payment is made to the exporter after the goods have been sold by a foreign distributor to the end customer.

Success in consignment exporting hinges on partnering with reliable and trustworthy foreign distributors or third-party logistics providers. It’s crucial to have adequate insurance to cover consigned goods during transit or while in the possession of a foreign distributor, thereby mitigating the risk of non-payment.

Role of RBI in Export Payment Terms

Understand the role of RBI in export payment terms:

- The Reserve Bank of India (RBI) regulates export payment terms within India.

- RBI establishes guidelines for export financing, specifying permissible financing types and associated terms and conditions.

- It oversees the foreign exchange market to ensure timely payment for exports and maintains adequate foreign exchange reserves.

- RBI has the authority to impose restrictions on export financing to safeguard against foreign exchange shortages and preserve the value of the Indian rupee.

Minimize Credit Risks in Exporting

To minimize credit risks in exporting, consider these points:

- Choose the Right Payment Mode: Opt for safer payment modes like cash in advance over riskier options like open accounts.

- Use Contracts: Draft written contracts to resolve future disputes, and consider credit guarantees from organizations like the Export Credit Guarantee Corporation (ECGC).

- Understand International Norms: Every country has its own business rules, so ensure your export contract aligns with these norms.

- Build Local Networks: Develop contacts in the buyer’s country to facilitate recovery efforts in case of payment defaults.

- Seek Legal Help Wisely: Explore options like international collection agencies or arbitration agencies for cost-effective dispute resolution, reserving legal action for significant disputes.

In conclusion, understanding export payment terms is essential for successful international trade. Whether opting for open account arrangements or utilizing secure methods like Letters of Credit and cash in advance, each option carries its own benefits and risks. By navigating these terms wisely and leveraging resources like the RBI’s guidance and credit risk mitigation strategies, exporters can safeguard their transactions and foster profitable global partnerships.

Also Read: Diverse Types of Export Letters of Credit

In the dynamic world of business, managing finances efficiently is key to ensuring sustained growth and success. One crucial aspect that often takes center stage is the management of receivables – the money owed to your business by customers.

This blog aims to shed light on the strategic use of financing receivables and the impactful practice of vendor financing, offering insights that are both accessible and beneficial to businesses of all sizes.

Financing Receivables:- What is Financing Receivables

Accounts receivable financing is a different way to get money compared to going to a regular bank. Basically, it’s a money move where you borrow cash using the money your customers owe you.

Here’s the deal: if your company is waiting for money to come in, but you need cash ASAP to cover your bills, accounts receivable financing steps in to help. It’s also great for businesses that don’t want to hassle with collecting money from people who owe them. Instead, they can pay a little fee and get the money right away.

In simple terms, it’s like turning the future money you’re expecting into real cash when you need it!

Types of Financing Receivables

Here are different types of financing receivables options that you need to understand:

Collateralized Loan Option

- If you have customers who owe you money, you can use these accounts as collateral for a loan from a financing company.

- When your customers settle their bills, you can use that money to pay off the loan.

Invoice Factoring Option

- Another way is to sell your accounts receivable to a factoring company.

- With a service known as invoice factoring, the factoring company buys your non-delinquent unpaid invoices.

- They pay you an upfront percentage, called the advance rate, of what your customers owe.

- The factoring company then collects payments directly from your customers, and once the accounts receivable are paid, they keep a small factoring fee and give you the remaining balance.

Advantages of Financing Receivables

Understand some of the benefits of financing receivables to help you make a wiser and informed decision:

Upfront Cash for Unpaid Accounts: With receivables financing, you receive immediate funds for invoices that your customers haven’t paid yet. It’s like getting a cash advance based on the money you’re expecting to receive in the future.

Potentially Lower Financing Costs: The financing rate in receivables financing may be more cost-effective compared to other borrowing options such as traditional loans or lines of credit. This can be particularly beneficial for businesses looking to manage their costs while accessing the necessary funds.

Relief from Unpaid Bill Collection: Opting for receivables financing can lift the weight of chasing down unpaid bills from your shoulders. Instead of spending time and resources on collections, a financing company takes on this task. It allows your business to focus on its core activities while ensuring a steady flow of working capital.

Ideal for Cash Flow Challenges: Receivables financing is a great solution for businesses facing cash flow issues. Whether you’re waiting for payments from customers or need quick funds to cover operational expenses, this option provides a flexible and accessible way to address cash flow gaps. It’s suitable for a variety of companies, regardless of their size or industry, offering a lifeline during financially challenging periods.

Disadvantages of Financing Receivables

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Requirement of Outstanding Invoices: To benefit from receivable financing, your business must have outstanding invoices, meaning customers owe you money. This financial option leverages these accounts receivable as assets that can be used to secure a loan or sell to a factoring company.

