Small and medium-sized businesses (SMBs) are a big part of the American economy. In the US, there are about 30 million SMBs. These businesses have created almost two-thirds of the new jobs in recent years. They are crucial for our economy, helping it grow and providing many people with work.

What is an SMB?

SMBs are businesses that are small or medium-sized based on how much money they make, how many assets they have, or how many employees they hire.

In the U.S., the Small Business Administration (SBA) sets the rules for what counts as a small business. These rules depend on the industry, how much money the business makes in a year, or how many workers it has.

SMBs are very important to the economy, but they are not as big as large global companies. Large companies often need complex systems to manage their finances, supply chains, and other operations.

On the other hand, SMBs usually only need a few systems because they are smaller and can adapt more easily to changes.

Why are SMBs Important?

SMBs are very important for a country’s economy. Here’s how they impact the US economy:

- Most Businesses are SMBs: Over 99% of all businesses in the US are small or medium-sized.

- Big Contribution to the Economy: SMBs produce 43.5% of the total money made in the US each year (this is called the GDP).

- Many Jobs from SMBs: Small businesses provide 39.7% of all the jobs in the private sector in the US.

- Creating Jobs: From 1995 to 2020, small businesses created 4.8 million more new jobs than large companies.

- Flexible and Local: SMBs are often more flexible and adaptable compared to big companies. They usually support local communities and help create a strong sense of community.

In summary, SMBs play a huge role in creating jobs, supporting the economy, and building strong local communities.

Example of a Small Business

Imagine a local bakery called Kiki. It’s a small business with 25 employees and makes $900,000 in revenue each year.

Kiki only sells a few types of baked goods and isn’t known outside the local area. But, in the neighborhood, it’s famous for its delicious items and friendly service.

Kiki’s success comes from focusing on the needs of its local customers and quickly adjusting to what they like and want.

SMBs and Private Equity

Private equity for small and medium-sized businesses (SMBs) means that investors give money to these businesses to help them grow.

This money usually comes from people called venture capitalists, angel investors, or other private investors who are looking to support SMBs.

In return for their investment, these investors often get a share of ownership in the business. This means they own a part of the business and can benefit from its growth.

SMBs and Asset Management

For small and medium-sized businesses (SMBs), managing their assets means handling money and property in the best way possible.

Here’s what SMB asset management involves:

- Managing Portfolios: This means overseeing collections of investments or assets to ensure they are doing well.

- Debt Recovery: If someone owes money, SMB asset managers help to get that money back.

- Training and Advice: They might also teach businesses how to handle difficult financial situations, such as dealing with unpaid debts or finding new funding.

- Investing: SMB asset managers help buy new assets or businesses to invest in, which can help the SMB grow.

In short, SMB asset management is about making sure a business’s money and assets are well looked after and used effectively.

Bank Products for Small and Medium-Sized Businesses (SMBs)

When small and medium-sized businesses (SMBs) need financial help, banks offer different types of products to support them. Here’s a simple guide to these products:

Lines of Credit

- What It Is: A special kind of bank loan for SMBs.

- How It Helps: Gives businesses money they can use as needed, usually for longer periods than other loans. This money can be used to grow the business, invest in new opportunities, or expand operations.

Partial Credit Guarantee Schemes (PCGs)

- What It Is: A program that helps SMBs get loans by assuring the bank that part of the loan will be repaid even if the business cannot pay it all back.

- How It Helps: Makes it easier for SMBs to get loans by reducing the risk for the bank.

Early Stage Innovation Finance

- What It Is: Money given to new or rapidly growing businesses that might not qualify for regular bank loans.

- How It Helps: Supports creative and new ideas, helping these businesses grow despite the higher risks involved.

Bank Small-Business Loans

- What It Is: Loans provided by banks specifically for SMBs.

- How It Helps: Can be used for various business needs. There are two types:

- Secured Loans: Require collateral (something valuable that can be taken if the loan isn’t repaid).

- Unsecured Loans: Don’t need collateral but might have higher interest rates.

SBA Loans

- What It Is: Loans insured by the U.S. Small Business Administration (SBA), which means the SBA helps cover part of the risk for banks.

- How It Helps: Often have lower interest rates and longer repayment periods than regular bank loans. They are used for things like buying equipment, working capital, or real estate.

Long-Term Loans

- What It Is: Loans with repayment terms longer than a year.

- How It Helps: Used for big expenses, like expanding the business or buying property. These loans usually have lower interest rates but may require collateral.

Short-Term Loans

- What It Is: Loans with repayment terms shorter than a year.

- How It Helps: Ideal for urgent needs like paying employees or buying inventory. They are easier to get but usually come with higher interest rates.

Startup Business Loans

- What It Is: Loans specifically for new businesses just starting out.

- How It Helps: Can be used for initial expenses like equipment or marketing. These loans often have higher interest rates and stricter requirements due to the higher risk.

Equipment Financing

- What It Is: A loan to buy or lease equipment for the business.

