Anti-dumping (AD) and countervailing duties (CV) are import duties designed to address unfair trading practices and protect domestic industries from the negative impacts of dumped or subsidized imports. Dumping occurs when foreign manufacturers sell goods in a foreign market at prices lower than their home market or below production costs, leading to unfair competition and potential harm to local businesses. Countervailing duties, on the other hand, are imposed to offset subsidies provided by foreign governments to their industries, leveling the playing field for domestic producers.

These duties are not unique to the United States; many countries around the world have similar mechanisms in place to safeguard their industries. Typically, government agencies such as the Department of Commerce in the US or relevant ministries in other countries handle the administration and enforcement of these laws. By imposing AD and CV duties, governments aim to promote fair competition, protect local businesses, and ensure a level playing field in the global marketplace.

What are Anti-dumping and Countervailing Duties?

Anti-dumping (AD) and countervailing duties (CVD) are two essential mechanisms employed by governments to address unfair trade practices and maintain fair competition in the global marketplace.

Dumping occurs when a company exports goods to a foreign market at a price lower than what they charge in their domestic market or below the cost of production. This practice can disrupt local industries and distort market dynamics. In response, governments may impose anti-dumping duties, which are tariffs levied on imported goods that are priced significantly lower than their domestic market value. These duties serve as a protective measure to safeguard domestic industries from the adverse effects of unfair competition.

Similarly, countervailing duties are tariffs imposed to counteract the impact of subsidies provided by exporting countries to their industries. Subsidies can artificially lower production costs, giving exporters an unfair advantage in international trade. By imposing countervailing duties, governments aim to level the playing field and prevent unfair competition that could harm domestic industries.

The implementation of these duties is governed by international trade rules, with the World Trade Organization (WTO) playing a crucial role in regulating trade practices. Before imposing countervailing duties, countries must conduct thorough investigations to determine the extent of subsidies and their impact on international trade. Once established, countervailing duties are imposed to neutralize the unfair advantage enjoyed by subsidized exporters, thereby promoting fair trade practices.

Both anti-dumping and countervailing duties serve as vital tools for ensuring a balance between domestic and international markets while fostering fair and equitable trade relations among nations. By addressing unfair trade practices and promoting competitive market environments, these duties contribute to the stability and prosperity of global trade.

