Did you know that efficient supply chain management can lead to a 15-20% reduction in overall business costs? It’s a compelling fact that underscores the crucial role of supply chain optimization in today’s competitive business landscape. Now, imagine adding a financial ally to this equation.

Enter channel financing – a game-changer in the world of supply chain dynamics. In the intricate dance of commerce, where businesses rely on a synchronized flow of goods and services, channel financing emerges as the unsung hero, offering strategic financial support.

Let’s delve into how channel financing can be your secret weapon, empowering you to not just navigate but excel in the complexities of modern supply chain management.

What is Channel Financing?

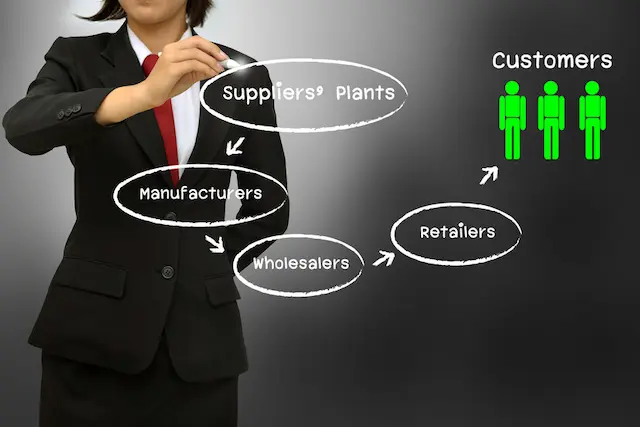

Channel financing, also known as supply chain financing, is a financial arrangement that involves providing funding and support to businesses involved in a supply chain. It’s a strategic method to optimize cash flow and enhance collaboration among various entities within the supply chain network.

In simpler terms, channel financing is like a financial support system for companies that operate together in a supply chain. It helps them manage their money more efficiently, ensuring that everyone in the chain has the financial resources they need. This kind of financing often involves a third-party financial institution that steps in to provide funds or other financial services, creating a more stable and efficient environment for businesses working together in the supply chain. Channel financing is a valuable tool for ensuring smooth operations, fostering collaboration, and gaining a competitive edge in the dynamic business landscape.

Ways in Which Channel Financing can Effectively Optimize Your Supply Chain Management

Explore the benefits of embracing channel financing to achieve a streamlined and successful approach to managing your supply chain-

Improved Inventory Management

Channel financing plays a pivotal role in advancing inventory management by promoting better control and optimization. Through this financial mechanism, businesses can achieve precision in maintaining optimal stock levels, effectively mitigating the risks associated with excess or insufficient inventory.

The infusion of timely funds enables a seamless flow in the supply chain, allowing for agile responses to demand fluctuations. This not only enhances operational efficiency but also contributes to cost-effectiveness.

Ultimately, improved inventory management, facilitated by channel financing, becomes a strategic asset for businesses seeking to navigate the complexities of supply and demand with precision and financial acumen.

Enhanced Cash Flow

Channel financing acts as a financial boost that ensures a steady and robust cash flow for businesses. This support comes just in time, preventing interruptions in the smooth flow of supply chain operations. With timely financial aid, companies can meet their financial needs without hiccups, ensuring they have the funds required to keep things running seamlessly.

This enhanced cash flow not only helps in paying bills and meeting expenses promptly but also provides the flexibility to seize new opportunities or navigate unexpected challenges. In simple terms, channel financing becomes the reliable financial backbone that keeps the wheels of the supply chain turning without disruptions.

Support for Growth

Channel financing serves as a key driver for business growth by offering access to extra capital. This financial support empowers companies to spread their wings, expanding operations and venturing into new markets. With the flexibility that comes from channel financing, businesses can seize opportunities that lead to overall expansion and development.

Whether it’s investing in new technologies, reaching more customers, or optimizing processes, the additional capital becomes a catalyst for sustained growth. In simpler terms, channel financing acts like a financial springboard, enabling businesses to take bold steps forward, explore new horizons, and propel themselves towards long-term success.

Strengthened Collaboration

Channel financing goes beyond financial transactions; it builds robust partnerships between suppliers and buyers, creating a foundation for mutual success. By facilitating easy and effective communication, it nurtures collaboration between the two parties.

This collaboration isn’t just about transactions; it’s about understanding each other’s needs and working together towards shared goals. With channel financing, suppliers and buyers develop a sense of trust and reliability, knowing that they can depend on each other.

This strengthened collaboration is not only good for business but also creates a supportive network where both parties thrive. In simpler terms, channel financing is like a bridge that connects suppliers and buyers, fostering a relationship that benefits everyone involved.

Cost-Efficient Operations

Affordable financing options provided by channel financing play a key role in helping businesses handle their day-to-day costs more efficiently. This, in turn, contributes to making the entire supply chain more cost-effective. Imagine it as getting a good deal on your money – businesses can access the funds they need without breaking the bank.

