Every business requires funds to grow and expand, and working capital is a vital financial tool for day-to-day operations. It’s calculated as the difference between a company’s current assets and current liabilities, providing insights into its growth potential and competence.

For businesses, especially MSMEs, accurately determining the funds needed to sustain operations, even in unforeseen circumstances, is crucial. This blog highlights essential factors for enterprises to consider when assessing and calculating their working capital requirements.

By understanding these details, businesses can better manage their finances and ensure smooth day-to-day operations, fostering growth and stability.

Also Read: What is Working Capital?

Working Capital Requirements for Small Businesses: Key Considerations

Explore vital factors to ponder when evaluating the working capital needs of a specific business.

Business Model

- Business models heavily relying on inventories and lengthy processing demand more working capital.

- Service-oriented businesses require capital primarily for seamless day-to-day operations.

- Seasonality influences working capital needs, especially for products tied to specific seasons.

- For instance, businesses selling air conditioners may require increased inventory ahead of summer.

- Adaptation is key; businesses should arrange for higher working capital loans during peak seasons.

- Working capital hinges on the dynamics of a business’s supply chain and production timelines.

- Accurate demand forecasting is crucial for aligning working capital with sales volumes.

- Flexibility is essential, allowing businesses to adjust working capital according to market conditions.

- Businesses dealing with seasonal fluctuations must strategically plan for varying working capital needs.

- The ability to secure working capital loans proactively ensures operational smoothness during peak periods.

Expansion Assessment

- Newly established businesses often need increased working capital for growth initiatives.

- Established companies with stable revenue may require less working capital in comparison.

- Business owners should assess growth plans and working capital positions to determine financing needs.

- Consideration of expansion goals is essential when evaluating the necessary working capital.

- Growth-focused businesses may demand higher working capital for developmental projects.

- Steady revenue streams in established companies can influence lower working capital requirements.

- Business owners must analyze their growth trajectory to align working capital with expansion plans.

- Financing needs should be tailored to the stage of business development and growth objectives.

- Newly formed businesses may prioritize acquiring higher working capital for initial expansion phases.

- Evaluating working capital positions is crucial for businesses at different stages to ensure financial adequacy.

Capital Dynamics

- Time gap between revenues and expenses directly affects working capital requirements.

- Working capital needs increase with a longer time difference between revenues and expenses.

- Consider the direct proportionality: higher time difference means higher working capital needs.

- Businesses must be mindful of the time lag between generating revenue and incurring expenses.

- Working capital cycles align with the time dynamics between revenue generation and expenditure.

Working Capital Management for Business Success

Explore the art of forecasting and calculating working capital needs for your business. Learn to strike the right balance, considering factors like size, business type, and turnover rate.

Forecasting Essential: Business owners should meticulously forecast their working capital needs.

Consider Various Factors: Factors like business size, type, and turnover rate impact working capital calculations.

Critical for Operations: Adequate working capital is vital for sustaining day-to-day business operations.

Avoiding Excess: Too much working capital can hinder growth, as funds may not be utilized for income generation.

Balancing Act: Striking a balance ensures the firm can meet obligations while fueling growth.

Reserve Funds Necessary: Having reserve funds safeguards against unexpected situations.

Quick Access Advantage: Rapid access to additional working capital enables businesses to seize growth opportunities.

Income Generation Focus: Working capital should be optimized to generate income supporting business growth.

Calculation Method: Calculating working capital needs involves a comprehensive analysis of various business aspects.

Strategic Approach: Adopting a strategic approach ensures a company is well-prepared for both expected and unforeseen circumstances.

