The HSN Code for construction work is categorized as a service and is labeled as 9954. This code specifically covers various services related to the construction, installation, repair, maintenance, and renovation of buildings or civil structures.

For more detailed classification, an additional 2 to 4 digits can be added as a suffix to the HSN/SAC code. It’s important to note that although construction works are considered services and are supposed to have a SAC code, the term “HSN code” is commonly used in practice, even for services under GST. However, you may not find these codes in the GST HSN Code search tool on the GST portal.

What is Construction as per GST?

In the realm of India’s Goods and Services Tax (GST), “construction” is seen as a service. As per the Central Goods and Services Tax Act (CGST Act), construction involves creating a complex, building, structure, or a portion of it, either wholly or partially, with the intention of selling it. This explanation is outlined in Schedule II of the CGST Act, defining the scope of construction as a service under the GST framework in India.

Also Read: HSN Codes: What You Need to Know for Trade and Taxation

What is the HSN Code and SAC in GST?

In the world of India’s Goods and Services Tax (GST), two important codes play a key role in sorting and identifying goods: the Harmonized System of Nomenclature (HSN) code and the Service Accounting Code (SAC). These are numerical codes that give each item a unique identity for tax purposes. Think of them like secret ID numbers for goods!

The HSN code is like a magic number for products in GST. It’s a 6-digit code, but sometimes it can stretch to 8 digits for super-detailed classification. This code is a must-have on the GST invoice. It’s like the tag on your favorite shirt, telling you what it’s made of and where it belongs.

Now, let’s break down the HSN code. Take the code “8703” for example. The first two digits, “87,” tell us it’s in the chapter of vehicles. Then, the next two digits, “03,” narrow it down to motor cars and other motor vehicles. It’s like a secret language that helps everyone understand what the product is all about.

On the other side of the coin, we have the SAC, or Service Accounting Code. This one is for services. While the HSN code is for goods, the SAC code is for all the cool services out there. It’s a numerical ID that helps in sorting and classifying services under GST.

Both these codes are like superheroes helping out in the world of taxes. They bring order and structure, making it easier for businesses to follow the GST rules. So, next time you see those mysterious numbers on an invoice, know that they are the HSN and SAC codes, quietly doing their superhero duty in the world of taxes!

