In this month, we focus on the outlook for global trade and its implications for India. This is followed by a quick assessment of US and India’s monetary policy along with the outlook on the Indian rupee.

1. Global trade to rebound in 2024, but risks remain

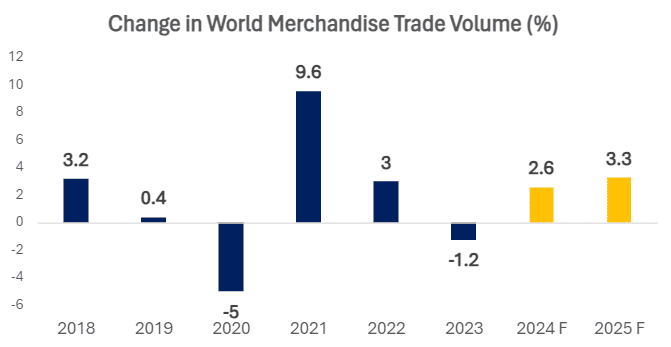

First, the good news. As per the World Trade Organization’s Global Trade Outlook and Statistics report (Apr-24), compared to a contraction of 1.2% in 2023, world merchandise trade volume is projected to expand by 2.6% in 2024 and further by 3.3% in 2025. As per the agency, easing of global inflationary pressures and the concomitant increase in household incomes should help support demand for merchandise trade in 2024 and 2025.

Chart 1: After a contraction in 2023, global merchandise trade volume is expected to recover in 2024 and 2025

Note: Values for 2024 and 2025 are forecasts by the WTO

Source: WTO, QuantEco Research

A similar portrayal is also done by the International Monetary Fund, in their World Economic Outlook presented in Apr-24. As per their forecasts, volume of global trade (goods+services) is set to expand by 3.0% and 3.3% in 2024 and 2025 respectively after a subdued growth of 0.3% in 2023.

From India’s perspective, the expectation of revival in global trade is comforting – after all, merchandise exports and services exports had a share of 12.5% and 9.7% in India’s GDP in CY2023. We take a regional look at what could drive this revival from India’s perspective.

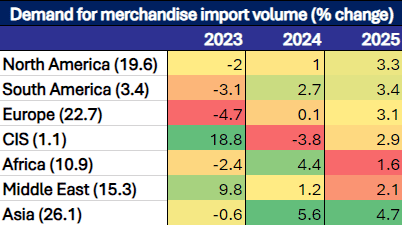

As per the WTO, growth in demand for imports on volume basis is expected to be the strongest for countries in Asia over 2024 and 2025. This is expected to be followed by countries in South America and Africa. Demand for imports is likely to be the weakest from the CIS group of countries in 2024 and 2025, followed by the European and Middle East countries.

Table 1: Regional heatmap depicting growth in volume of merchandise import demand

Note: (i) Figures in parenthesis lists the region’s share in India’s merchandise exports in 2023 in percentage terms, (ii) Asia includes Oceania

Source: India’s Commerce Ministry, WTO, QuantEco Research

Notwithstanding the optimistic outlook for global trade, there are unpredictable downside risks due to current geopolitical conflicts (esp. in the Middle East/ West Asia region) and trade policy uncertainty (esp. involving US and China). Notably, while the trade volume forecasts by the WTO and the IMF for 2024 suggest recovery, both estimates were marked down by 70 bps and 50 bps respectively vis-à-vis their previous forecast levels provided in Oct-23.

2. A quick round-up of India’s export performance in FY 2023-24

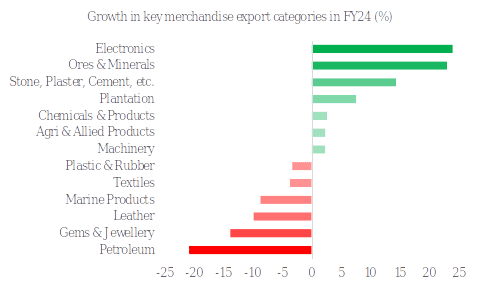

As per preliminary estimates from the Ministry of Commerce, India’s merchandise exports contracted by 3.1% to USD 437 bn in FY 2023-24 from USD 451 bn in FY 2022-23. At a granular level, there were wide variations in category wise export performance.

- Electronic items grew at the fastest pace, with its annualized share in the total export basket scaling an all-time high of 6.7%.

- Stone, Plaster, Cement, etc. did well as a category, which helped its annualized share in the total export basket touch 1.0%.

- Meanwhile, Leather, Gems & Jewellery, Plastic & Rubber, and Textiles saw their share in the total export basket dip to an all-time low of 1.0%, 7.5%, 1.8%, and 7.4% respectively.

- With respect to incremental change in sectoral shares, while Electronics saw the biggest increase, Petroleum products saw the largest decline.

Chart 2: Despite contraction at an aggregate level, there was wide variation in the performance of key export categories in FY 2023-24

Source: Ministry of Commerce, QuantEco Research

2. Monetary Policy Shift: Easing by the US Fed to get delayed

Since our last update in Mar-24, there has been a considerable reassessment of market expectation with respect to the monetary policy trajectory in the US. Continued resilience in US economic data has started to cast doubt whether the entire cumulative rate cut of 225 bps as indicated by the latest Fed official’s projection for 2024-2026 period would be needed to glide Core PCE inflation towards its target of 2.0% by 2026.

The recent hardening of global crude oil prices has further dampened the outlook for near term inflation prospects.

As such, market participants have scaled back their expectation of imminent monetary easing by the US Fed. The futures market currently indicates the probability of just under two round rate cuts before the end of CY 2024. This is lower than the expectation of at least three round of rate cuts for 2024, just about a month back. We now expect the Fed to begin cutting rates from Sep-24 onwards, with possibility of up to 75 bps cumulative rate cut by Mar-25.

