Last few weeks saw hectic activity in the sphere of policies with respect to global trade. We take a cursory look at the key developments. This is followed by a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. Implications of recent trade related policy developments

During the last few weeks, India participated in three global trade related policy developments, viz., WTO’s 13th Ministerial Conference, India-EFTA Trade and Economic Partnership Agreement, and Indo-Pacific Economic Framework for Prosperity. Below, we highlight key takeaways from each:

WTO’s 13th Ministerial Conference (MC13)

The WTO’s MC13 meet that concluded on Mar 2nd with participation from 166 trade ministers saw the acceptance of the Abu Dhabi Declaration, which turned out to be rather underwhelming. Geopolitical uncertainty (like wars involving Russia-Ukraine and Israel-Hamas), slowdown in few economies, and pending elections in several countries in 2024 posed headwinds, with the MC13 failing to conclude several areas of negotiations. To highlight, deals on fisheries and agriculture remains open while consensus on WTO’s dispute settlement architecture is yet to be formed. However, negotiations on the extension of the e-commerce moratorium offered a silver lining.

From India’s perspective, we note that:

- The current stance on MSP (Minimum Support Price) and PSH (Public Stock Holding) was maintained with no commitment towards reduction in farm subsidy unless WTO delivers a permanent solution on PSH for all members and protects the treaty-embedded Special and Differential Treatment provision in the Agreement on Agriculture.

- The stance on fisheries was maintained as no restrictions within the EEZs (Exclusive Economic Zones) for preserving livelihood and food security.

- India opposed duty-free digital transmission to safeguard against potential revenue losses amidst the need for supervising growing digital trade.

India-EFTA Trade and Economic Partnership Agreement

After over a decade of negotiations, India signed the Trade and Economic Partnership Agreement with EFTA countries (comprising Switzerland, Iceland, Norway & Liechtenstein) on Mar 10th. The TEPA with EFTA countries is unique as:

- This is India’s first FTA with four developed nations

- For the first time in history of FTAs, binding commitment of USD 100 bn FDI and 1 mn direct jobs in the next 15 years has been given by the EFTA countries

The agreement comprises of 14 chapters with main focus on market access related to goods, rules of origin, trade facilitation, trade remedies, sanitary and phytosanitary measures, technical barriers to trade, investment promotion, market access on services, intellectual property rights, trade and sustainable development and other legal and horizontal provisions.

Under this deal, India will reduce most import tariffs on processed food and beverages along with electrical machinery items, pharmaceutical products, and medical devices (gold imports will not receive any tariff concession) from the four countries in return for investments over 15 years. The investments are expected to be made across a range of industries, including pharmaceuticals, machinery, and manufacturing.

As per India’s Ministry of Commerce, the FTA will provide a window to Indian exporters for improved access to the European market. In addition, the FTA aims to provide Mutual Recognition Agreements in professional services (such as Nursing, Chartered Accountancy, and Architecture) for cross-border exchanges and collaborations while also boosting agreements in services like IT, Business, Culture, and Education.

Indo-Pacific Economic Framework for Prosperity (IPEFP)

India along with its other IPEFP partners had their first ministerial meeting on Mar 14th. IPEFP was launched in May-22, bringing together 14 regional partners (Australia, Brunei, Fiji, India, Indonesia, Japan, Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, US, and Vietnam) – in a new model of economic cooperation. While the Framework is not a trade agreement/treaty, it nevertheless seeks to advance cooperation across four key pillars of Trade, Supply Chains, Clean Economy, and Fair Economy.

India has signed a supply chain resilience agreement with the US and 12 other members of the IPEFP to reduce its dependence on China. It has so far stayed away from the trade pillar of the Framework.

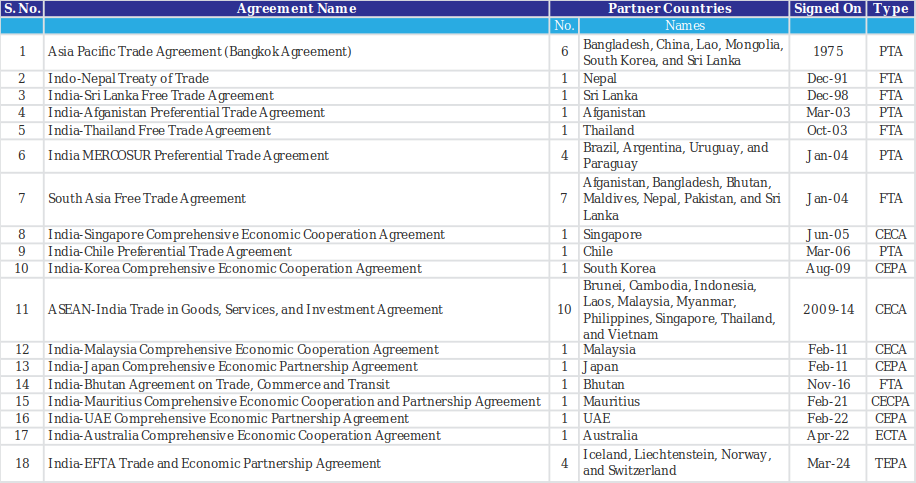

Table 1: India currently has 18 key trade agreements on bilateral and multilateral basis