Importance of Clear Terms for Unpaid Accounts: Keeping clear and accurate records of the terms associated with unpaid accounts is crucial. This includes documenting when payments are expected, the amounts owed, and any specific conditions. Maintaining meticulous records is essential for the smooth process of receivable financing, ensuring transparency and accuracy in the transactions.

Impact of Credit History on Qualification: Qualifying for receivable financing may depend on your business’s credit history. If your business lacks a stable credit history, it could pose a challenge in accessing this form of financing. Lenders or factoring companies often assess the creditworthiness of a business before extending receivable financing. Having a stable credit history enhances your eligibility and may lead to more favorable terms. It emphasizes the importance of maintaining good financial standing to maximize the benefits of receivable financing.

Vendor Financing:- What is Vendor Financing?

Vendor financing, also known as supplier financing or trade credit, is a financial arrangement where a company obtains funding or extended payment terms from its suppliers. In this scenario, the vendor, or the supplier of goods or services, plays a crucial role in providing financial support to the purchasing company.

It’s a smart move when you’re buying a lot of big stuff. If you’re getting things like inventory for a store, computers, vehicles, or machinery, talk to your suppliers about financing deals. It’s like making a deal to pay for these things over time instead of all at once. This helps you avoid running low on cash and gives you the chance to grow your business while paying for the equipment. It’s a win-win!

Also Read : What Is a Vendor? Definition, Types, and Example

Benefits of Vendor Financing

Understand some of the benefits of vendor financing to help you make a wiser and informed decision:

Equipment Purchase without Upfront Payment: One big advantage of vendor financing is that it lets you buy the equipment you need without having to pay for it all upfront. Instead of emptying your wallet in one go, you can work out a deal with your vendor to spread the cost over time. This means you can get essential equipment for your business without a hefty immediate expense.

Preservation of Cash for Emergencies: By using vendor financing, you’re able to keep more cash on hand. This is crucial for dealing with unexpected emergencies or opportunities that may come up in your business journey. Preserving your cash flow provides a financial safety net, allowing you to handle unforeseen challenges without disrupting your day-to-day operations or long-term plans.

Also Read: How to Use Vendor Financing to Buy a Business?

Disadvantages of Vendor Financing

Understand some of the cons of financing receivables to help you make a wiser and informed decision:

Extended Payment Period: One downside of vendor financing is that your payments might stretch out over a long period. While this eases the immediate financial burden, it could mean you’re committed to paying for the equipment over an extended timeframe. This extended payment period may limit your financial flexibility and tie up resources that could be used for other business needs.

Risk of Equipment Retrieval: If you fall behind on your payments, there’s a risk that the vendor could take back the equipment. This is a significant concern because it means not keeping up with your agreed-upon payment schedule could result in losing the very equipment your business relies on. It emphasizes the importance of carefully managing your financial commitments to avoid potential disruptions to your operations.

Distinguishing Accounts Receivables Finance from Accounts Receivable Factoring

Navigating the world of turning accounts receivables into immediate cash flow can be a game-changer for businesses in need of quick funds. While both services share the common goal of providing timely financial solutions, it’s essential to understand their fundamental differences:

Nature of the Transactions

Accounts Receivables Finance (Invoice Financing)

Think of this as a loan. Your business uses its outstanding invoices as collateral to secure a loan. It’s a financial arrangement where you borrow against the money your customers owe you, providing a flexible solution to bridge financial gaps.

Accounts Receivable Factoring

In contrast, factoring involves the outright sale of your receivables. Factoring companies become the owners of the current asset – your unpaid invoices. They pay you a portion upfront (known as the advance), and then they collect the full amount directly from your customers.

Roles of the Service Providers

Factoring Companies

Factoring companies act as buyers of a business’s current assets, taking ownership of the accounts receivable. They assume the responsibility of collecting payments from your customers.

Accounts Receivable Financing Companies

On the other hand, companies providing accounts receivable financing act as financiers or lenders. They extend a loan to your business, using the outstanding invoices as collateral, without taking ownership of the receivables.

Scope of Application

Accounts Receivable Factoring

Factoring is specifically tailored for commercial financing. It is a solution designed for businesses looking to optimize their cash flow by selling their unpaid invoices in commercial transactions.

Final Words

In the world of business, managing finances wisely is the key to success. Whether it’s unlocking cash through accounts receivables financing or securing equipment with vendor financing, these financial tools offer both opportunities and considerations. Accounts receivables financing turns future money into immediate cash, ideal for addressing cash flow challenges.

Vendor financing, on the other hand, lets you spread the cost of essential equipment, preserving cash for emergencies. While each has its advantages, it’s crucial to weigh the pros and cons. Whether you’re considering accounts receivables financing or vendor financing, understanding these financial strategies empowers you to make informed decisions, propelling your business toward sustained growth and financial resilience.

Credlix is becoming a big player in helping businesses with money. We want to make small businesses stronger, so we offer really good financing solutions made just for them.

Also Read : What Is a Vendor? Definition, Types, and Example