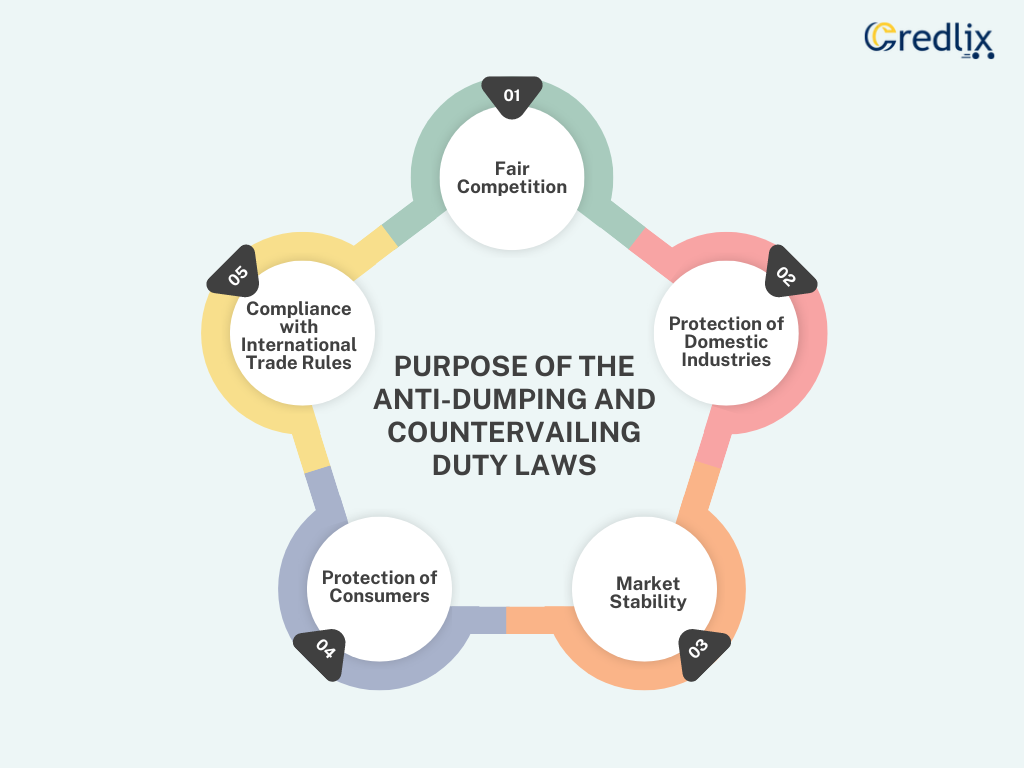

Purpose of the Anti-Dumping and Countervailing Duty Laws

The purpose of anti-dumping and countervailing duty laws is multifaceted, aiming to address unfair trade practices, protect domestic industries, and promote fair competition in the global marketplace.

Fair Competition

One of the primary objectives of anti-dumping and countervailing duty laws is to ensure fair competition among businesses operating in international trade.

By preventing practices such as dumping and the provision of subsidies, these laws create a level playing field where companies can compete based on the quality of their products and services rather than artificially manipulated prices or government support.

Protection of Domestic Industries

Anti-dumping and countervailing duty laws serve to safeguard domestic industries from the adverse effects of unfair trade practices. Dumping and subsidized imports can undermine the competitiveness of local businesses, leading to job losses, reduced investment, and economic instability.

Imposing duties on such imports helps shield domestic industries from unfair competition and preserve their viability and growth.

Market Stability

Unfair trade practices like dumping and subsidies can disrupt market stability by distorting supply and demand dynamics and artificially inflating or deflating prices.

By curbing these practices through anti-dumping and countervailing duty laws, governments aim to maintain market stability and prevent volatility that could harm consumers, businesses, and the overall economy.

Protection of Consumers

Fair competition facilitated by anti-dumping and countervailing duty laws benefits consumers by ensuring access to a diverse range of high-quality products at competitive prices.

By promoting fair trade practices, these laws help prevent monopolistic behavior, price manipulation, and inferior product quality that could negatively impact consumer welfare.

Compliance with International Trade Rules

Anti-dumping and countervailing duty laws are also aimed at ensuring compliance with international trade rules and agreements. By adhering to established protocols and guidelines, countries foster a predictable and transparent trading environment conducive to sustainable economic growth and development.

Additionally, compliance with international trade rules promotes cooperation and mutual respect among trading partners, enhancing overall trade relations.

Anti-Dumping Duty Laws

Anti-dumping duty laws are put in place to help local businesses compete fairly with international companies. These duties are imposed when imported products are priced lower than they are in the exporter’s home country or below their production costs. By imposing anti-dumping duties, the government aims to protect local industries from unfair competition and prevent job losses.

While these duties may sometimes lead to higher prices for locally-made products, they ultimately help support domestic businesses and preserve jobs in the long run.

Countervailing Duty Laws

Countervailing duty laws are put in place to address situations where foreign governments provide subsidies to their local industries. These subsidies can include things like tax breaks or low-interest loans, making it cheaper for manufacturers to export their goods. When this happens, it can create unfair competition for local businesses in other countries.

To prevent this, the International Trade Commission investigates the value of the subsidies and imposes countervailing duties to level the playing field. This helps protect local industries from facing extreme competition, job losses, and factory closures. Ultimately, countervailing duties ensure that international trade is fair for everyone involved.

