GST, short for Goods and Services Tax, was introduced to overhaul taxes in India. It’s like a big umbrella that covers various taxes like VAT, Excise, and Service Tax, putting them all in one place. Since it started in 2017, there have been some changes in the rules and how much tax you pay. But people still argue about whether it’s good or not. It’s a bit like trying a new café. You might think it serves the best coffee, but your friend might disagree.

Some people think the GST is fantastic. They say it makes things simpler, especially for businesses. Others aren’t so sure. They say there are problems and issues with it. In the end, it’s us, the taxpayers, who have to decide if GST is good or bad. So, whether it’s a good thing or a pain, that’s something each of us has to think about.

Also Read: Merchant Exports | Meaning and Process Under GST

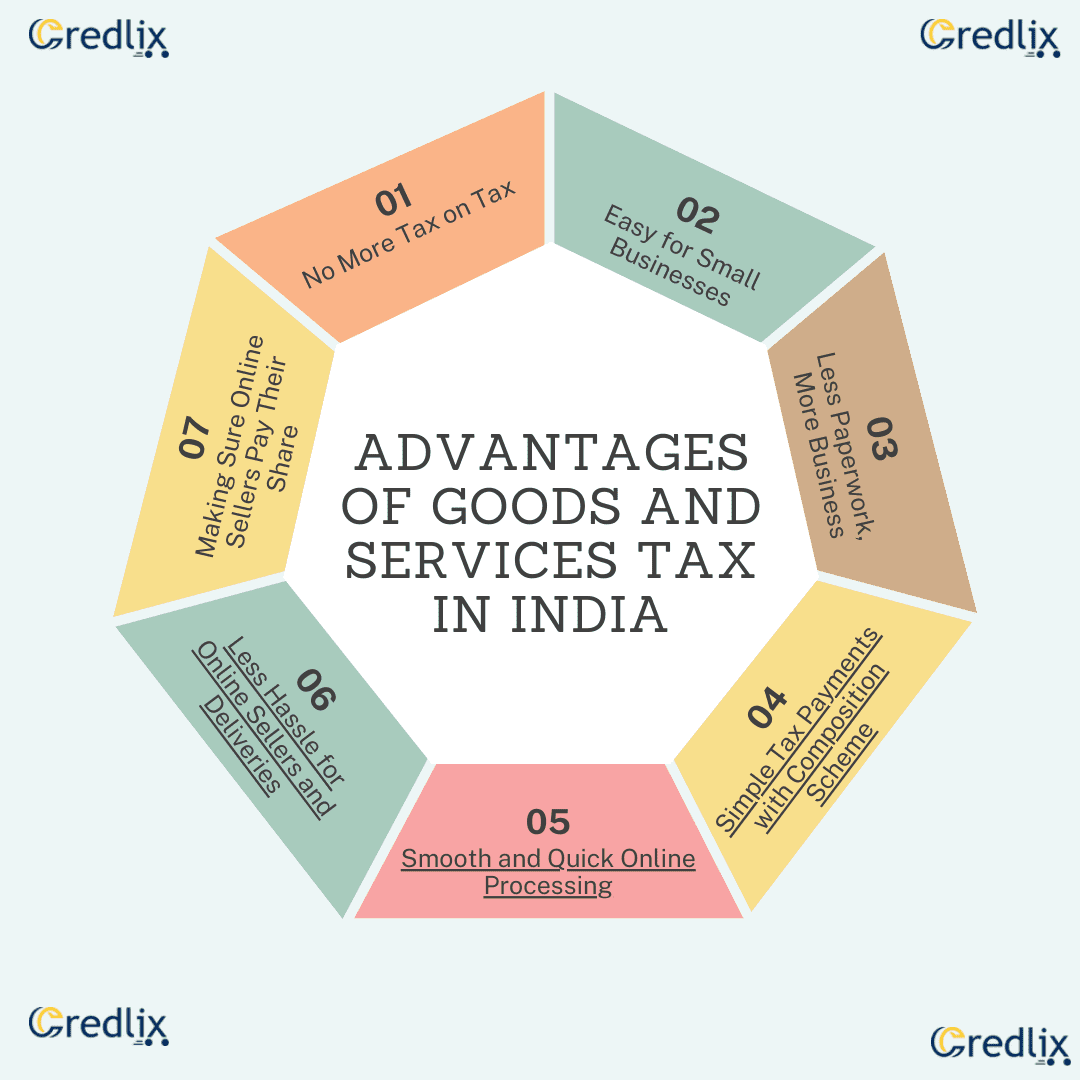

Advantages of Goods and Services Tax in India

Here are the key benefits of the goods and services tax in India:

No More Tax on Tax

GST eliminates the cascading effect of taxes by allowing businesses to claim input tax credit (ITC) on the taxes paid on inputs. This ensures that taxes are levied only on the value added at each stage of production or distribution.

