Did you know that in the intricate world of international trade and business, a Standby Letter of Credit (SBLC) acts as a financial safety net, providing assurance and trust between parties involved? Let’s embark on a journey to demystify the essence of SBLC, exploring its meaning, the various forms it takes, and the gears that power its operational mechanism.

In the realm of financial instruments, the SBLC emerges as a silent guardian, offering a secure backdrop for transactions, fostering confidence, and ensuring a smooth flow of business dealings.

So, buckle up as we unravel the layers of the Standby Letter of Credit, understanding how it serves as a beacon of financial reliability in the dynamic landscape of global commerce.

What is a Standby Letter of Credit (SBLC)?

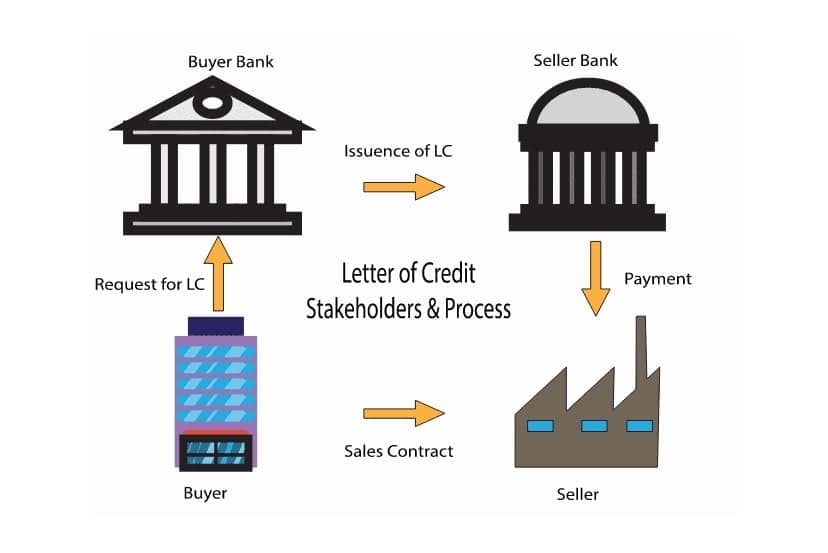

A Standby Letter of Credit (SBLC) is a financial instrument issued by a bank on behalf of a client to guarantee payment or performance if the client cannot fulfill its obligations. It serves as a backup, assuring the beneficiary that they will receive the agreed-upon amount or compensation in case the client fails to meet their contractual or financial commitments.

The SBLC acts as a form of financial assurance, often used in international trade, construction projects, or other business transactions to build trust between parties involved.

What is the Use of Standby Letter of Credit?

The primary use of a Standby Letter of Credit (SBLC) is to provide financial assurance and a safety net in various business transactions. Here are some key purposes and uses of an SBLC:

Payment Guarantee

An SBLC assures a seller or beneficiary that they will receive payment for goods or services, even if the buyer is unable to fulfill their payment obligations.

Bid and Performance Bonds

In construction and project contracts, an SBLC may serve as a bid bond to guarantee that the winning bidder will enter into the contract. It can also function as a performance bond, ensuring completion of the project as agreed.

Trade Transactions

Facilitates international trade by assuring the exporter that they will be paid, and the importer that they will receive the ordered goods in accordance with the terms of the contract.

Real Estate Transactions

Offers protection to parties involved in real estate deals, ensuring that financial commitments are met, and the transaction proceeds smoothly.

Credit Enhancement

Can be used to enhance the creditworthiness of a party, making it easier for them to secure financing or engage in business activities.

Contractual Agreements

Acts as a guarantee in various contractual agreements, providing confidence to both parties and mitigating the risk of non-performance.

Legal and Regulatory Compliance

Helps businesses comply with legal or regulatory requirements that mandate financial assurances in certain transactions.

Default Protection

Protects parties from financial loss in case of default or non-performance by providing a source of funds to cover the agreed-upon amount.

In essence, the use of an SBLC is versatile, providing a valuable tool for businesses and individuals engaged in transactions where a financial guarantee is necessary to build trust and mitigate risks.

Who Issues an SBCL?

A Standby Letter of Credit (SBLC) is issued by a financial institution, typically a bank, on behalf of a client. The issuing bank undertakes the responsibility to pay a specified amount to a beneficiary if the client fails to fulfill their contractual or financial obligations. The SBLC serves as a financial guarantee and is a commitment by the bank to honor the payment or performance requirements outlined in the document.