- How It Helps: Helps businesses get necessary equipment, like machinery or technology, even if they don’t have a lot of collateral.

These banking products provide various ways for SMBs to get the financial help they need, depending on their specific needs and stage of growth.

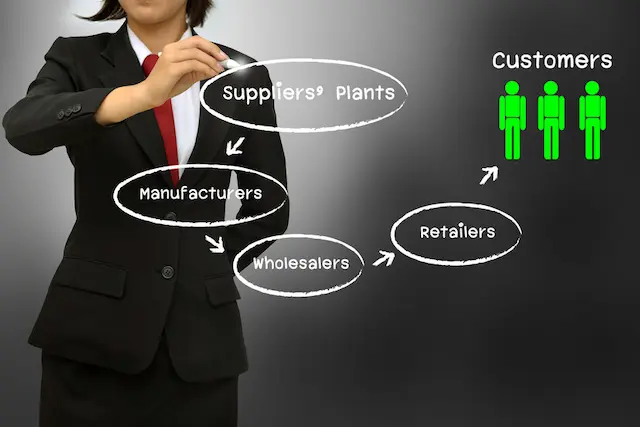

SMBs in the Supply Chain

Small and medium-sized businesses (SMBs) play important roles in the supply chain. They often work as suppliers, vendors, or service providers for larger companies, government agencies, and other organizations.

Here’s how SMBs fit into the supply chain:

- Suppliers and Vendors: SMBs provide products and services to bigger companies. They help keep the supply chain running smoothly by offering goods at competitive prices.

- Service Providers: SMBs also offer specialized services that larger businesses or government agencies need.

By being part of the supply chain, SMBs help keep costs down and encourage healthy competition in the industry.

Clean Financing

What It Is: A clean loan is one where the borrower has always paid back the loan on time and hasn’t had any problems like missing payments or needing special help.

Why It Matters: A clean loan shows a good track record of managing debt, which can make it easier to get new loans or favorable terms in the future.

Three Types of Small and Medium-Sized Businesses (SMBs)

Small and medium-sized businesses (SMBs) come in different sizes. Here’s a simple way to understand the three main types:

Micro Businesses

Micro businesses are the smallest kind of SMBs. They usually have fewer than 10 employees. Often, these businesses are run by their owners and have limited resources.

Examples: A local bakery run by one person with a few helpers, or a small home-based consulting business.

Characteristics:

- Few employees

- Limited resources

- Often managed by the owner

Small Businesses

Small businesses are bigger than micro businesses but still quite modest. They usually have between 10 and 49 employees. These businesses are more organized and have more resources than micro businesses.

Examples: A small retail store, a local restaurant, or a small law firm.

Characteristics:

- More employees than micro businesses

- More organized with a management team

- Might have multiple locations

- Larger customer base

Medium Businesses

Medium businesses are larger and can employ between 50 and 249 people. In the US, the limit can go up to 500 employees. These businesses often have a separate human resources department and a more complex organization.

Examples: A regional chain of grocery stores, a mid-sized manufacturing company, or a larger tech company.

Characteristics:

- Many employees

- More complex structure with departments

- Might operate in different regions or countries

- Offer a wide range of products or services

Medium businesses often have more sophisticated systems for managing their operations compared to smaller businesses. They can handle bigger projects and have a broader market reach.

Understanding these types helps in recognizing the role and needs of different SMBs in the economy.

SMBs in the United States

In the United States, the Small Business Administration (SBA) and the Internal Revenue Service (IRS) use different ways to categorize businesses based on size. Here’s a simple breakdown:

SBA Classification

The Small Business Administration (SBA) is a government agency that helps small businesses. It classifies businesses based on:

- Number of Employees: Businesses with fewer than 10 employees are often called small office/home offices (SOHO).

- Revenue and Industry: The SBA also looks at how much money a business makes and what type of business it is.

SOHO businesses are similar to what the European Union calls small businesses.

IRS Classification

The Internal Revenue Service (IRS) has its own way of classifying businesses for tax purposes. Here’s how the IRS defines businesses:

- Small Businesses: These are businesses with assets (total value of everything they own) of $10 million or less.

- Large Businesses: These have assets greater than $10 million.

- Self-Employed People: The IRS also considers self-employed individuals separately from small and large businesses.

The SBA’s focus is on helping small businesses grow and succeed, while the IRS uses these classifications mainly for tax reporting and regulation.

Understanding these classifications helps in recognizing the different types of SMBs and their roles in the economy.

Also Read: 4 Types of Export Financing for Small Businesses

Conclusion

Small and medium-sized businesses (SMBs) are essential to the American economy. They create jobs, support local communities, and drive economic growth. Understanding the different types of SMBs and how they are classified helps us see their importance. From small local shops to medium-sized companies, SMBs play a key role in our everyday lives. By knowing the financial tools available, like loans and lines of credit, SMBs can better manage their growth and succeed. Overall, SMBs are the backbone of our economy, making it stronger and more vibrant.

Also Read: Top Export Finance Options for Small Businesses