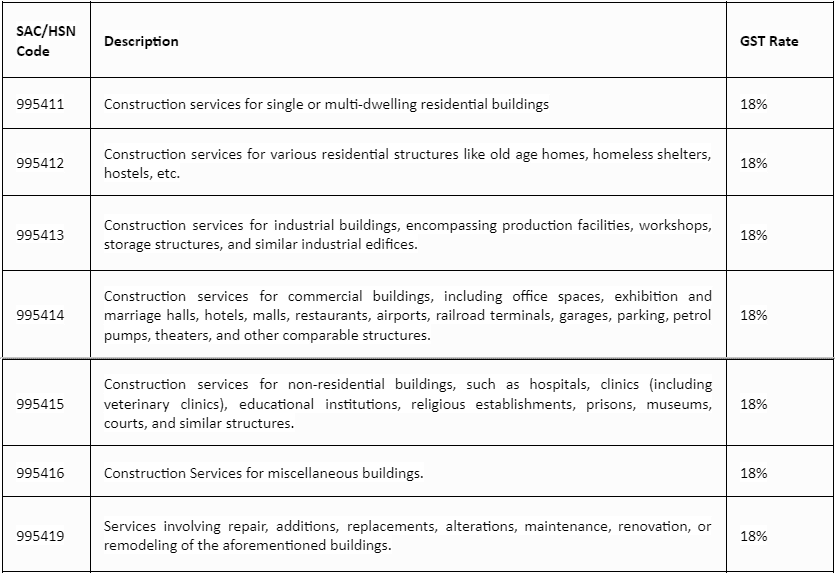

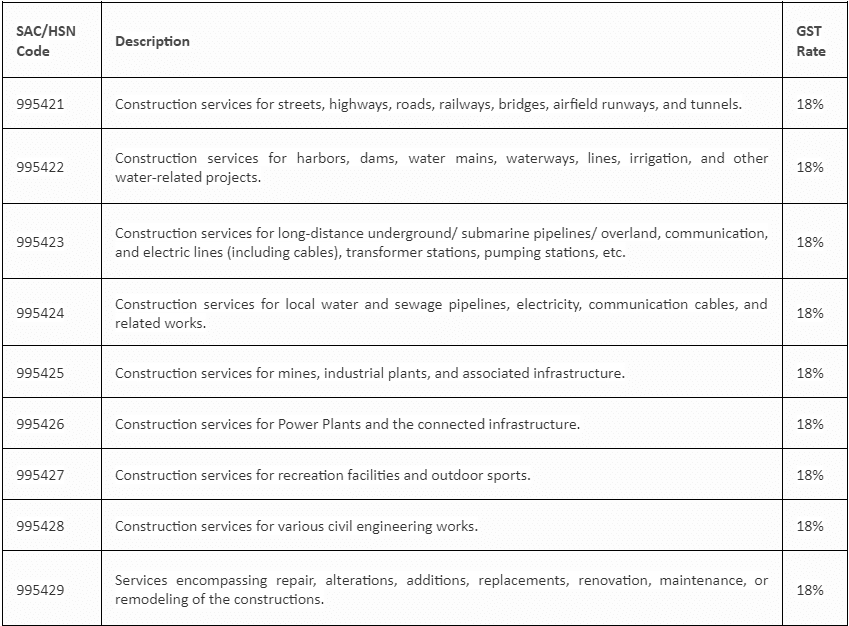

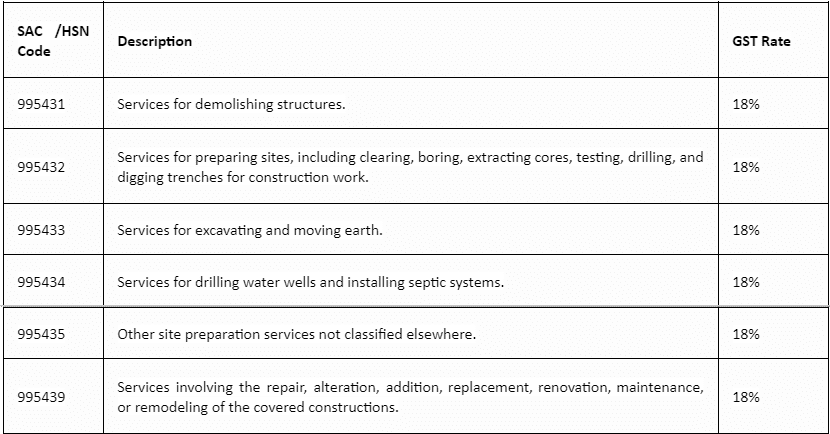

Construction Services SAC/HSN Codes and GST Rates Guide

SAC codes, descriptions, and GST rates for a variety of construction services and related activities.