Note: There is often a lag between signing of a trade agreement and its implementation

Source: India’s Commerce Ministry, PIB, US International Trade Administration, Media reports, QuantEco Research

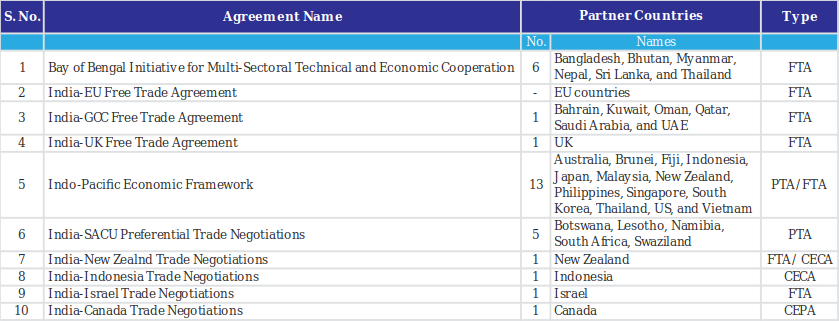

Table 2: India currently has 10 key ongoing trade negotiations on bilateral and multilateral basis

Note: As per media reports, negotiations with EU and UK are at an advanced stage

Source: India’s Commerce Ministry, PIB, QuantEco Research

2. Outlook on monetary policy

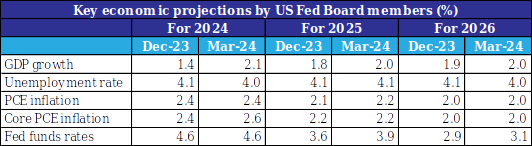

Along expected lines, the US Fed left its policy rate unchanged (in the 5.25-5.50% range) at its policy review on Mar 20, 2024. However, there were few noticeable changes in the FOMC (Federal Open Market Committee) projections:

- The outlook for growth saw an upgrade across 2024-2026. The most sizeable upward revision was seen in case of 2024, with GDP growth now projected at 2.1% vs. the earlier projection of 1.4% in Dec-23.

- The forecast for unemployment rate in 2024 and 2026 saw a minor downward revision to 4.0% from 4.1% projected earlier in Dec-23.

- Forecast for Core PCE inflation for 2024 saw an upward revision to 2.6% from 2.4% projected earlier in Dec-23.

- Last, but not the least, the median projection for fed funds rate for 2024 stood unchanged at 4.6%. This maintains the likelihood of 75 bps cumulative rate cut from the Fed before the end of 2024. In contrast, the projection for fed funds rate for 2025 and 2026 saw an upward revision to 3.9% and 3.1% from its earlier projection of 3.6% and 2.9% respectively in Dec-23.

Market pricing of US interest rate as per the futures market is currently in sync with the latest set of FOMC projections. We maintain our expectation of the first rate cut from the US Fed to begin from Jun-24 onwards.

With this as a backdrop, other key central banks could also begin their rate easing cycle with a lag (among developed countries, the Swiss National Bank (SNB) has in fact taken the lead, by announcing its first rate cut in Mar-24). In case of India, as CPI inflation starts providing durable comfort in the coming quarters, we expect the RBI to start its monetary easing cycle. With government recently announcing a series of fuel price cuts (Rs 100 per cylinder on LPG, Rs 2.1 per litre on diesel, and Rs 2.0 per litre on petrol), the RBI’s FY25 CPI inflation estimate of 4.5% could see some downside adjustment. As such, we now bring forward our expectation of the first rate cut from the RBI to Aug-24 from Oct-24 earlier, while maintaining the likelihood of 75 bps cumulative rate cut by

Mar-25.

