The Foreign Exchange Management Act, commonly known as FEMA, is a key legislation that governs the flow of foreign exchange in India. Introduced to replace the earlier Foreign Exchange Regulation Act (FERA), FEMA aims to facilitate external trade and payments, and to promote the orderly development and maintenance of the foreign exchange market in India. For anyone involved in exporting goods from India, understanding and complying with FEMA is crucial, as it sets the guidelines for all foreign exchange-related transactions.

What is the FEMA Declaration?

The FEMA Declaration is a mandatory document that exporters in India must submit to ensure that their transactions comply with the rules laid out under the Foreign Exchange Management Act. This declaration serves as a legal confirmation that the payment for exported goods will be received in foreign currency, and that the funds will be brought back to India within a specified time frame, typically within 9 months from the date of export.

The purpose of the FEMA Declaration is to protect India’s foreign exchange reserves by ensuring that all export earnings are properly accounted for. It also helps the government monitor and regulate the flow of foreign currency into the country, which is essential for maintaining the stability of the Indian economy.

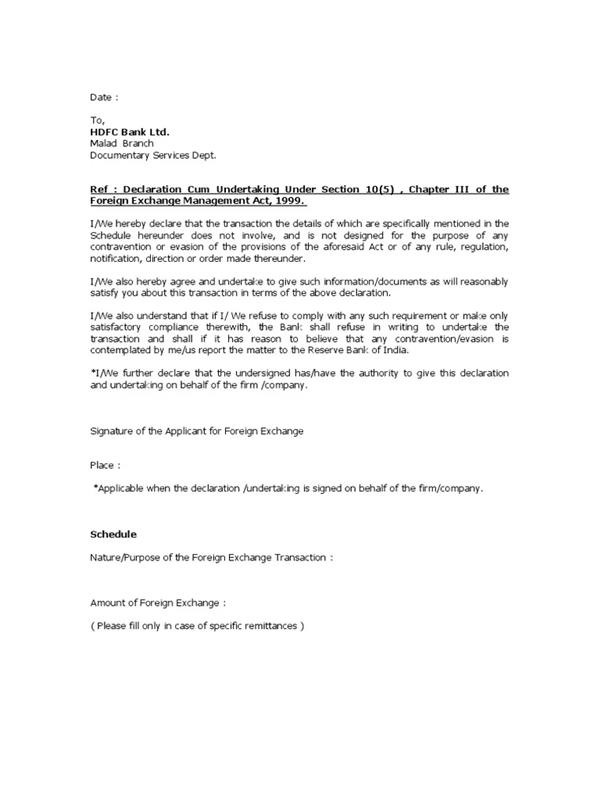

FEMA Declaration Sample Image

Why is the FEMA Declaration Important?

The FEMA Declaration is important for several reasons:

Legal Compliance: Exporters are required by law to submit this declaration. Without it, the export process cannot be completed, and the goods may be held up at customs, leading to delays and potential financial losses.

Foreign Exchange Management: The declaration ensures that the foreign exchange earned through exports is brought back to India within a stipulated period. This is important for maintaining the country’s foreign exchange reserves, which are crucial for economic stability.

Prevention of Money Laundering: By requiring exporters to declare their earnings, FEMA helps prevent illegal activities such as money laundering. It ensures that all foreign exchange transactions are conducted through authorized channels and that the funds are used for legitimate purposes.

Facilitating Trade: By streamlining the foreign exchange process, FEMA makes it easier for exporters to conduct business with foreign buyers. The declaration provides a clear framework for transactions, reducing the risk of misunderstandings and disputes.

Key Highlights of FEMA

Understanding some of the key highlights of FEMA can help exporters better appreciate the importance of the FEMA Declaration:

Authorized Dealings: FEMA prohibits foreign exchange dealings unless conducted by authorized persons or entities. This means that only those who have received permission from the Reserve Bank of India (RBI) can engage in foreign exchange transactions.

Prohibited Transactions: Certain types of transactions, such as those related to lotteries, banned magazines, and gambling, are completely prohibited under FEMA. Exporters must ensure that their dealings do not involve any such prohibited activities.

Freedom to Hold Foreign Assets: FEMA grants residents of India the freedom to hold or transfer foreign securities or immovable property located outside India, provided they have acquired these assets lawfully.

Increased Limits: FEMA has significantly increased the limits for foreign exchange transactions. For example, residents traveling abroad for business purposes can now avail foreign exchange up to $25,000 per trip without needing RBI approval.

How to Comply with the FEMA Declaration?

Complying with the FEMA Declaration involves a few straightforward steps:

Documentation: Exporters must provide all necessary documents to prove that the goods have been shipped and that payment will be received in foreign currency. This includes the shipping bill, invoice, and any other relevant documents.

Timely Submission: The declaration must be submitted to the authorized dealer (usually a bank) within the prescribed time frame. Failure to do so can result in penalties and complications in completing the export process.

Monitoring: Exporters should keep track of the payment due date and ensure that the foreign currency is received within the 9-month period. If there is a delay, they must inform the authorized dealer and seek an extension, if necessary.

Using Authorized Channels: All foreign exchange transactions must be conducted through authorized channels, such as banks or financial institutions approved by the RBI. This ensures that the transactions are legal and properly documented.

Conclusion

The FEMA Declaration is an essential document for anyone involved in exporting goods from India. It not only ensures compliance with legal requirements but also plays a vital role in managing the country’s foreign exchange reserves. By understanding the importance of the FEMA Declaration and following the necessary steps to comply with it, exporters can ensure a smooth and successful export process. This not only benefits their business but also contributes to the stability and growth of the Indian economy.