It’s important to note that the issuing bank, in the context of an SBLC, plays a crucial role in providing credibility and assurance to the parties involved in a transaction. The beneficiary, who is the party receiving the guarantee, relies on the issuing bank’s commitment to ensure that they will be compensated if the client fails to meet their obligations.

The terms and conditions of the SBLC, including the amount, expiration date, and specific requirements for payment or performance, are outlined in the document issued by the bank. The SBLC is a widely used instrument in international trade and various business transactions where a financial guarantee is essential.

Understanding SBLC: Issuing and Costs

To get a standby letter of credit (SBLC), you need to talk to a bank. First, the bank will check if you’re trustworthy to handle this kind of financial arrangement. If the risk or the amount is big, the bank might ask you to provide extra security, like valuable assets.

Once the bank is satisfied with your financial standing and agrees to give you the SBLC, they issue the document. But, remember, it’s not free. The bank charges you a fee, usually between 1% to 10% of the total amount, and you have to pay this fee every year as long as the SBLC is valid. It’s like a small price to ensure things go smoothly in your business deals.

Types of a Standby Letter of Credit

Standby Letters of Credit (SBLCs) come in various types, each serving specific purposes in financial transactions. Here are common types explained along with definitions and examples:

Performance SBLC

Definition: A guarantee ensuring the completion of a contract or project according to agreed-upon terms.

Example: A construction company might provide a Performance SBLC to assure a client that the project will be finished within the specified timeframe and quality standards.

Financial SBLC

Definition: Used to secure repayment of a loan or line of credit, providing a safety net for lenders.

Example: A business obtaining a loan might offer a Financial SBLC as collateral, assuring the lender of repayment even if the borrower faces financial challenges.

Bid SBLC

Definition: Issued to support a bidder in a tender process, ensuring that the winning bidder will fulfill their contractual obligations.

Example: In a government contract bid, a company might present a Bid SBLC to demonstrate their commitment and financial capability to execute the project.

Advance Payment SBLC

Definition: Ensures repayment in case an advance payment is made but the agreed-upon goods or services are not delivered.

Example: A manufacturer receiving an advance payment for a large order might provide an Advance Payment SBLC to assure the buyer that the products will be delivered as agreed.

Counter SBLC

Definition: Used as collateral for another financial instrument, creating a secondary layer of security.

Example: A company might present a Counter SBLC to secure a loan, adding an extra layer of assurance for the lender beyond the primary collateral.

Insurance SBLC

Definition: Provides financial protection in case of specific events, such as non-payment or default.

Example: An exporter might obtain an Insurance SBLC to mitigate the risk of non-payment by the importer, ensuring they receive payment even if the buyer faces financial difficulties.

Understanding the nuances of these SBLC types allows businesses to tailor their financial instruments to specific needs and risk scenarios in various transactions.

Advantages of a Standby Letter of Credit

A Standby Letter of Credit (SBLC) offers several advantages in various business and financial scenarios:

Financial Assurance

- Advantage: Provides a financial safety net for both parties involved in a transaction.

- Example: In international trade, an SBLC assures the seller that they will receive payment, and the buyer is assured that the goods or services will be delivered as agreed.

Risk Mitigation

- Advantage: Helps mitigate risks associated with non-payment, default, or project performance.

- Example: A construction company using an SBLC assures the client that the project will be completed, reducing the risk of financial loss for both parties.

Enhanced Credibility

- Advantage: Bolsters the credibility of the party providing the SBLC, making them more attractive to lenders, suppliers, and business partners.

- Example: A company with an SBLC may find it easier to secure favorable credit terms or attract investors due to the added financial security.

Global Trade Facilitation

- Advantage: Facilitates international trade by providing a standardized and widely accepted instrument.

- Example: Exporters and importers can engage in cross-border transactions with increased confidence, knowing that an SBLC assures payment and delivery.

Flexible Financial Tool

- Advantage: Offers flexibility in structuring financial arrangements and transactions.

- Example: Businesses can use SBLCs in various forms, such as Performance SBLCs for project completion or Bid SBLCs for participating in competitive bidding processes.

Contractual Compliance

- Advantage: Ensures parties adhere to the terms of a contract or agreement.

- Example: In a real estate transaction, an SBLC may be used to guarantee that the buyer makes timely payments, assuring the seller that the deal will be executed according to the agreed terms.

Alternative to Cash Deposits

- Advantage: Acts as an alternative to tying up large sums of cash as collateral.

- Example: Instead of providing a substantial cash deposit for a project, a company can present an SBLC, preserving liquidity for other business needs.