HSN Code for Building Construction

General Construction Services of Civil Engineering Works

SAC/ HSN Code for Site Preparation Services

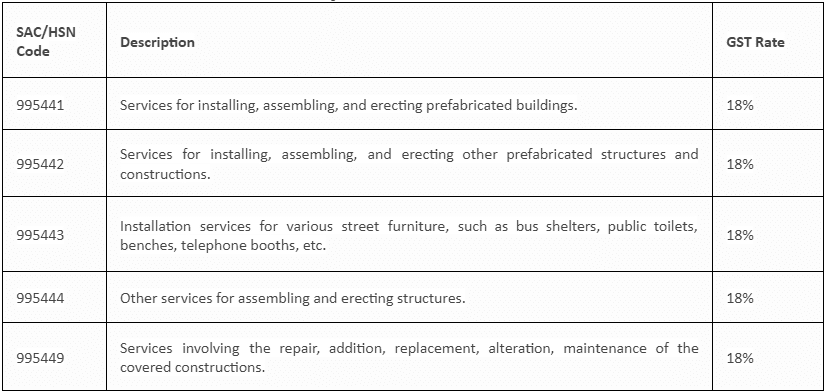

SAC/ HSN Code for Assembly and Erection of Prefabricated Constructions

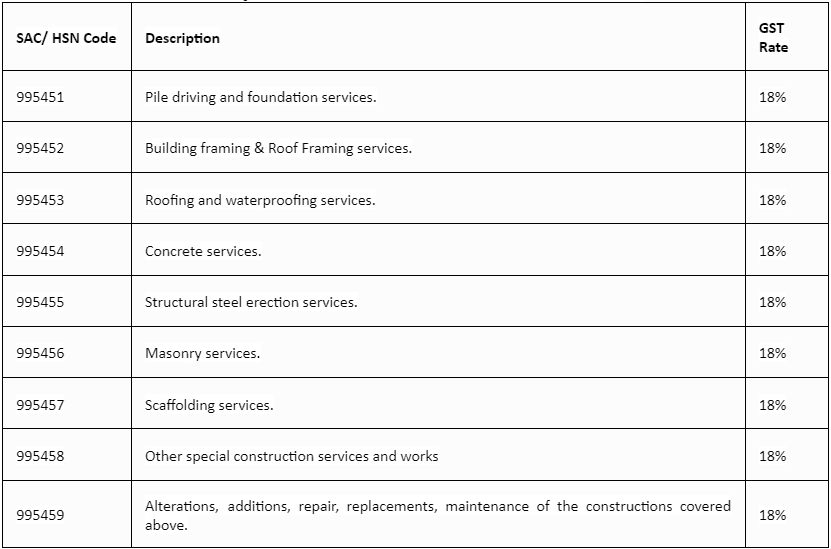

SAC/ HSN Code for Special Trade Construction Services

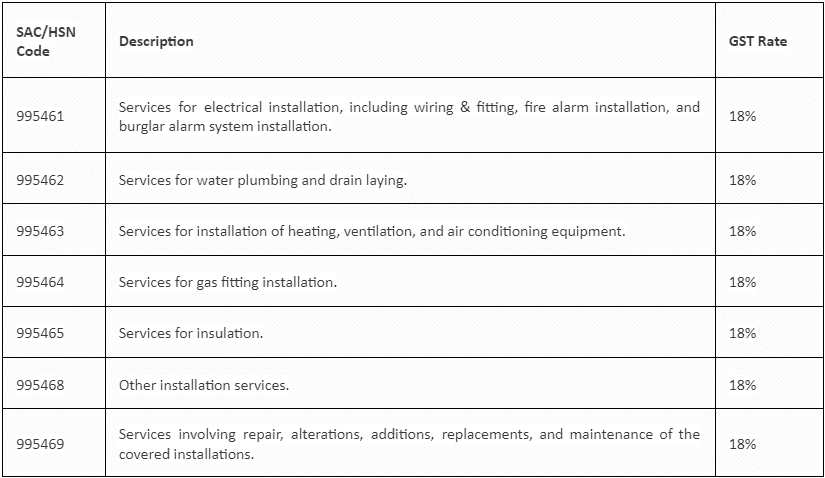

SAC/ HSN Code for Installation Services

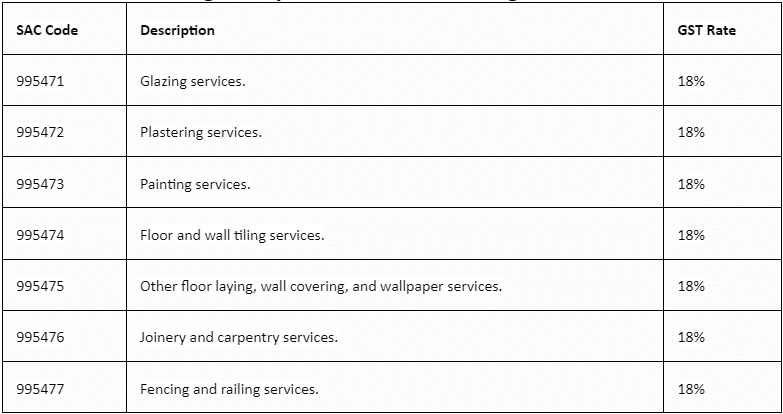

SAC Code Building Completion and Finishing Services

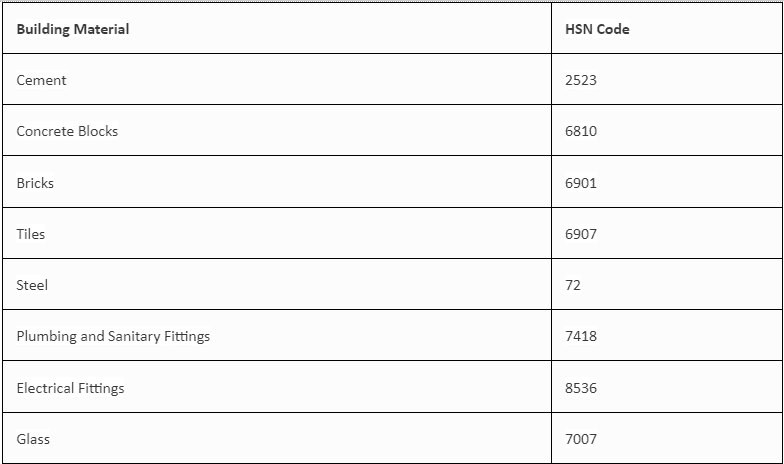

HSN Code for Building Construction with Material

The HSN Code for building construction with materials is 9954. If you’re making bills for job work, it’s important to break down the construction and material portions separately. In simple terms, HSN code 9954 covers all kinds of building and construction work. Adding two more digits at the end gives specific details for different types of construction. Using these codes correctly helps make sure your invoices are accurate, taxes are right, and you’re following the GST rules properly.

Final Words

To wrap it up, HSN and SAC codes are vital tools for navigating GST in construction. HSN Code 9954 is your go-to for diverse construction works, with added digits for specific details. Getting these codes right ensures accurate invoices, seamless taxation, and compliance. Whether it’s general construction, site prep, or installation services, these codes act as your GST superhero guide. So, decode your tasks, apply the right codes, and sail through the world of GST with ease!

FAQs

What HSN code applies to construction?

The HSN code for construction is 9954. You can add two more digits as a suffix for a more specific classification of the type of construction work.

What does HSN code 995421 mean?

HSN code 995421 specifically covers the construction of roads, runways, railways, tunnels, and bridges.

What’s the 6-digit HSN code for construction service?

The 6-digit HSN code for construction service is 9954. The last two digits give details about the specific type of construction. For instance, 995411 is for construction services related to single or multi-dwelling residential buildings.

What’s the GST rate for construction services?

The GST rate for construction services is 18%. However, for works contract services where the contractor supplies the material, the GST rate is 12%.

Also Read: Demystifying HSN Codes: Impact on Your Business and Its Significance