Table 3: In last 3-months, there has been an increase in Fed’s optimism with respect to the US economy

Source: Federal Reserve, QuantEco Research

3. Rupee view

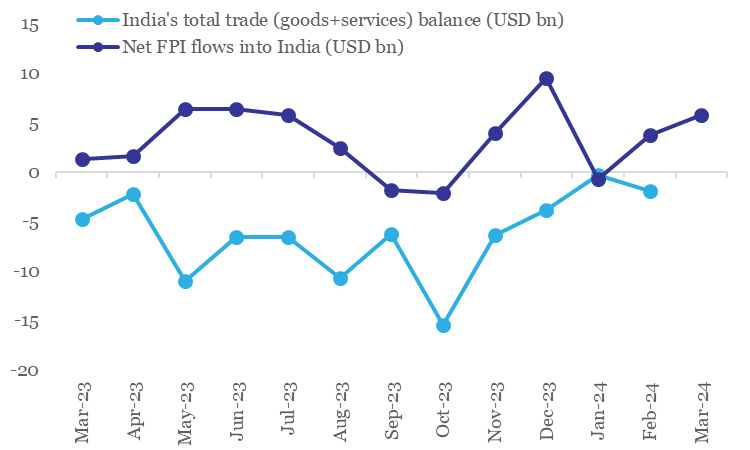

After three consecutive months of mild appreciation, INR has reversed direction, and is currently trading 0.6% weaker against the USD in the month of Mar-24 so far. While INR was behaving in line with its favorable financial year-end seasonality and had strengthened somewhat in the first 2-3 weeks of Mar-24 (touching 82.75 on Mar 11th vs. 82.91 on Feb 29th), the reversal happened post the US Fed policy outcome, and more importantly after the SNB’s surprise rate cut, dilution of Bank of England’s hawkishness, and market expectations of a rate cut from the People’s Bank of China. While the USD appears to be on a rather neutral turf post the Mar-24 FOMC meet, expectation of monetary easing is weighing upon CNY, which in turn is adversely impacting other emerging market currencies, including the INR.

While we still believe that INR will be supported by favorable financial year-end trade seasonality along with healthy portfolio inflows (India has received USD 5.8 bn FPI inflow in Mar-24 so far), last few days of price action in the global currency market has added upside risk to our Mar-24 INR call of 82.5.

Having said so, we do maintain our medium-term view of a mild depreciation in INR, with likelihood of 84.5-85.0 by Mar-25. RBI’s proactive FX intervention should continue to remain a key source of suppression in INR volatility.

Chart 1: In recent months, INR has found support from narrowing of total trade deficit along with healthy portfolio inflows

Source: CEIC, QuantEco Research

Note: FPI flow data for Mar-24 is until 21st

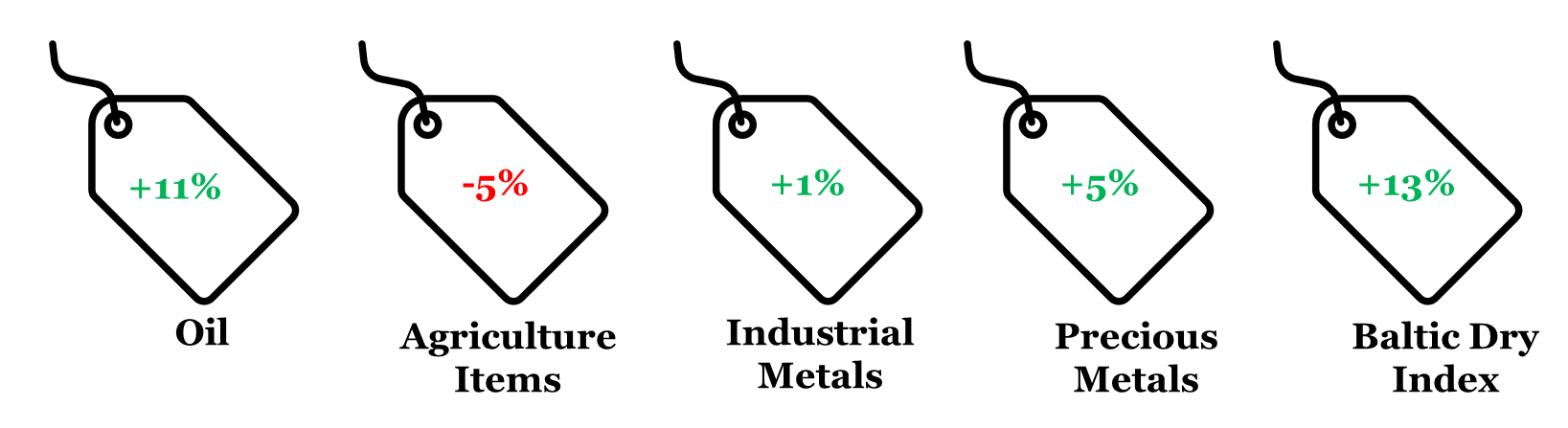

4. CYTD price change in key commodity groups and shipping cost

Note: (i) Price change is between Mar 15, 2024 and Dec 31, 2023; (ii) Oil price is represented by Brent; (iii) Agriculture Items, Industrial Metals, and Precious Metals are represented by respective Bloomberg Commodity indices; (iv) rounded off figures represented.

Data: Refinitiv, QuantEco Research