If you’re in the market for air conditioning machines, understanding the Goods and Services Tax (GST) rates and Harmonized System of Nomenclature (HSN) codes can make your shopping experience a breeze. GST rates determine the amount of tax applicable to air conditioning units, while HSN codes help classify them for easier identification during transactions.

Understanding GST rates and HSN codes may seem daunting at first, but fear not! We’re here to break it down for you in a simple and easy-to-understand manner.

Firstly, GST rates for air conditioning machines can vary depending on factors such as their capacity and intended use. By knowing the applicable GST rates, you can better estimate the total cost of your air conditioning purchase.

Additionally, HSN codes provide a standardized way to classify air conditioning machines based on their characteristics and features. This makes it easier for businesses and consumers alike to find the right products and ensure accurate tax calculations during transactions.

So, whether you’re a homeowner looking to beat the heat or a business owner upgrading your cooling systems, understanding GST rates and HSN codes for air conditioning machines can help you make informed decisions and breeze through your shopping experience.

GST on Air Conditioners

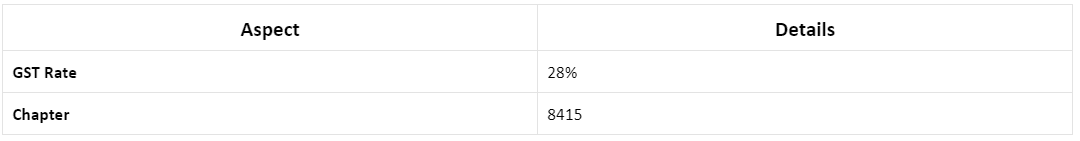

The Goods and Services Tax (GST) on air conditioners is currently set at 28%, the highest tax rate. While GST lowered taxes for many electronic items, air conditioners remained at this rate. This decision aimed to maintain tax levels for certain goods like air conditioners and large screen TVs, despite reductions in other areas.

However, at the 56th Meeting of the GST Council of India, major reforms were announced, including a reduction in the tax rate from 28% to 18% on Air Conditioners to boost affordability.

Impact of GST on Air Conditioner Prices

Before the implementation of GST on air conditioners, consumers encountered a tax structure comprising Value Added Tax (VAT) and excise duty. This pre-GST taxation varied between 23% to 27%, contingent on the respective state’s regulations. However, with the introduction of GST, air conditioners were categorized under the 28% tax slab. Consequently, companies passed this additional tax burden onto consumers, resulting in a price hike ranging between 1% to 5%. Essentially, while the transition to GST aimed at simplifying the tax structure, the specific tax rate adjustment impacted the affordability of air conditioners for consumers, albeit marginally.

For instance, if an air conditioner was priced at Rs. 30,000 pre-GST, its post-GST price could range from Rs. 30,300 to Rs. 31,500. While GST aimed to simplify taxation, this adjustment impacted air conditioner affordability marginally.

GST on Air Conditioners & Tax Rates

The Goods and Services Tax (GST) applies to a wide range of electronic goods, including air conditioners. Under GST, there are four main tax rates: 5%, 12%, 18%, and 28%. Essential goods fall under the 5% tax rate, while standard rates range from 12% to 18%. Luxury items are taxed at 28%, and air conditioners are categorized as such.

However, as climate changes and temperatures rise, air conditioners have transitioned from being considered a luxury to becoming a necessity in many Indian cities. Despite this shift in perception, they continue to be taxed at the luxury rate of 28% under GST regulations.

Total Value for GST on Air Conditioners

In GST, supply covers all sorts of transactions like sales, exchanges, rentals, and more. The value of supply equals the transaction value, which is basically the price paid or payable for the goods or services.

Now, let’s talk about air conditioners. Often, when you buy an air conditioner, the seller also provides installation services. This means that both the air conditioner and its installation are bundled together as a package. This is called a composite supply. The main item here is the air conditioner, and the installation charges come along with it. So, to figure out the value of supply for GST, you just add the selling price of the air conditioner to the installation charges. Easy, right?

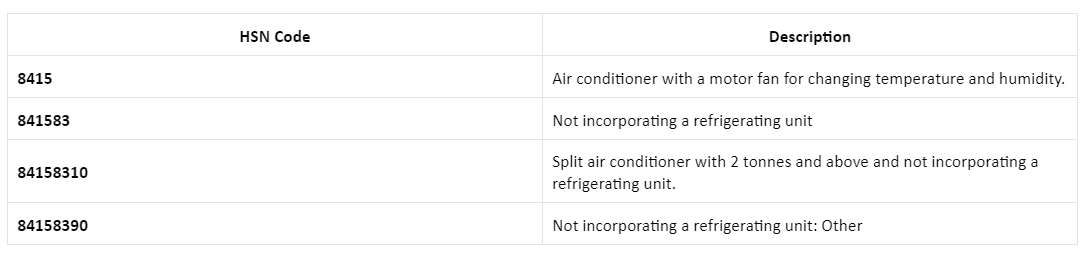

GST Rate and HSN Code Breakdown for Air Conditioners

Here’s a table representation of the GST rate and HSN code breakdown for Air Conditioners:

Input Tax Credit (ITC) Availability and Reversal Guidelines for Air Conditioners under GST

Under GST, businesses can claim Input Tax Credit (ITC) on goods and services used for furthering their business activities. However, Section 17(5) of the GST Act restricts ITC on goods or services used for constructing immovable property, excluding plant and machinery, for business purposes.

Air conditioners, despite being affixed to walls, are not considered immovable property as they can be detached and relocated. Centralized AC systems are categorized as plant and machinery, exempt from Section 17(5) restrictions. To ensure eligibility for ITC, businesses must separately account for the cost of air conditioners as plant and machinery, distinct from building costs.

ITC is available for air conditioners installed in offices or factories for business use. However, if the supply includes both taxable and exempt goods, ITC reversal must be performed according to CGST Rules, specifically Rule 42 and Rule 43.

GST and Import Duty Structure for Air Conditioner Imports

The government imposes high import duties on air conditioners to boost sales of domestically manufactured products. The government imposes high import duties on air conditioners to boost sales of domestically manufactured products.

Taxes applicable to air conditioner imports include:

- Basic customs duty is set at 20% of the assessable value.

- IGST is imposed at 28% of the assessable value plus basic customs duty.

- Social welfare surcharge is levied at 10% of the assessable value, basic customs duty, and IGST amount combined.

Please Note: No GST Exemptions for Air Conditioner Sales. In the current scenario, there are no exemptions granted under GST for the sale of air conditioners. All sales of air conditioners are subject to GST taxation without any exemptions.

Under the previous VAT regime, air conditioners incurred taxes ranging from 12.5% to 14.5%, coupled with 12.5% excise duty and cess, totaling a maximum of 27%. Transitioning to GST saw air conditioners categorized under the 28% tax slab, resulting in higher product prices.

However, there are benefits. Manufacturers and dealers can now claim Input Tax Credit (ITC) on raw materials, eliminating tax cascading. Despite this, placing air conditioners in the 28% tax bracket suggests they’re still deemed luxury items rather than necessities. Consequently, the increased tax rates and growing inflation are likely to further inflate air conditioner prices.