When you’re dealing with shipping, there’s this thing called the CBP Form 7512. It’s a bit like a passportMeta Title: “CBP Form 7512: Your Essential Guide to Smooth Customs Clearance”

Meta Description: “Learn about CBP Form 7512, a crucial document for US customs clearance. Understand its significance, types, components, and steps for smooth importation processes.”

Slug: cbp-form-7512-guide for your goods, issued by the US Customs & Border Protection. This form kicks in when your stuff is heading into the US.

Picture it as a detailed ID card for your shipment. You can’t skip it—it’s the ticket to smoothly passing through customs.

Getting this form is like making sure your package has all the right labels—it helps your goods breeze through customs without a hitch.

So, whether you’re sending goods in or shipping out products, filling out this paperwork properly ensures your goods reach their destination without any bumps along the way.

What is CBP Form 7512?

CBP Form 7512, also known as the ‘Transportation Entry and Manifest of Goods Subject To CBP Inspection and Permit’ form, is a vital document utilized by the US Customs & Border Protection (CBP). It serves as a detailed record, providing insights into the imported goods’ characteristics and their country of origin. This form facilitates customs officials in verifying the shipment’s contents, ensuring compliance with regulations before granting entry into the US.

In essence, CBP Form 7512 plays a crucial role in the smooth flow of goods across borders by enabling thorough inspection and permitting entry into the country.

The Significance of CBP Form 7512

CBP Form 7512 plays a crucial role in the world of importing goods into the US. It’s a key document managed jointly by the US Department of Homeland Security and Customs and Border Protection (CBP). This form is all about verifying cargo, making it absolutely essential for anyone bringing goods into the country.

Inside, you’ll find important details about the shipment, like where it’s coming from and where it’s headed. It’s a must-have at entry points where businesses or individuals are receiving goods. Specifically designed for shipments arriving in the US under bond, it’s like a guidebook for brokers and carriers handling the cargo.

Packed with all the nitty-gritty details about the goods, this form helps speed up processes for quick transportation or exportation. Plus, it acts as a watchful eye, allowing CBP to keep tabs on in-bond goods and stop any shady cargo from slipping through. In short, it’s a vital piece of the puzzle for keeping imports safe and legal, making it a cornerstone of global trade logistics.

Types of CBP Form 7512

There are primarily two types of CBP Form 7512:

Immediate Transportation (IT) Entry: This type of CBP Form 7512 is used when goods need to be transported immediately after arriving in the US. It allows for the movement of goods from the port of arrival to another location within the US without undergoing formal entry procedures at the port.

Transportation and Exportation (T&E) Entry: This type of CBP Form 7512 is used when goods arriving in the US are intended for exportation to another country. It allows for the movement of goods from the port of arrival to another port where they will be exported, without the goods entering the US commerce stream.

Components of CBP Form 7512

Here’s what you’ll find within a CBP Form 7512:

Origin Port: This denotes the starting point of the shipment’s journey, providing vital context regarding its source.

Destination Port: This specifies where the cargo is ultimately headed, guiding its path through the intricate network of transportation.

Merchandise Details: A meticulous breakdown of the goods being transported, including their nature, quantity, and any pertinent identifying characteristics.

Consignor and Consignee Details: Information regarding both the sender (consignor) and recipient (consignee) of the cargo, ensuring clear communication and accountability.

Import and Export Dates: These timestamps mark the crucial moments in the cargo’s journey, delineating its entry into and potential exit from the US.

Lighterage and Cartage Information: Pertaining to the handling and transport of goods within port facilities, ensuring smooth logistics operations.

Furthermore, it’s imperative to engage with the CBP officer to ascertain the requisite number of copies necessary for handling the shipment’s entry, manifest, or withdrawal. It’s a step important to facilitating seamless processing and compliance.