This pushback in the anticipated rate easing in US could have an impact on other emerging market economies, like India. A surplus rainfall projected for the 2024 south-west monsoon season will be preceded by (ongoing) severe heatwave conditions across India in Apr-Jun, that will potentially stoke food price pressures in the near term. As such, we now expect the RBI to start easing monetary policy from Oct-24 onwards, with likelihood of a cumulative 50 bps rate cut by Mar-25.

3. Rupee view

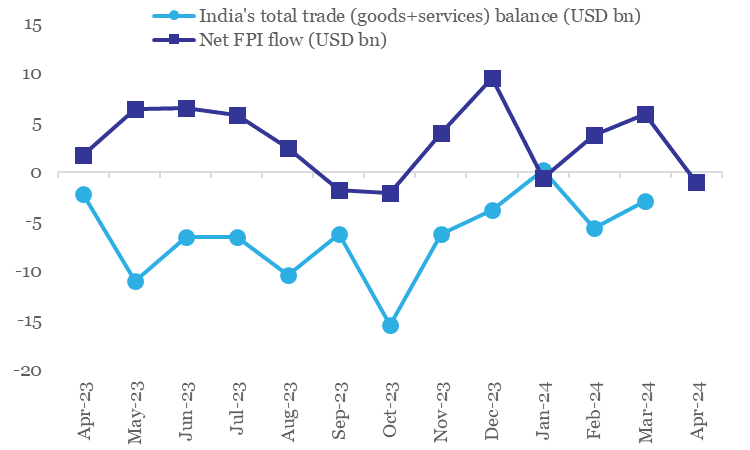

The Indian rupee clocked a mild depreciation of 1.5% against the US dollar in FY 2023-24. This was accompanied by subdued volatility, both from a historical perspective, as well as compared to key currency peers across the DM (developed markets) and EM (emerging markets) FX space. Our baseline view for FY25 mirrors the outturn in FY24, i.e., the likelihood of a mild depreciation accompanied by subdued volatility.

In recent weeks, global factors have turned adverse on the margin:

- Resilience in US economic data has pushed back expectations of monetary policy easing by the US Fed, as discussed above. This has provided a leg up to the US dollar, which in turn has weighed upon emerging market currencies, including the Indian rupee.

- Escalation of geopolitical conflict in the Middle East/ West Asia region is providing an upside to the US dollar (as it enjoys a safe haven status) as well as crude oil prices (this could potentially weigh upon the rupee as oil accounts for ~40% of India’s merchandise trade deficit).

These risks could get partly offset on account of resilience in India’s underlying macro-stability parameters, our forecast of a Balance of Payments surplus in FY 2024-25, and expectation of a recovery in global trade, as discussed above.

Overall, we maintain our call of USDINR moving towards 84.5 levels by Mar-25.

Chart 3: While total trade deficit remains moderate, portfolio inflows have lost momentum in recent weeks

Source: CEIC, QuantEco Research

Note: FPI flow data for Apr-24 is until 21st

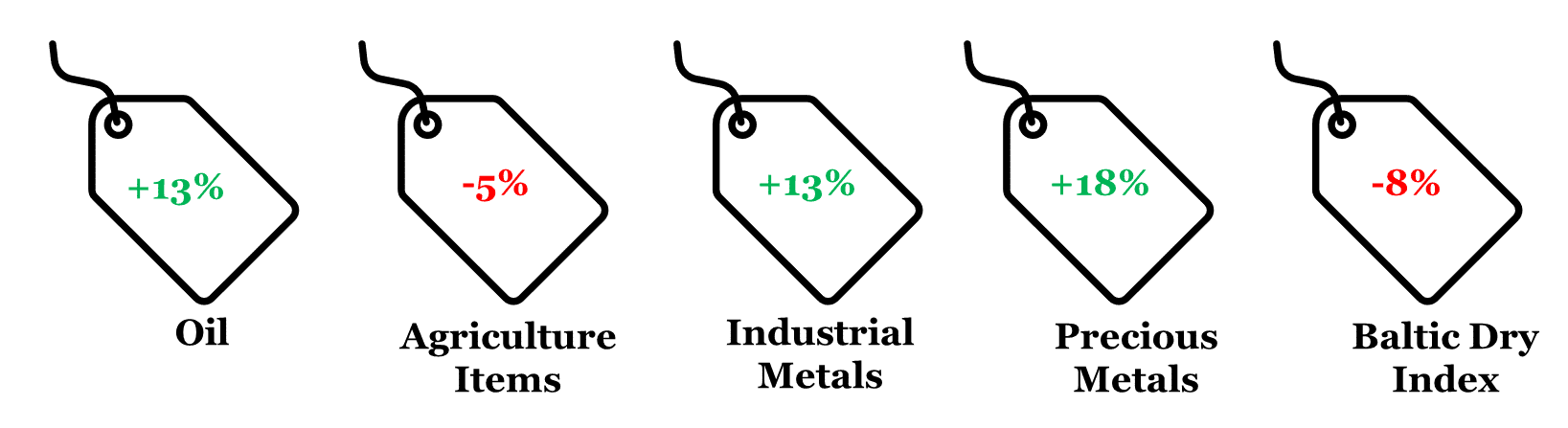

4. CYTD price change in key commodity groups and shipping cost

Note: (i) Price change is between Apr 19, 2024 and Dec 31, 2023; (ii) Oil price is represented by Brent; (iii) Agriculture Items, Industrial Metals, and Precious Metals are represented by respective Bloomberg Commodity indices; (iv) rounded off figures represented.

Data: Refinitiv, QuantEco Research