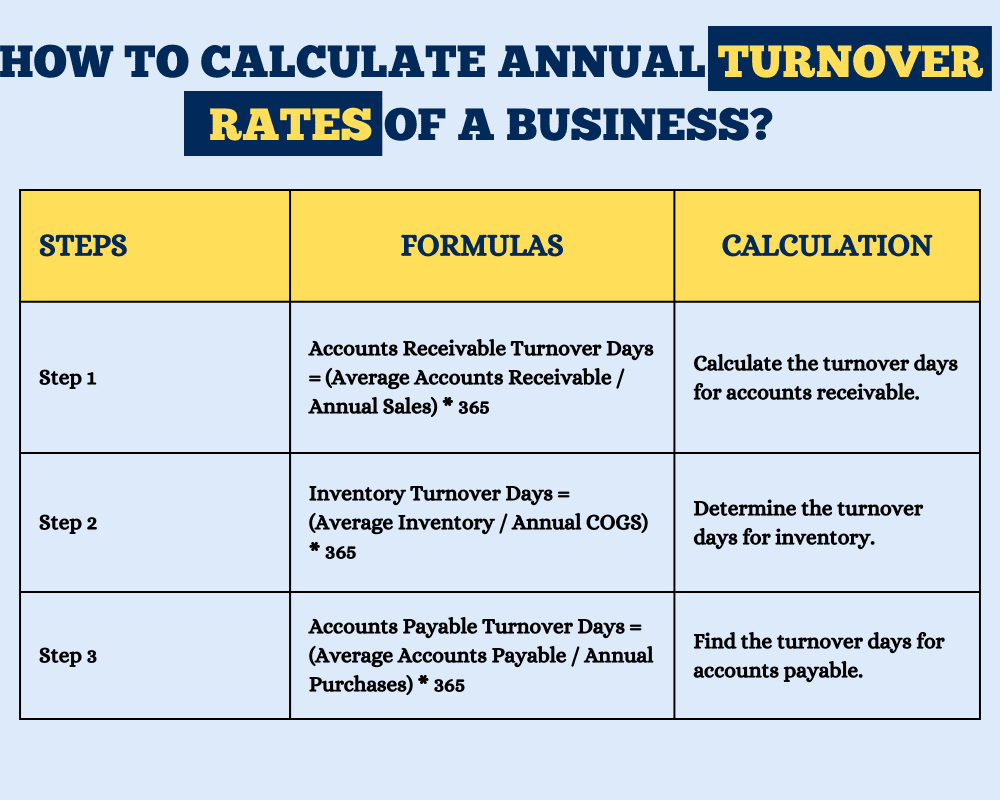

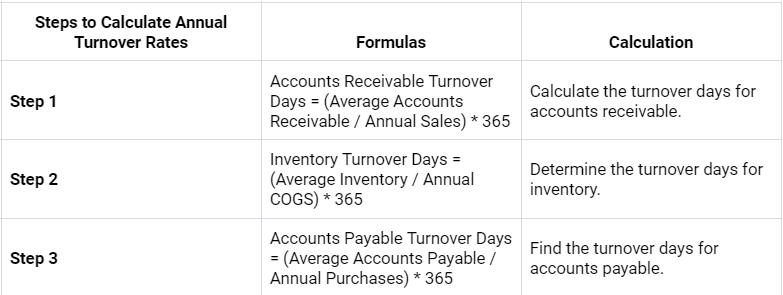

How to Calculate Annual Turnover Rates of a Business?

Data Needed for Working Capital Needs Calculation:

- Accounts Receivable Turnover Days

- Inventory Turnover Days

- Accounts Payable Turnover Days

- Projected Sales

- Projected Purchases

Note: After calculating turnover rates, use the data above in conjunction with a projected income statement, including the cost of goods sold and projected sales, to determine working capital needs for the business.

