Did you know that after the COVID-19 pandemic shook things up, businesses faced a huge money challenge? It was like a financial rollercoaster! But guess what? There’s a hero in the story – it’s called channel financing.

During the pandemic, our global supply chains got seriously mixed up. Things got tough, and businesses needed a money friend to help them out when times got rough. That’s where channel financing stepped in – like a buddy lending a hand in tough times.

In this adventure, we’ll uncover the ways channel financing is quietly making a big difference. From helping businesses stay strong to making sure everyone works together, and even using advanced technology, channel financing is like a much-needed aid in the post-COVID comeback story. So, be ready as we explore how channel financing is making the world a safer and better place after the wild ride of COVID-19!\

The World Post-Covid

In the past few months, lots of companies that make things (we call them OEMs) have been fast to change direction. They’ve come up with new or better technology because of the COVID-19 situation. Some of these ideas include better computer stuff for working from home, machines that check your temperature and make sure you’re wearing a mask at work without touching you, and even robots that use UV light to clean things up. They’re finding smart ways to deal with the challenges from the pandemic!

With everything becoming smarter, the money dynamics is no exception.

What is Channel Financing

Channel financing is a financial arrangement that involves providing funds to businesses involved in a supply chain. This funding typically targets suppliers, distributors, and other intermediaries, helping them manage their working capital and cash flow effectively.

The goal of channel financing is to strengthen the entire supply chain by ensuring that each participant has the necessary financial resources to operate smoothly.

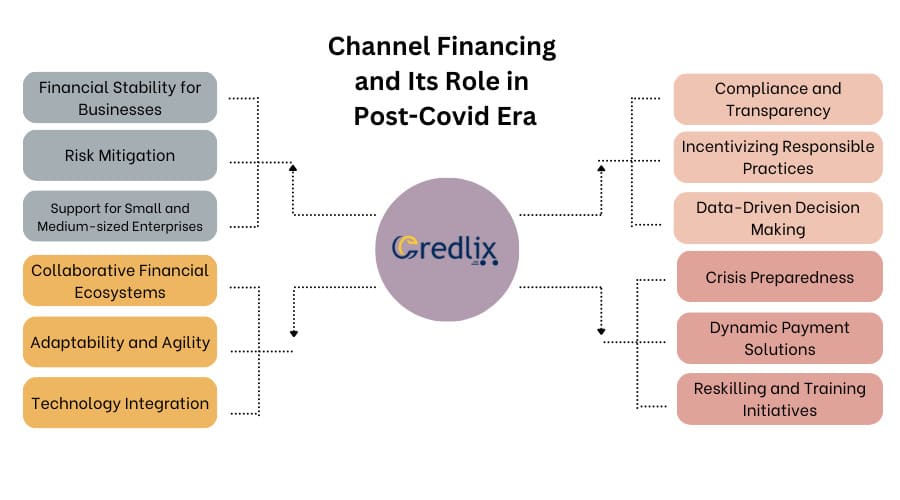

Channel Financing and Its Role in Post-Covid Era

Here are several ways in which channel financing contributes to a stronger world post COVID pandemic:

Financial Stability for Businesses

Channel financing provides businesses with working capital, helping them maintain financial stability during challenging times. This is particularly important post-COVID, as many businesses have faced disruptions and financial strains.

Risk Mitigation

Channel financing helps mitigate risks in the supply chain by ensuring that suppliers and distributors have the necessary financial resources. This resilience is crucial in the aftermath of the pandemic, where disruptions have highlighted the vulnerabilities of global supply chains.

Support for Small and Medium-sized Enterprises (SMEs)

SMEs, which form a significant portion of various supply chains, may face difficulties accessing traditional financing. Channel financing provides them with the financial support needed to recover and grow post-COVID.

Collaborative Financial Ecosystems

Channel financing fosters collaboration among various stakeholders in the supply chain, including manufacturers, suppliers, and distributors. This collaborative approach enhances communication and support, contributing to a safer and stronger ecosystem.