Project Funding Facilitation

- Advantage: Supports project financing by providing assurance to lenders and investors.

- Example: A company seeking funding for a large-scale project may use an SBLC to demonstrate its commitment and financial viability to potential investors or lenders.

Obtaining and Utilizing a Standby Letter of Credit (SBLC) in India

Obtaining a Standby Letter of Credit (SBLC) in India involves a straightforward process. Here’s a step-by-step explanation:

Application

The buyer initiates the process by approaching a bank or financial institution to apply for an SBLC.

Creditworthiness Assessment

The bank assesses the creditworthiness of the buyer, examining financial history, credit reports, and ratings. If there are concerns about the buyer’s ability to fulfill the commitment, the bank may request additional collateral based on the business nature and associated risks.

Submission of Agreement Details

Upon establishing the buyer’s creditworthiness, the bank requests details of the agreement between the buyer and the seller. This includes information such as the seller’s name and address, company details, the SBLC duration, and relevant shipping documents.

Bank Approval and Issuance

Once satisfied with the provided information and background checks, the bank issues the SBLC to the buyer. The bank charges a yearly fee, typically ranging from 1% to 10% of the SBLC amount, applicable for the duration of its validity.

Contract Fulfillment

If the buyer meets the contractual obligations before the due date, the bank terminates the SBLC without additional charges. Upon the buyer’s payment to the seller, the bank concludes the SBLC.

SBLC Activation (if needed)

The SBLC serves as a security against default. If the buyer fails to honor the agreement, the seller submits proofs to the bank. Upon verification, the bank releases payment to the seller. The buyer then repays the bank at a later date with interest.

In essence, the SBLC acts as a safeguard, ensuring that the buyer’s commitments are met. It is a security measure that comes into play only if there is a default, providing a structured and reliable mechanism for international trade transactions.

How Safe is SBLC?

A Standby Letter of Credit (SBLC) is generally considered a secure financial instrument when obtained from a reputable and well-established bank. The safety of an SBLC depends on factors such as the issuing bank’s credibility, the creditworthiness of the applicant, and the clarity of terms and conditions outlined in the document.

Thorough assessments by banks during the application process, adherence to international standards, and the legal enforceability of SBLCs in relevant jurisdictions contribute to their safety. Additionally, the proper use of SBLCs for risk mitigation in international trade enhances their reliability. Parties involved should exercise due diligence, understand the terms, and seek professional advice to ensure the secure and effective utilization of Standby Letters of Credit.

Is SBLC legal in India?

Yes, Standby Letters of Credit (SBLC) are legally recognized and fully operational in India, provided they are issued by banks certified by the Reserve Bank of India. The use of SBLCs in financial transactions is permissible under Indian law, facilitating secure and internationally accepted trade practices.

Is SBLC Transferable?

While a Standby Letter of Credit (SBLC) is transferable in the sense that the beneficiary can sell or assign the rights to the proceeds from the SBLC, it’s crucial to note that the beneficiary retains exclusive authority to demand payment.

In other words, the transferability of an SBLC lies in the beneficiary’s ability to transfer the entitlement to receive funds, but ultimate control over payment remains with the original beneficiary. This feature allows for flexibility in financial arrangements without compromising the security and control inherent in SBLC transactions.

Is it Possible to Cancel an SBLC?

The Standby Letter of Credit (SBLC) is irrevocable, and as such, it cannot be canceled unilaterally. The cancellation of an SBLC requires the consent of all parties involved in the transaction. This irrevocability ensures the commitment and security of the financial instrument, providing assurance to both the issuer and the beneficiary.

Any modifications or cancellations to the SBLC must be mutually agreed upon by all relevant parties, maintaining the integrity of the contractual agreement and safeguarding the interests of those involved in the transaction.

Final Words

In conclusion, the Standby Letter of Credit (SBLC) serves as a critical tool in the realm of international trade and business, acting as a reliable financial safety net. From its diverse applications, such as payment guarantees and bid bonds, to its role in facilitating secure and trustworthy transactions, the SBLC plays a pivotal role in the global commerce landscape.

In India, where it is legally recognized and operational, the SBLC provides a structured and secure mechanism for financial transactions.

While its safety is anchored in factors like the issuing bank’s credibility and adherence to international standards, the SBLC’s versatility and reliability make it an invaluable asset in various business scenarios. The transferability and irrevocability of the SBLC underscore its flexibility and commitment to ensuring financial security. As businesses navigate the complexities of international transactions, the SBLC stands as a steadfast guardian, fostering confidence and ensuring the smooth flow of commerce.