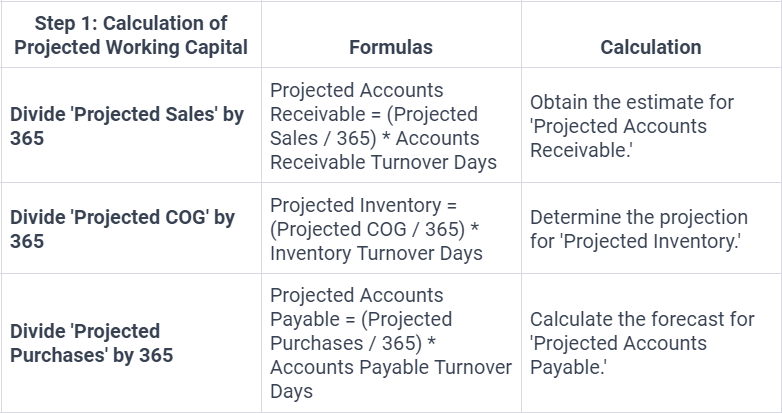

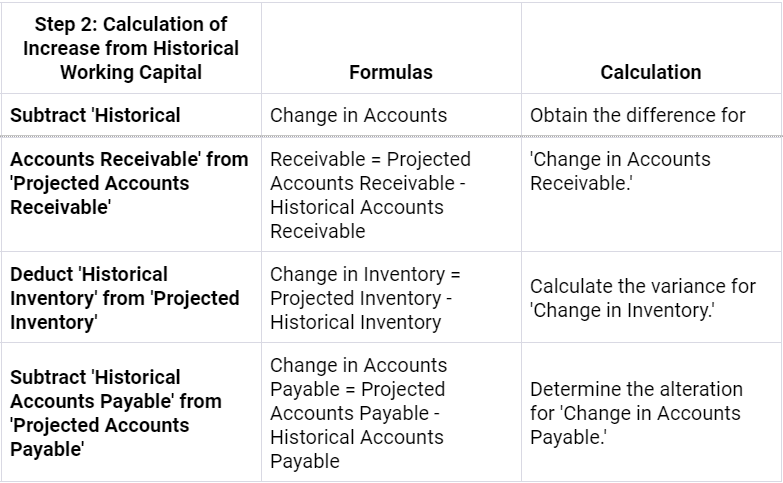

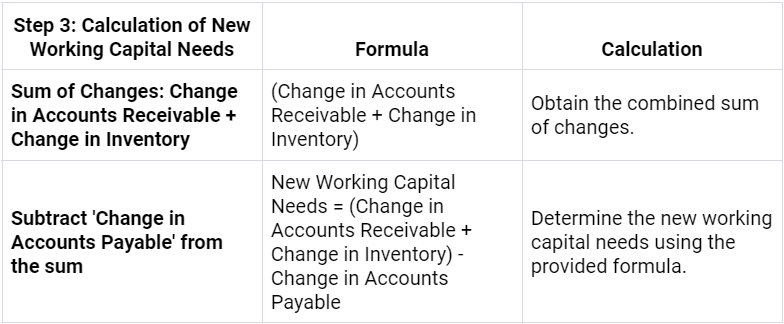

How to Calculate Working Capital Needs?

To calculate working capital needs, follow these steps: assess current assets, deduct current liabilities, and consider operational requirements for precision.

Small Business Finances: Why Working Capital is Essential

Discover why small businesses rely on extra working capital for stability, growth, and overcoming financial challenges.

Cash Crunch Resolution: Sudden cash shortages can hinder commitments to suppliers and employees, making additional working capital crucial.

Tax Payment Assurance: Businesses may struggle with tax payments due to delayed customer payments; working capital becomes vital in such situations.

Project and Temporary Staff Funding: Working capital is needed for project-related expenses and paying temporary employees, ensuring smooth business operations.

Supplier Discount Opportunities: Extra working capital enables small businesses to take advantage of supplier discounts when placing bulk orders.

Seasonal Cash Flow Challenges: Seasonal variations in cash flow pose challenges; extra working capital becomes a vital solution for sustaining operations.

Invoice Discounting Solutions: Fintech providers like Credlix offer transparent and hassle-free working capital solutions, particularly through innovative services like invoice discounting.

Technology-Driven Support: Credlix utilizes cutting-edge technology to streamline working capital processes, providing efficient solutions for small businesses.

Flexible Financing: Businesses benefit from the flexibility of additional working capital, adapting to various financial needs and ensuring stability.

Transparent Policies: Credlix’s transparent policies contribute to a straightforward working capital experience, fostering trust and reliability for businesses.

Smooth Working Capital Access: Fintech services like Credlix facilitate smooth access to working capital, supporting small businesses in addressing their financial needs effectively.

Conclusion

Businesses must analyze and determine their working capital requirements to unlock their full potential. Small businesses often encounter difficulties accessing working capital due to limited assets for collateral and a thin credit history.

Despite these challenges, various working capital finance solutions, such as invoice discounting, offer valuable assistance. Invoice discounting proves advantageous for small businesses, providing a flexible and accessible financing option that aligns with their unique needs. By embracing such financial tools, businesses can bridge the gap, ensuring smooth operations, and fostering growth even in the face of initial resource constraints.

Also Read: What is Gross Working Capital?