By avoiding taxation on taxes, GST promotes efficiency, reduces the cost of goods, and enhances competitiveness in the market.

Easy for Small Businesses

Under GST, the threshold for registration is significantly higher compared to previous tax regimes. This benefits small businesses as they are exempted from GST if their turnover falls below the prescribed threshold.

It reduces the compliance burden for small enterprises, encourages entrepreneurship, and fosters economic growth by bringing more informal sectors into the formal economy.

Less Paperwork, More Business

GST streamlines the tax compliance process by replacing multiple taxes with a single unified tax system. Businesses need to file only one consolidated return instead of separate returns for various taxes.

This simplifies administrative procedures, reduces paperwork, and enhances the ease of doing business, especially for small and medium-sized enterprises (SMEs).

Simple Tax Payments with the Composition Scheme

The Composition Scheme under GST allows small taxpayers to pay tax at a fixed rate based on their turnover, without the hassle of maintaining detailed records. It provides relief to small businesses by reducing the compliance burden and administrative costs.

Moreover, it facilitates ease of tax payment, enabling businesses to focus more on their operations and growth rather than on complex tax calculations.

Smooth and Quick Online Processing

GST operates through a robust online portal, facilitating seamless and quick processing of tax-related transactions. Taxpayers can easily register, file returns, make payments, and claim refunds online, reducing manual intervention and paperwork.

The online platform enhances transparency, accuracy, and efficiency in tax administration, ensuring timely compliance and reducing the scope for errors or discrepancies.

Less Hassle for Online Sellers and Deliveries

GST eliminates the need for multiple warehouses across states to avoid inter-state taxes. With the introduction of a unified tax system, e-commerce and logistics companies can streamline their supply chain operations by consolidating warehouses, thereby reducing costs and improving efficiency.

This simplification of logistics infrastructure promotes smoother interstate trade and enhances the overall competitiveness of the sector.

Making Sure Online Sellers Pay Their Share

GST brings e-commerce operators under its ambit, ensuring fair taxation and creating a level playing field between online and offline sellers. It mandates the collection of tax at source (TCS) by e-commerce platforms, ensuring compliance with tax regulations.

This inclusion of e-commerce operators in the tax net promotes transparency, prevents tax evasion, and generates revenue for the government while fostering the growth of the digital economy.

Disadvantages of Goods and Services Tax in India

Here are the disadvantages of the goods and services tax in India:

Increased Cost of Operation

Implementing the GST scheme often requires businesses to invest in new accounting systems and software to comply with the new tax regulations. This initial investment can increase operational costs, especially for small and medium-sized businesses (SMBs) that may have limited resources.

Additionally, businesses may also incur additional expenses for training staff to understand and manage the complexities of GST compliance, further adding to their operational costs.

Increased Tax Liability on SMBs

While GST aims to simplify the tax structure, it can lead to higher tax liabilities for SMBs, particularly those operating in sectors previously benefiting from tax exemptions or lower tax rates. Small businesses may find it challenging to absorb the increased tax burden, which could ultimately affect their competitiveness and profitability.

Moreover, the complexities of GST compliance may also result in unintentional errors or underestimation of tax liabilities, leading to financial strain due to penalties or interest charges.

Enhanced Burden of Compliance

GST introduces a more comprehensive compliance framework compared to previous tax systems, requiring businesses to file multiple returns, maintain detailed records, and adhere to strict deadlines.

This increased compliance burden can be particularly challenging for SMBs with limited administrative resources and expertise. Ensuring accurate reporting and timely compliance with GST regulations may necessitate additional manpower or outsourcing services, further adding to the administrative costs and operational complexities for businesses.

Penalties for Non-GST-Compliant Firms

Non-compliance with GST regulations can result in significant penalties and fines for businesses. Small and medium-sized firms, in particular, may struggle to navigate the complexities of GST compliance, making them more susceptible to errors or oversights that could lead to penalties.

Moreover, the enforcement of GST regulations may impose additional administrative burdens on businesses, diverting resources away from core operations and hindering business growth. The fear of penalties may also deter businesses from taking full advantage of GST benefits or exploring new opportunities, thus stifling innovation and economic development.

In conclusion, while GST in India brings several benefits like simplifying taxes and helping businesses grow, it also has its challenges. The increased costs and compliance burdens can be tough for small businesses, and there’s a risk of penalties for those who don’t follow the rules. However, with proper understanding and adaptation, GST can pave the way for a more transparent and efficient tax system, benefiting both businesses and the economy in the long run. So, while it may have its bumps along the road, GST is like a journey where we learn and adapt to make things better for everyone.