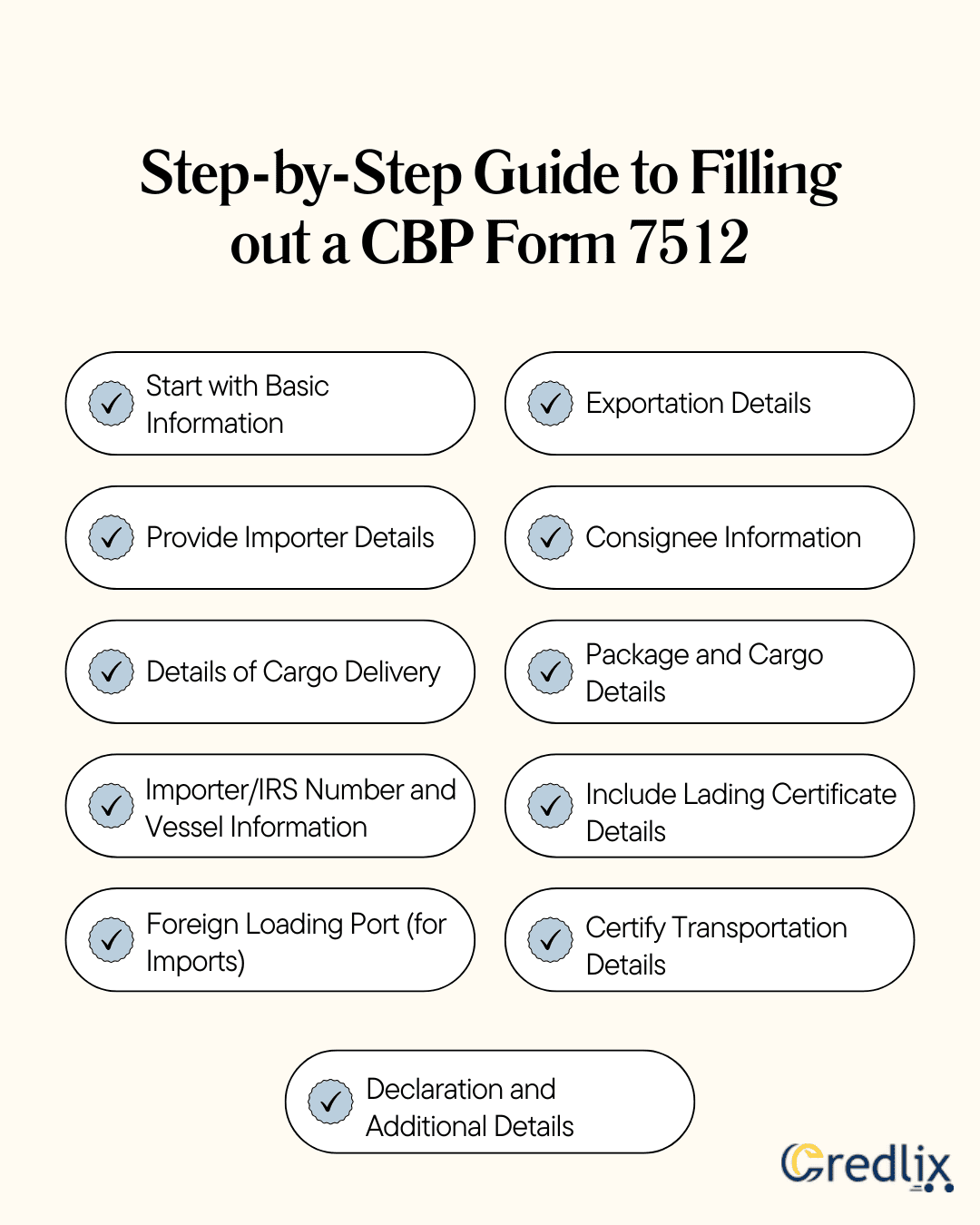

Step-by-Step Guide to Filling out a CBP Form 7512

Here’s a detailed guide on how to fill out a CBP Form 7512. Following these steps ensures thorough completion of the CBP Form 7512, facilitating efficient customs processing and compliance with importation and exportation requirements.

Start with Basic Information

Enter the shipment entry number, class of entry (like immediate transportation or transportation and exportation), date, port of entry, and port code number. This sets the foundation for identifying and tracking the shipment.

Provide Importer Details

Specify the US port of unloading and furnish crucial information about the importer, including their name, address, and any relevant bond description. This ensures clear communication and compliance with customs regulations.

Details of Cargo Delivery

Mention the name of the lighterman responsible for delivering the cargo and outline the destination where the goods will be received. This step facilitates smooth coordination in the transportation process.

Importer/IRS Number and Vessel Information

Enter the importer/IRS number, car number, pier number, and details of the vessel or carrier involved in transporting the goods. This information aids in accurate tracking and identification of the shipment.

Foreign Loading Port (for Imports)

If the cargo is being imported, provide details about the foreign loading port. This adds context to the origin of the goods and assists customs officials in verifying the shipment’s authenticity.

Exportation Details (if applicable)

If the goods are destined for export, input the export date, country name, final destination, and the current location of the goods, such as the pier, warehouse, or station. This ensures compliance with export regulations and facilitates seamless processing.

Consignee Information

Specify details of the consignee who will receive the goods at the destination. If the consignee information is unavailable, indicate the involvement of a freight forwarder or third party handling the shipment.

Package and Cargo Details

Provide information regarding the number of packages, quantity of goods, and their gross weight duty, rate, and value. If the exact value is unknown, provide an estimate to the best of your knowledge.

Include Lading Certificate Details

Attach the leading certificate for goods transportation and exportation, including details such as the inspector’s name, date of inspection, and information about the vessel, aircraft, or vehicle used for transportation.

Certify Transportation Details

Certify the reason for transportation, departure locations, and the ultimate destination of the goods. This confirms the legitimacy and intended purpose of the shipment.

Declaration and Additional Details

Declare the accuracy of the provided information and ensure to include any necessary cartage or lighterage details along with other pertinent information required by customs regulations.

Sample CBP Form 7512

Clearing Customs for Imported Goods Using CBP Form 7512

Clearing customs for imported goods using CBP Form 7512 involves several steps:

Preparation: Ensure that all necessary information about the imported goods is accurately filled out on the CBP Form 7512, including details such as origin and destination ports, merchandise specifics, consignor and consignee information, import and export dates, and any other required data.

Submission: Present the completed CBP Form 7512 along with other required documentation to the customs authorities at the port of entry. This may include invoices, bills of lading, packing lists, and any permits or licenses necessary for the imported goods.

Verification: Customs officials will review the information provided on the CBP Form 7512 to ensure compliance with import regulations. They may inspect the goods physically or electronically to confirm the accuracy of the declared information.

Payment of Duties and Taxes: If applicable, duties, taxes, and any other fees associated with importing the goods must be paid to customs authorities. The amount owed is typically based on the value, type, and quantity of the imported goods, as well as any trade agreements in place between the importing and exporting countries.

Release of Goods: Once customs clearance is obtained and any required payments are made, the imported goods will be released from customs custody. They can then be transported to their final destination within the United States.

Record Keeping: Maintain accurate records of the CBP Form 7512 and any other documentation related to the importation process for future reference and compliance purposes.

Knowing your way around the CBP Form 7512 is key for getting goods smoothly into the US. By understanding what it is, what it needs, and how to fill it out, you make sure your stuff clears customs hassle-free. Whether you’re bringing things in for business or personal use, following these steps helps things move quickly and safely across borders. Think of the CBP Form 7512 as your trusty guide in the world of global trade, making sure your goods reach where they need to be without any bumps along the way.