Adaptability and Agility

Channel financing often offers flexible financing solutions tailored to the specific needs of businesses. This adaptability is crucial in a post-COVID world, where uncertainties and changes in market dynamics require businesses to be agile in their financial strategies.

Technology Integration

The integration of digital platforms in channel financing facilitates faster and more transparent transactions. This technological advancement enhances efficiency and reduces the administrative burden, enabling businesses to focus on recovery and growth.

Compliance and Transparency

Channel financing solutions often incorporate compliance measures to ensure that financial transactions adhere to regulatory standards. This transparency is vital in building trust and stability in the post-COVID business environment.

Incentivizing Responsible Practices

Channel financing can be structured to encourage responsible business practices, including environmental sustainability and social responsibility. This aligns with the growing importance of ESG considerations in the post-COVID era.

Data-Driven Decision Making

Many channel financing solutions incorporate data analytics tools that provide valuable insights into financial transactions and supply chain performance. Data-driven decision-making becomes essential for businesses adapting to the evolving post-COVID landscape.

Crisis Preparedness

Emergency funding options. Channel financing can include provisions for emergency funding to address unforeseen crisis. This ensures that businesses are better prepared to navigate challenges and uncertainties that may arise in the post-COVID world.

Dynamic Payment Solutions

Channel financing solutions often integrate with digital payment platforms, providing businesses with dynamic and efficient payment solutions. This contributes to a faster and more streamlined financial ecosystem.

Reskilling and Training Initiatives

Channel financing can be utilized not only for financial purposes but also to support initiatives such as reskilling and training programs. This investment in human capital is crucial for businesses looking to adapt to changing market demands and technological advancements in the post-COVID era.

Channel Financing and Credlix

If businesses want to try out new ideas, Credlix is here to help makers, sellers, and dealers. Credlix can give money to makers or sellers for projects through channel financing. This way, sellers can start their projects without waiting.

Credlix pays the maker or seller, which keeps their money safe, lowers risks, and takes care of the money stuff. Also, for sellers, Credlix can give more time to pay, so they have enough time between getting money from customers and paying the maker. It’s like a money helper for everyone!

Final Words

So, there you have it – the superhero in the post-COVID story is channel financing! It’s like a money friend for businesses, helping them stay strong and work together smoothly. With its superpowers like financial stability, risk reduction, and support for small businesses, channel financing is making our world safer and better after the bumpy ride of COVID-19.

By using smart technology and encouraging responsible practices, it’s like a sidekick for businesses, ensuring they’re prepared for any challenges that come their way. So, as businesses and the world keep getting smarter, channel financing is right there, making everything better!

FAQs

What is channel financing?

Channel financing is a financial setup that provides funds to businesses in a supply chain, ensuring smooth operations and financial stability.

How does channel financing support small businesses?

Channel financing offers vital financial support, particularly for small businesses, helping them recover and grow after the challenges of the COVID-19 pandemic.

Can channel financing help during crises?

Absolutely! Channel financing includes emergency funding options, ensuring businesses are better prepared to navigate unforeseen challenges and uncertainties.

How does technology play a role in channel financing?

Technology integration in channel financing, such as digital platforms, enhances efficiency, reduces paperwork, and provides real-time visibility into transactions.

Is channel financing only for big businesses?

No, it benefits businesses of all sizes. Channel financing supports small and medium-sized enterprises (SMEs), providing them with the financial resources needed for recovery and growth.

How does channel financing contribute to supply chain resilience?

By mitigating risks in the supply chain, channel financing ensures that suppliers and distributors have the necessary financial resources, contributing to overall supply chain resilience.

What role does data-driven decision-making play in channel financing?

Data analytics tools in channel financing provide valuable insights into financial transactions and supply chain performance, enabling businesses to make informed, data-driven decisions.

How does channel financing promote responsible business practices?

Channel financing can be structured to encourage responsible practices, including environmental sustainability and social responsibility, aligning with the growing importance of ESG considerations in the post-COVID era.