By managing operational costs wisely with this affordable financing, companies can optimize their spending, allocate resources judiciously, and ultimately operate in a way that makes the most financial sense. In simpler terms, channel financing acts as a money-saving tool, ensuring that businesses can keep things running smoothly without overspending.

Mitigation of Supply Chain Risks

Channel financing acts as a safety net for businesses, especially when unexpected challenges hit the supply chain. It’s like having a financial superhero that steps in during tough times. When disruptions happen, like delays or unexpected expenses, channel financing provides stability and support. It’s a bit like having an emergency fund for the supply chain.

This financial support ensures that operations can continue smoothly even when things get tough. So, if there’s a hiccup in the supply chain, channel financing is there to help businesses stay on track, ensuring they can navigate through uncertainties without major setbacks. In simpler terms, it’s a reliable financial backup that keeps things running, no matter what surprises come along.

Improved Supplier Relationships

Building good relationships with suppliers is like having strong teamwork in a sports game. Timely payments and financial support, thanks to channel financing, are the MVPs that make this teamwork shine. Imagine you’re in a team, and everyone plays their part well – that’s what happens when businesses make payments on time and offer financial support to their suppliers.

It creates a positive vibe in the supply chain network, encouraging trust, reliability, and loyalty. It’s a bit like saying, “You can count on us, and we can count on you.” This positive relationship is a win-win, making sure everyone in the supply chain game is on the same winning team.

Flexibility in Payment Terms

Channel financing brings a bit of flexibility to the financial game, especially when it comes to paying the bills. It’s like having options in a game – you can choose what works best for you. With channel financing, businesses and their suppliers can decide on payment terms that suit everyone involved. It’s a bit like finding the right rhythm in a dance – each partner can move comfortably.

This flexibility promotes financial agility, allowing businesses to adapt their payment plans to fit their unique needs and circumstances. It’s like saying, “Let’s find a payment dance that works for both of us,” making the financial steps in the supply chain a lot smoother and more harmonious.

Efficient Working Capital Management

Think of working capital as the fuel that keeps the supply chain engine running smoothly. With channel financing, businesses can become expert drivers, making sure they use this fuel efficiently. It’s a bit like budgeting for a road trip – you want to make sure you have enough money for gas, snacks, and unexpected detours. Channel financing helps businesses allocate their working capital strategically, ensuring it goes where it’s needed most in the supply chain.

This strategic use of funds means that operations run like a well-oiled machine, with each part of the supply chain getting the right amount of financial support. So, it’s not just about having money; it’s about using it wisely for a smooth journey.

Streamlined Documentation Processes

Imagine paperwork becoming a breeze instead of a headache – that’s what happens with channel financing. The financing process acts like a helpful assistant, making documentation a whole lot simpler. It’s like having a magic wand that reduces the paperwork stress. By simplifying the documentation steps, businesses can wave goodbye to unnecessary administrative burdens.

It’s a bit like upgrading from an old computer to a super-fast one – everything becomes quicker and more efficient. With streamlined documentation processes, the supply chain management becomes a well-organized symphony, with each note (or document!) playing its part seamlessly. So, thanks to channel financing, businesses can enjoy a smoother and more efficient journey in the world of paperwork.

Competitive Advantage

Picture channel financing as a secret weapon in a business’s toolkit, giving it a special advantage in the market. It’s like having a superhero cape that helps businesses adapt quickly to changes in the market. With channel financing, businesses become agile, able to adjust their strategies swiftly. It’s a bit like being the first to spot a treasure on a treasure hunt – businesses can seize emerging opportunities before others do.

This competitive edge means that businesses are not just keeping up with the market; they’re one step ahead. So, leveraging channel financing is like having a strategic ally that ensures businesses not only survive but thrive in the ever-changing landscape of the business world.

Consider partnering with fintech leaders like Credlix, known for their expertise in delivering swift and comprehensive cash flow solutions. Optimal for suppliers facing financial constraints, Credlix excels in providing cash availability within a remarkable timeframe, ranging from 24 to 72 hours*.

By leveraging such fintech solutions, you position yourself to maximize the benefits offered by channel financing, making it a strategic and efficient tool in your supply chain management arsenal.

Final Words

So, think of channel financing as your business sidekick, making things run smoother in the world of buying and selling. It’s like having a helpful friend that brings money to the table exactly when you need it. From making sure you have just the right amount of stuff in stock to paying the bills on time, channel financing has your back. And guess what? It doesn’t stop there – it helps your business grow and stay ahead of the game. Imagine it as a secret power that makes your business life easier, like having a superhero cape for your company. So, in this big world of business, let channel financing be your sidekick, turning challenges into successes.