AD and CV Duties For Fair Trade

Anti-dumping (AD) and countervailing (CV) duties are essential measures established to safeguard local markets and businesses from unfair competition and financial losses caused by foreign products. These duties aim to level the playing field for all local businesses, ensuring they have a fair chance to thrive.

AD duties are imposed at the company level, bridging the gap between the proper market value and the price set by foreign manufacturers for specific products. This prevents companies from undercutting local businesses with artificially low prices.

On the other hand, CV duties are implemented at the country level to counteract subsidies provided by foreign governments to their industries. By neutralizing these subsidies, CV duties promote fair trading practices and prevent international companies from exploiting local businesses. Together, AD and CV duties create a balanced and equitable trading environment where all businesses have the opportunity to succeed.

Who Does AD and CVD Investigations?

The U.S. Department of Commerce and the U.S. International Trade Commission (USITC) are responsible for conducting investigations into anti-dumping (AD) and countervailing duties (CVD). Any company or manufacturer within the U.S. can file a complaint against foreign manufacturers selling goods below market price or against foreign governments providing subsidies that harm local businesses.

These complaints must include comprehensive information about the imported goods, foreign exporters and importers, transaction details, product prices, subsidies, injury information, and any critical circumstances affecting local businesses. After receiving the petition, authorities review the information to determine whether to proceed with the investigation.

During the investigation process, both departments play distinct roles. The Department of Commerce verifies the extent of subsidizing or dumping and calculates associated amounts, while the USITC assesses whether the local industry faces financial injury or threats from foreign imports. Once both departments reach a consensus, the Department of Commerce implements AD or CV duties to support the domestic market.

Accurate and thorough information provided by business owners is crucial for a successful investigation. This ensures that appropriate measures are taken to address unfair trade practices and protect the interests of local businesses and industries.

Products Covered by Anti-Dumping (AD) and Countervailing (CV) Duties

A lot of different products are covered by anti-dumping (AD) and countervailing (CV) duties in the United States. These include:

Steel fittings: Different types of steel fittings used in building and industries may have these duties to make sure competition is fair.

Carbon and steel alloy rods: Rods made from carbon and steel mixes, often used in building and making things, might also have these duties.

Glass containers: Bottles and jars made of glass that are brought into the United States could have these duties to protect American glassmakers.

Shaft engines: Parts or pieces related to shaft engines, like bits and extra stuff, could also have these duties to help American engine makers.

Milk products and wood moldings: Various milk products and shaped pieces of wood brought into the United States might have these duties to help American milk and wood companies.

Quartz products: Things like countertops and tiles made of quartz that are brought in might also have these duties to make sure things are fair.

Metal lockers: Metal lockers made overseas could have these duties to help American locker makers.

And there are many more things like wooden furniture, plastic bags, tissue paper, stuff for your home, lawnmowers, steel wires for concrete, and tiles made of ceramic. These duties are there to make sure trade is fair, protect American businesses, and keep things even in the world market.

What is the Process for AD and CVD?

Anti-dumping duties are levied by the government on any imported good whose price is less than its market worth. The amount that the foreign exporter has lowered will be this duty. A straightforward formula is used to compute it:

Normal Value – Export Value equals AD Duty

In this case, the price of the product as it appears on the local market is its normal value, and the price at which the foreign business ships the items is its export value.

The amount of subsidies the foreign government offers for exporting the items is taken into account by the government while calculating CV duties.

The main difference between anti-dumping (AD) and countervailing (CV) duties lies in their underlying reasons for imposition. Anti-dumping duties are enforced by governments to safeguard local markets from the adverse effects of low-priced foreign goods. Countervailing duties target foreign products that have benefited from government subsidies, resulting in artificially low prices.

In both scenarios, the importing country experiences financial challenges due to unfair competition. The AD duty amount is determined by the dumping margin, representing the difference between the normal value (local market price) and the export value (foreign price). In contrast, the CVD amount is solely based on the subsidy value of the foreign goods. This value is determined through comprehensive investigations conducted by the government to ascertain and finalize both duties.